California’s big investor-owned utilities are under the gun to start turning on their smart meters' home area network (HAN) capabilities -- and they’re starting to make it happen. Late last year, Southern California Edison got the ball rolling with offers to synch up devices from Canadian startup Rainforest Automation and home security player ADT to the ZigBee radios inside their smart meters.

Last week, San Diego Gas & Electric joined the party, launching a program that allows customers to buy and install HAN devices and link them to the ZigBee radios inside their smart meters. As with SCE, the program promises that a simple phone call or website visit is all that is needed to get customers’ new devices up and running, at which point they can receive meter data updates as often as several times a minute -- a lot faster than the AMI backhaul data collection that heads back to the utility itself.

And on Monday, Pacific Gas & Electric, which has been the most resistant of the state’s big three investor-owned utilities (IOUs) about turning on their smart meters’ HAN connectivity, launched its new “Home and Business Networking” program. PG&E’s program requires an eligibility check for each customers’ address and a two to five business day wait, but promises a similarly hassle-free validation and activation process for connecting smart meters to in-home devices once that’s done.

All three utilities have a limited list of partner devices that they’ve certified to connect to their networks. SDG&E’s list includes Rainforest Automation’s EMU devices, as well as in-home power displays from startup Energy Aware. PG&E’s list also includes Rainforest’s EAGLE device, as well as startup Aztech’s Energy Information Display, and demand response company Comverge’s in-home display device.

Now the big question is, how many customers will go out and buy devices to test the utilities on their promises? Most of the devices on offer cost $60 to $120, which is at the high end of the price range that surveys have indicated people are willing to pay to monitor and manage their home energy use. Of course, rebates such as SCE’s $50 cash-back offer on Rainforest’s $60 EMU devices will doubtless drive increases in sales.

California’s big three IOUs are also likely to target their most engaged customers, like those that have signed up for summer peak-saver programs and the like. While the majority of homeowners may not care that much about their power bills, engaged customers can achieve huge reductions in energy use through behavior changes like running appliances at night and turning air conditioners down at times of peak power demand.

California’s big three IOUs have deployed smart meters through almost all of their territories, and they’ve also been piloting ZigBee meter-to-home technologies for years now. But until late last year, they hadn’t started to turn on their meter’s HAN radios for customers, beyond pilot projects.

Beyond the cost and complexity of turning on a whole new communications and control channel for multimillion-endpoint AMI networks, there’s the question of which technologies to sink investment into, and when to do so. PG&E has argued that the industry should wait for a key standard for home automation, Smart Energy Profile 2.0, to be formalized before proceeding with commercial-scale deployments.

But the California Public Utilities Commission is speeding up the timetable. In October it asked the state’s big three IOUs to start providing meter-to-HAN connectivity on some kind of consistent basis, as well as to make HAN-enabled devices available via third parties.

That’s a lot different than most of today’s utility-to-home load control networks, which use one-way paging or radio systems that offer the utility direct control over household loads. As for smart meters, while lots of utilities collect their data and make it available to customers via web portals, that’s day-old data, collected via the 15-minute to hourly AMI backhauls to the utility, then (usually) run through a back-office batch process overnight before being posted.

Smart meter-to-home connections are much rarer. Right now, the only other contender to California is Texas, which has a statewide ZigBee device registration program for customers to connect to smart meters from IOUs like Oncor and CenterPoint Energy, as well as programs from Texas retail electricity providers like Reliant Energy and TXU. In Oklahoma and Canada’s Ontario province, utilities have signed up tens of thousands of customers for smart-meter-to-home energy pricing and demand response programs.

All these HAN devices are using a previous version of Smart Energy Profile, known as 1.0 (or 1.1, or 1.x, depending on the latest update), which is specific to ZigBee. SEP 2.0, on the other hand, will include Wi-Fi and the wireline HomePlug communications standard as well. That opens up a new world of connectivity once SEP 2.0 is made an official standard sometime next year.

At the same time, home broadband and cellular networks are increasingly being tapped to provide utility-to-customer connectivity. In the case of California’s big three utilities, however, the CPUC has made it pretty clear that they’re going to have to “push” a lot of consumer data through their AMI networks to their millions of residential customers.

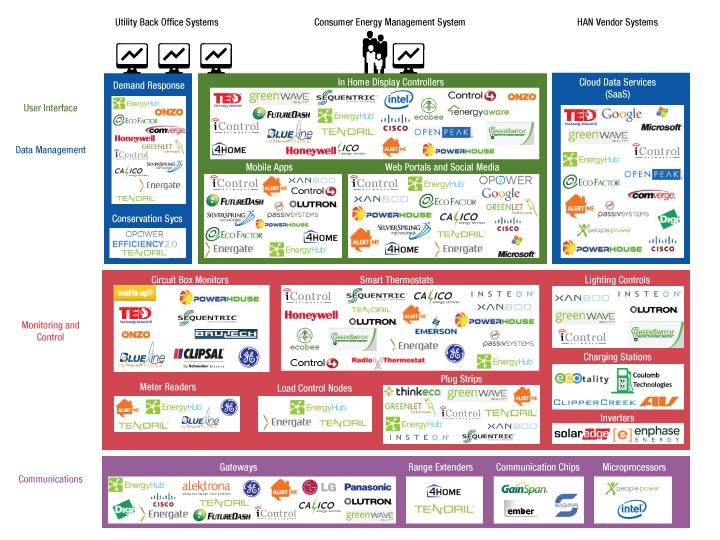

All told, Greentech Media Smart Grid Research forecasts a $750 million U.S. HAN market by 2015.See diagram below for the HAN taxonomy from the most recent GTM Research HAN report.