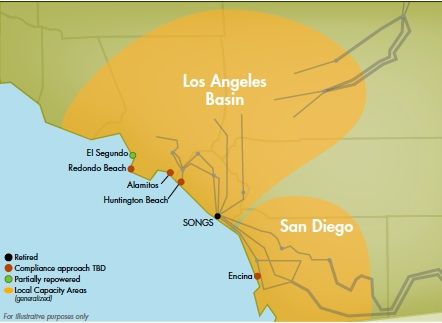

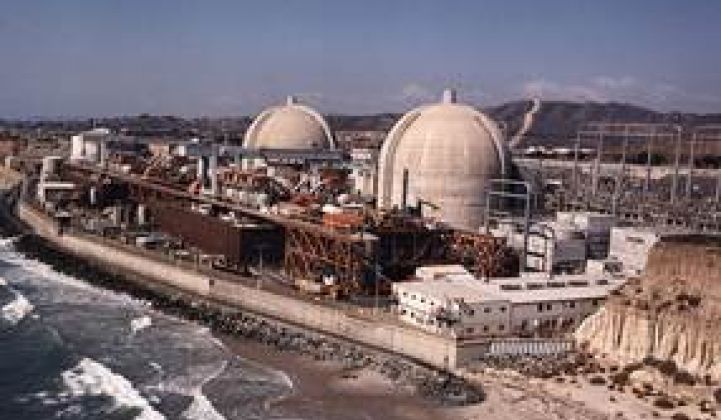

Down in Southern California, a battle over the state’s energy future has just been set in motion. At issue is the loss of the 2,200-megawatt San Onofre Nuclear Generation Station (SONGS) -- and the debate over how much green energy can be relied on to replace it.

On Tuesday, the California Public Utilities Commission issued a proposed decision (PDF) that would require Southern California Edison and San Diego Gas & Electric to each procure between 500 megawatts and 700 megawatts of new energy capacity by 2022 to make up for the generation lost with the 30-year-old nuclear plant’s closure last year.

Of that new capacity, at least 400 megawatts for SCE and at least 200 megawatts for SDG&E must come from “preferred resources.” Those are the energy efficiency, demand response, solar and wind power, and grid energy storage resources that must come before fossil-fuel-fired power -- namely, natural-gas-fired power plants -- under the state’s “loading order” regulations.

The proposed decision in this long-term procurement proceeding (LTTP), known as “Track 4,” comes on top of last year's CPUC decision ordering SCE to procure 1,400 megawatts to 1,800 megawatts to make up for “once-through cooling” power plants set to close under state water quality regulations. Of that, at least 650 megawatts must come from preferred resources. The new decision also sets a target for SDG&E to procure at least 25 megawatts of energy storage, in a process modeled on SCE's 50-megawatt energy storage procurement launched late last year.

By most grid-planning measures, this adds up to a lot of green resources, much of them intermittent in nature and spread across millions of homes and businesses, used to replace a single, reliable, dispatchable source of carbon-free nuclear power.

But to green energy advocates in the Golden State, it’s not enough. In the past few months, environmentalists, community activists and green technology entrepreneurs have been asking the state’s regulators and politicians to demand that SONGS be replaced by 100 percent preferred resources, and no new gas-fired power plants.

Fighting for an All-Green Replacement Strategy

In the past few months, the Sierra Club has packed CPUC meetings with protesters opposed to new gas-fired power plants in parts of California already suffering from air pollution and high respiratory illness rates. On the policy side, it has filed briefs accusing state agencies of underestimating the role of efficiency and demand response, overstating the threat of remote “once in a decade” grid emergencies, and ignoring the impacts that new gas-fired power plants would have on statewide greenhouse gas reduction goals.

The Clean Coalition, an energy policy nonprofit, has filed comments noting that distributed solar PV, combined with smart inverter technologies, could provide grid support more efficiently than large-scale, traditional grid alternatives. It’s also pointed out that work underway by grid operator CAISO and SCE’s “living pilot” program could provide breakthroughs in bringing local renewable, storage and demand-side resources into play to support local and system-wide grid needs.

And last month, a bevy of Silicon Valley venture capitalists and greentech CEOs sent a letter to state Gov. Jerry Brown, decrying the move to build new gas-fired generation as a “missed opportunity to showcase the clean technologies coming out of California” and a failure to capitalize on the state’s leading position in utility-scale and distributed solar power, not to mention its groundbreaking mandate to install 1.3 gigawatts of energy storage on the grid by decade’s end.

“We’ve led in energy efficiency, in renewables, in energy storage,” Nancy Pfund, managing partner of DBL Investors and the letter’s author, explained to me in a phone interview last week. “The world looks to us for leadership here, and we’re all benefiting from that. We can’t take that now and say we don’t know how to fit that into our existing approach to the grid.”

That sentiment is backed by co-signatories to the letter, including DFJ’s John Fisher, Foundation Capital’s Steve Vassallo, Silver Lake Kraftwerk’s Raj Atluru, Firelake Capital’s Peter Shannon and Westly Group’s Steve Westly, along with top executives of solar companies SolarCity, Sunrun, Sungevity and Verengo, as well as energy storage players Stem and Green Charge Networks.

The CPUC’s proposal is now subject to public comment over the next 30 days before heading to a full commission vote, and arguments like these are sure to surface in the weeks to come. While neither SCE or SDG&E are forced to choose natural gas-fired power plants for the share of megawatts not set aside for preferred resources, they are required to choose the lowest-cost reliable alternatives -- and with natural gas prices at their current low levels, picking gas-fired plants would be the logical choice.

That could damage the state's progress on its carbon reduction goals under AB 32, as replacing 2,200 megawatts of the emissions-free power that SONGS produced with natural-gas-fired plants would add 8 million metric tons of CO2 emissions per year to the state’s skies.

But beyond that, Pfund said, “Why should we contemplate sitting out this innovation cycle on energy, when the benefits far outweigh the risks of sticking with the status quo?”

The Goldilocks Challenge for a Green, Reliable Grid Future

The problem with relying on unproven green alternatives to tried-and-true central power plants and large-scale transmission projects, state agencies have pointed out, is that they increase the risks of major future problems on the grid. Those could include reduced power quality and reliability, the threat of blackouts during peak demand times or transmission outages, and potentially undermining the economic competitiveness and public safety of one of the country’s largest metropolitan regions.

As the CPUC’s proposed decision notes, “Replacing the capacity from SONGS is not a simple matter. SONGS was located in a critical spot on the coast straddling the SCE and SDG&E territories, providing energy, capacity and ancillary services such as voltage ampere reactive (VAR) support to both territories.” CPUC acknowledges the calls to forego gas-fired power as a resource, but notes, "While we strongly intend to continue pursuing preferred resources to the greatest extent possible, we must always ensure that grid operations are not potentially compromised by excessive reliance on intermittent resources and resources with uncertain ability to meet LCR [local capacity resource] needs."

In fact, CPUC’s proposal is already asking for far less than the 2,400 megawatts to 2,500 megawatts that CAISO has predicted will be needed in the SONGS study area by 2022. Some of the reasons include the decision to include more energy efficiency in SDG&E territory that was counted in CAISO’s initial survey, as well as to allow 528 megawatts of emergency load-shedding in SCE territory to stand in for new generation to manage a highly unlikely “N-1-1” grid failure, in which two major transmission lines go out at once during the hottest summer afternoons.

But CPUC’s lower figure also included an assumption that some -- but not all -- of the state’s new fast-reacting demand response, building code-driven efficiency improvements, upcoming energy storage deployments and better forecasted and managed distributed solar PV, will play a role. Building in the assumption that at least 13 percent to 22 percent of the resources in the following table will be available by 2022, the CPUC was able to bring down the “upper bound” of what the region might need from more predictable, dispatchable grid resources by then:

Can policy changes help these distributed, customer-owned and operated grid edge systems play an even greater role in solving the region's challenges? The answer to that question relies on a lot of moving parts coming together. Other proceedings that are now underway, such as the CPUC and CAISO work on establishing so-called "flexible capacity" resources (PDF) to help manage the multi-hour swings in energy demand that are expected to come with more distributed solar PV, will have a significant influence on how energy storage might be used in the region, for example.

Uncertainty over how distributed energy storage systems, renewable energy and demand-side resources can be pulled into grid-scale planning is another key challenge. CPUC’s proposal notes that CAISO has endorsed the idea that “substantial portions of the local capacity needs created by the SONGS outage can be filled with preferred resources," with two caveats:

First, the Commission and parties must be diligent in moving ahead to develop the necessary programs that can participate with other supply-side resources (such as demand response) and that will provide load-shaping demand-side benefits (such as energy efficiency and small PV) with the necessary locational data that the ISO can use in its local area capacity studies to offset the need for conventional infrastructure.

Secondly...the Commission must be diligent and expeditious in tracking the development of preferred resources in order to verify that they are actually materializing in the locations and amounts predicted in the studies and resource procurement efforts that established such forecasts."

There remains some time to sort out these challenges. CPUC’s proposed decision notes that both utilities are expected to have “sufficient supplies to meet projected demands” through 2018, with new supply coming on-line and lower-than-expected demand driven by a weak economy and successful energy efficiency programs.

At the same time, the CPUC’s proposed decision rejected requests that the commission delay its decision until new information becomes available, such as CAISO’s most recent transmission planning process report, which is due in March. “With long lead-time resources requiring several years of effort, and potential reliability issues surfacing starting in 2018, we cannot wait for further information at this point,” CPUC stated -- at least, not to begin a process that has uncertainty and change already built into it.