It's still unclear how Britain's coming split with the European Union will impact its energy markets. Will regional energy trading suffer? Will energy bills rise? Will investors walk away?

Those questions are still unanswerable. But even if Brexit doesn't dramatically change the U.K. energy system, there are already radical changes underway in one market: solar.

A series of deep cuts to Britain's solar promotion programs over the last year is finally catching up to installers.

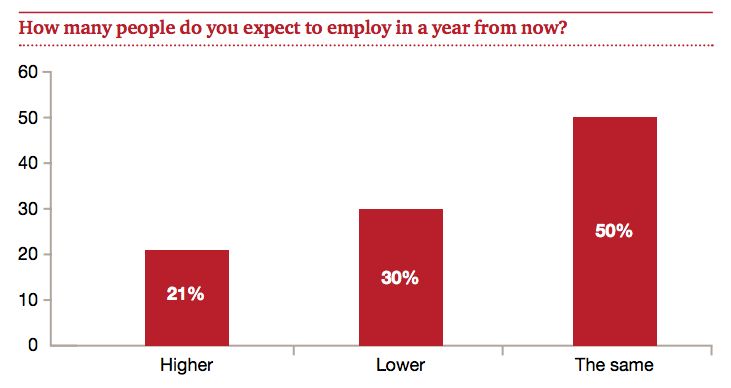

According to a new industry survey from PwC and the Solar Trade Association, U.K. solar companies have shed 12,500 jobs over the last year. And more job cuts are likely on the way. Nearly one-third of businesses surveyed by the organizations said they expect to lay off more employees in the next year.

In addition, nearly 40 percent of solar companies surveyed are considering shutting down business altogether -- or may fully exit the market in favor of international opportunities.

The job losses are an added blow to a region that could already be facing a recession post-Brexit. Only 21 percent of survey respondents said they would hire more workers over the coming 12 months.

Source: PwC's Seeing Through the Gloom report

Britain's solar market has been in retreat since December, when officials announced a 65 percent cut to residential feed-in tariffs and a complete elimination of support for large-scale solar projects. The changes were part of an effort to align subsidies with solar installation costs. They came just months after the government shut down its poorly performing weatherization program, called the Green Deal.

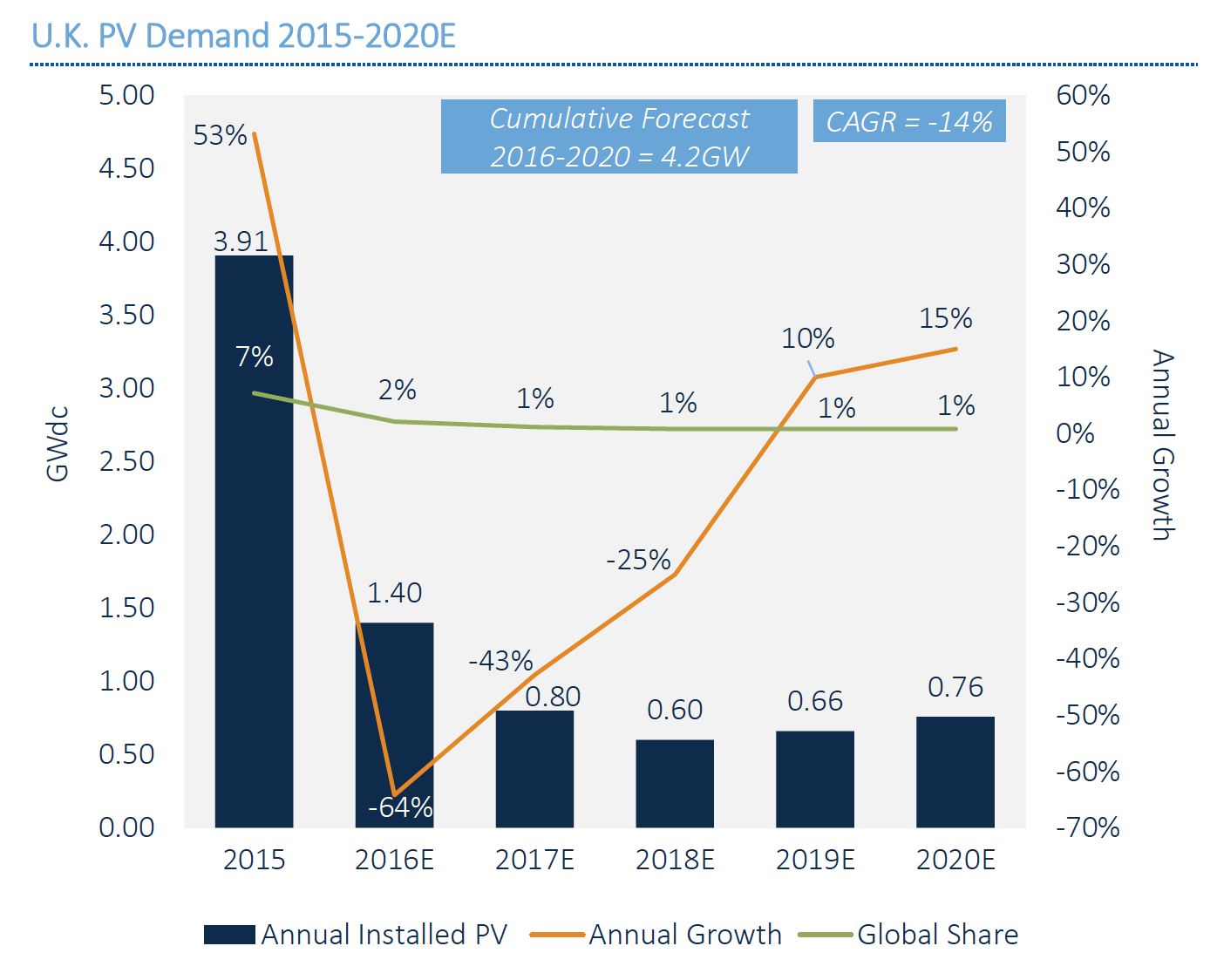

The latest numbers from GTM Research show a market in free-fall. In 2015, the U.K. installed nearly 4 gigawatts of photovoltaics; this year will likely only see 1.4 gigawatts installed. All three segments -- residential, commercial and utility-scale -- have been impacted by the cuts and caps.

By 2018, under the current reforms, Britain's solar market could decline to 600 megawatts.

"The severe job losses then are no surprise -- and we can expect much worse in the months ahead," said Mohit Anand, GTM Research's senior global solar demand analyst.

Source: GTM Research's Global Solar Demand Monitor

Brexit adds a whole new layer of complexity to the solar industry's woes. Depending on how it splits with the European Union, the U.K. will need to renegotiate trade deals, rethink its participation in Europe's internal energy market, and figure out whether its low-carbon energy will apply to Europe's emission scheme. Solar's future in Britain will be further dictated by those changes.

Even if Brexit is a best-case scenario, the U.K. solar market likely won't start growing until 2018 or 2019 -- and even then, growth will be anemic.

"You can't kill something that's already dead," said Anand.

Below, listen to Mohit Anand discuss the bleak outlook for the U.K. solar market on the Energy Gang podcast. The Britain discussion starts at 30:36.