In recent times, Brazil has been heralded as a shining example of how biofuels can lead towards energy independence, as 50% of the country's gasoline market is fueled by ethanol.

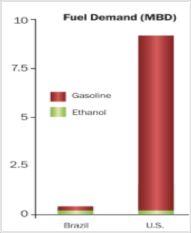

Since the 1970s, Brazil has embarked on a path towards widespread commercialization of ethanol derived from sugarcane, the feedstock that is present in 100% of Brazilian ethanol. Although the Brazilian ethanol market trails behind the U.S. in terms of production capacity, one could argue that the Brazilian industry is more advanced.

According to the Brazilian ethanol trade group UNICA, Brazil uses less than half of the landmass (7.6 million acres vs. 15.6 million acres) that the U.S. uses for ethanol, translating to 1% of the total available arable land in Brazil. Emissions are significantly lower with sugarcane ethanol as compared to corn-based ethanol, due to the capacity to burn sugarcane bagasse and utilize it as a source of heat and power. As a result, the CO2 emissions required to produce a liter of Brazilian ethanol can be as low as 0.2-0.3kg CO2/liter, which is a 90% reduction from traditional gasoline (2.8 kg CO2/liter). In recent times, the costs of producing a gallon of Brazilian ethanol was much less than those associated with a gallon of U.S. corn ethanol due to the low price of sugar, cheaper labor costs in Brazil, dedicated ethanol pipelines and the capacity to generate electricity from bagasse and potentially sell excess energy back to the grid.

Additionally, Brazil is further ahead in terms of solving downstream the logistical problems endemic in ethanol production, like having dedicated ethanol pipelines, market penetration of "Flex-Fuel" vehicles, and retail fuel stations with stand-alone "E85" pumps.

Yet, not all is well in the land of Pele and Copa Cabana.

Torrential rains in 2009 resulted in only 530 million tons of sugarcane being crushed -- compared to expectations of a 580 million ton crop. The resulting lack of supply -- and high sugar prices --- has led to producers opting to produce sugar for human consumption rather than ethanol production. Feedstock prices have led to higher costs for ethanol producers and an uncompetitive position when compared to gasoline.

Consumers with Flex-Fuel Vehicles have the choice to purchase gasoline and ethanol. Given the fact that ethanol contains 67% the amount of energy per gallon compared to petroleum gasoline, for E85 to be competitive, it must be priced at at least a 29% discount to gasoline. In recent weeks, E85 was only selling at a 20% discount.

To compensate for the diminished harvest and lower ethanol supplies, the Brazilian government recently reduced the amount of ethanol required to be blended in the nation's gasoline supply from 25% downward to 20%. Additionally, in a bid to contain inflation, the government reduced the CIDE tax on gasoline to 15 centavos per liter from 23 centavos. This action will further make Brazilian ethanol less competitive compared to gasoline.

The national sugarcane association, UNICA, is talking about calling for an end to the 20% import tariff on ethanol. The confluence of these events is leading some industry analysts to think what was once the unthinkable: could Brazil become an export market for U.S. corn ethanol producers?

Before our corn ethanol producers book their flights from Des Moines to Sao Paulo, a few things must be kept in context. Brazil's discussion about repealing the import tax is likely a negotiation ploy to convince the U.S. to end its $0.54/gal import tariff on Brazilian ethanol. Brazil does not have a leg to stand on telling the U.S. to eliminate the import tariff if it maintains one of its own.

Additionally, by 2015, the U.S. oil refiners will be required to purchase up to 15 billion gallons of corn ethanol (from 10.5 billion in 2009). If corn yields do not improve, the U.S. could be using well over 40% of its corn crop for ethanol. Considering that the global population increases by 80 million each year --- and that the U.S. is the largest producer of corn --- it is likely that the laws of supply and demand will dictate increased prices for both corn and corn ethanol in coming years. If sugar prices are currently high in Brazil, farmers will be incentivized to grow more of the crop, resulting in higher supplies and lower prices.

Even if Brazilian ethanol remains uncompetitive with gasoline in its domestic market, there is another reason to think that the U.S. is more likely to import significant amounts of Brazilian ethanol than vice versa: last week, when the U.S. released its revised renewable fuel standards (RFS), it found that Brazilian sugarcane ethanol reduced greenhouse gas emissions by 61% compared to petroleum. This number is significant, because any non-corn based fuel that reduces emissions more than 60% qualifies as an "undifferentiated advanced biofuel" and U.S. refiners will be required to purchase escalating amounts of this fuel in the coming years. Although 3rd Generation biofuel companies are developing promising algae, biobutanol, and synthetic biofuels that, in theory, might qualify as a fuel that reduces GHGs by 60%, what is the likelihood that these companies will be able to compete with Brazilian ethanol, at least over the short to medium term?

Thus, while Brazilian ethanol is taking a short-term hit, it should be fine in the long term. Perhaps that is why Shell announced last week that it was investing $1.63B of capital to create a joint venture with Cosan.