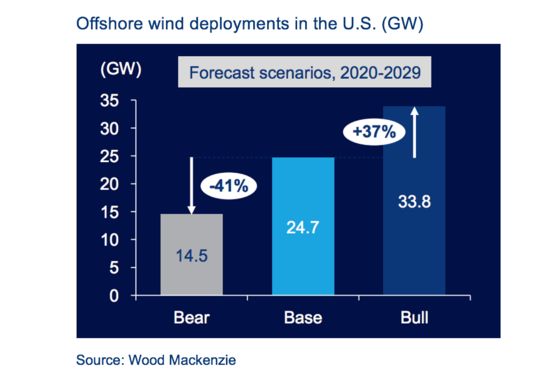

The United States offshore wind industry is set to ramp up from near zero today to as much as 25 gigawatts in 2029, according to new Wood Mackenzie research.

That means offshore wind will capture almost half of the U.S. market for new wind power installations by the end of the decade — if the industry can avoid potential permitting and transmission capacity challenges.

On the other hand, if the market moves more slowly, the total build this decade will total just 15 gigawatts.

Today, more than 9 gigawatts of offshore wind projects are already contracted or soon to be approved in the U.S., and up to 6 gigawatts more will be solicited through 2022.

The U.S. offshore wind sector will effectively launch in 2023, when the 800-megawatt Vineyard Wind project comes online to supply Massachusetts customers, along with about 260 megawatts of smaller projects supplying New York, Maryland, and Maine.

In 2024, offshore wind will comprise over a third of the year’s wind capacity installations in the U.S., increasing to close or even half of the wind build in each subsequent year to 2029.

In New England and New York, 80 percent of wind build through 2026 will be located offshore. The West Coast market will open gradually, since the commercialization of floating technology will be instrumental in expanding offshore wind’s regional reach to key 100 percent renewable portfolio standard markets such as California and Hawaii.

The U.S. offers an opportunity for experienced European players and oil and gas producers, as well as domestic utilities and supply chain providers.

The large-scale transmission hurdle

The U.S. federal government’s lease program currently supports about 20 to 30 gigawatts of offshore wind, depending on turbine density, and areas supporting as much as 45 gigawatts are under consideration for future leasing.

State renewable portfolio standards, wind carve-outs and contracting call for the installation of 34 gigawatts of offshore wind capacity by 2035.

However, permitting delays and political risk at both the state and federal level could hamper the sector’s long-term outlook if the transmission grid can’t adapt to higher offshore wind penetration.

Building out high levels of offshore wind will be a challenge for the constrained U.S. onshore transmission grid. Some recent large-scale, renewable-energy-focused transmission projects have failed to move forward due to a combination of permit delays, NIMBYism and high network upgrade costs.

Despite the uncertainty, East Coast states have pushed ahead with solicitations and policy expansions, helping position the U.S. as an attractive emerging market for global players.

The role of the PTC and ITC

Offshore wind’s rapid expansion in market share is partly due to the expiration of the federal Production Tax Credit. This will see onshore installations dropping from an estimated 14 GW in 2021 to a typical level of under 5 GW per year later in the decade.

The phasing-out of the federal Investment Tax Credit (ITC) adds some uncertainty to the offshore sector’s outlook as well. There are concerns that price declines, driven by technology and economies of scale, may not be sustainable.

The first few commercial-scale projects contracted in 2017 have prices in the $150 to $170 per megawatt-hour range (levelized 2019 dollars).

Vineyard Wind and Revolution Wind shocked with levelized 2019 prices in the $65 to $80/MWh range. This substantial drop made the technology viable as a route to decarbonizing the Northeast’s power grid and encouraged policymakers across the region to increase mandates.

These low prices are made possible by the latest in offshore wind turbine technology, as well as the continued availability of the ITC. It remains to be seen if technology improvements and economies of scale can outweigh the rise in required prices the phaseout will bring.

***

Max Cohen is the author of U.S. Offshore Wind Market Outlook, 2020-2029, a new report from Wood Mackenzie that shares analysis of expected U.S. offshore wind build-out and market evolution through 2029.