Butamax Advanced Biofuels (Butamax) is a Delaware-based joint venture between BP and DuPont formed in 2009 to develop biobutanol.

Biobutanol is an advanced biofuel which has some important advantages over ethanol, including an energy content closer to that of gasoline and the capacity to create higher blend concentrations with gasoline.

Butamax owns U.S. Patent No. 7,851,188, entitled “Fermentive production of four carbon alcohols” (’188 Patent). The ’188 Patent is directed to Butamax’s biobutanol production technology and recombinant microbial host cells that produce the biofuel.

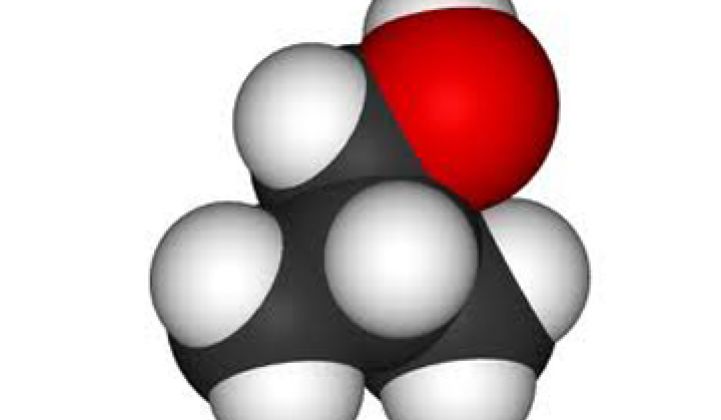

Last month Butamax sued Gevo, an Englewood, Colorado-based advanced biofuels company, for infringement of the ’188 Patent. Gevo went public earlier this month and its stock is climbing (see below). That's an isobutanol molecule in the photo.

The complaint (Butamax_Complaint), filed in federal court in Delaware, alleges that Gevo’s isobutanol production pathway infringes the ’188 Patent:

On information and belief, Gevo makes recombinant microbial host cells by engineering DNA constructs containing isobutanol pathway genes and integrating them into the cells. These DNA constructs encode enzymes that catalyze conversion of 1) pyruvate to acetolactate; 2) acetolactate to 2,3-dihydroxyisovalerate; 3) 2,3-dihydroxyisovalerate to α-ketoisovalerate; and 4) α-ketoisovalerate to isobutyraldehyde. These host cells produce isobutanol through this pathway.

According to the complaint, Gevo has produced isobutanol using such microbial host cells in a retrofitted ethanol production facility and is converting another ethanol facility for isobutanol production.

Butamax is seeking an injunction and monetary damages.

As far as I know, this is the first instance of biofuel patent litigation involving a major oil company. With the oil majors increasingly involved in biofuels startups via research funding, buyouts, and JVs like Butamax, it won’t be the last.

***

Eric Lane is a patent attorney at Luce, Forward, Hamilton & Scripps in San Diego, where he works in the Intellectual Property and Climate Change & Clean Technologies practice groups. Mr. Lane can be reached at or at [email protected]. He authors the Green Patent Blog.

Bonus: Here is our story on Gevo's IPO from February 9. Since then, the stock has climbed above $20, a 30 percent increase in less than two weeks.

Gevo -- which coaxes microbes to secrete a form of isobutanol but garners most of its revenue from corn ethanol -- saw its stock rise from an opening price of $15 to $16.43 on the first day of trading.

The company sold off 7.15 million shares of its stock yesterday at the high end of the $13-to-$15 range. The IPO raised close to $100 million for the company after fees. Last year, it had hope to raise $150 million. The stock went as high as $17.53. Investors include Khosla Ventures and the Virgin Green Fund.

A ten percent rise will no doubt make some critics sniff once again that green tech has yet to produce a Google. (Generally, the critics also missed out on Google too, but who's counting?) Still, the moderate increase could be a good sign. Last year, Amyris, which gets genetically modified microbes to generate hydrocarbons, sold stock for $16 a share. It rose to $17 on the first day of trading, but now it sells for close to $31 a share, a spike driven by interest in its industrial lubricants.

Molycorp went public at $13 and sank. After the Chinese threatened to throttle the export of rare earth minerals, the stock quadrupled.

By contrast, A123 Systems saw its stock zoom after the IPO in late 2009. Now, it trades below its opening price.

What is Gevo? It's a promise more than anything else. The company's scientists are working on genetically modified microbes that eat sugars and secrete isobutanol, a popular industrial chemical used in diesel, gas, plastics, lubricants and jet fuel. Jet fuel commands a healthy price and the demand for clean alternatives is pressing. Regulations are forcing commercial airlines to reduce their carbon footprints and the Department of Defense has laid down directives to reduce their dependence on fuel imports. The microbes produce a single, consistent molecule. 40 billion gallons of isobutanol and its derivatives get consumed each year.

"Aviation fuel is the one market where it is difficult to believe there is any other alternative" like batteries to traditional fossil fuels, said Nat Goldhaber of Claremont Creek Ventures in a separate, non-Gevo-related interview.

Gevo can also make its bio-isobutanol in retrofitted ethanol plants. The company, in fact, has been sniffing around for mothballed ethanol plants at a discount since 2009, Anup Jacob, an investor with Virgin Green Fund, told us.

The downsides? Gevo feeds its genetically enhanced microbes sugar to produce the desired chemicals via fermentation. Sugars fluctuate in price although it may in the future be able to take advantage of cellulosic sugars from forest and farming waste. Also, biological processes can cost more than traditional thermochemical processes.

More importantly, Gevo isn't growing because of the strength of its microbes. Revenue jumped from $660,000 in 2009 to over $32.7 million in 2010, but that's because it acquired Agri-Energy, a traditional ethanol producer, and began to buy and sell ethanol. The vast bulk of its 2010 revenue -- $31.5 million -- came from selling corn ethanol, while its cost of goods sold that year came to $28.9 million. In other words, most of the revenue got absorbed in wash-like transactions.

In fact, Gevo only gets $138,000 from technology licensing, far less than the $1.2 million it gets from grants. One could even argue that Gevo is really an old-time ethanol company with an intriguing science project that could bear fruit someday.

It has also consistently reported losses. In all, the firm has lost $78 million.

Then again, Amyris had the same sort of corn-fed IPO: most of its early revenues have come from ethanol sales, as well.