In its latest New Energy Outlook, Bloomberg New Energy Finance describes a world where the energy system looks fundamentally different from today. But that doesn’t mean natural gas won’t have a place.

While renewables will dominate the generation mix, Seb Henbest, lead author and BNEF’s head of Europe, Middle East and Africa, said gas peakers will remain an integral part of the landscape.

“They are necessary in our outlook,” Henbest said. In the United States, especially, “there’s a lot of gas that gets baked in in the 2020s and doesn’t get pushed out.”

BNEF projects 1,002 gigawatts of added peaker gas capacity worldwide by 2050, which will remain a “cheaper, more nimble alternative” to large-scale combined cycle gas plants.

A coming clean energy takeover is what keeps gas in the picture. BNEF said it’s a matter of “when and how” such an overtake happens. Approaching mid-century, Henbest said renewables trends “start to get pretty punchy.”

By 2050, analysts project a two-thirds renewable energy mix, including 50 percent wind and solar, rather than the approximately two-thirds fossil fuels included in today’s energy mix.

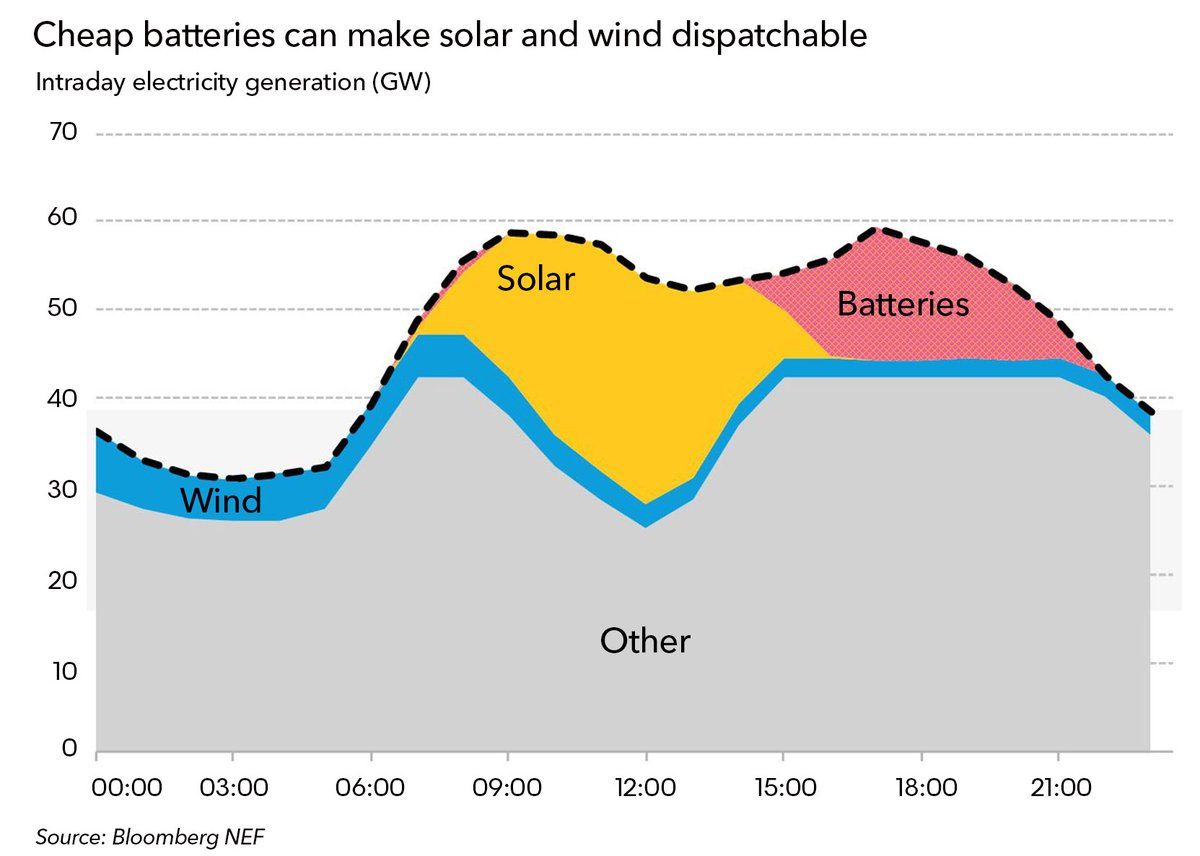

“If we think about the electricity dispatch today, or certainly historically, what we’re describing is something where demand is pretty static. The way we meet that is we stack up technologies,” said Henbest, describing the current daily mix of nuclear, coal, gas, hydro and sometimes renewables. “Tomorrow is going to look pretty similar.”

"What we’re painting here is not a system that looks like that," he added.

Continued cost declines in wind, which will drop by 58 percent by 2050, and solar, which will drop by 71 percent in the same period, lead renewables to supply 87 percent of Europe’s electricity and 75 percent of India’s. India, which has already seen record-low prices, will continue to be home to the lowest prices for both solar and wind. Overall, BNEF expects global PV prices at $25 per megawatt-hour, although lower prices have already emerged in some locations.

“Solar and wind we think have already won the race for cheap electricity,” said Henbest. BNEF notes that in the future, the need to purchase fuel will be a decided disadvantage.

Compared to other regions, the uptake of renewables in the U.S. will be more modest at just 55 percent of electricity and in China at 62 percent of electricity.

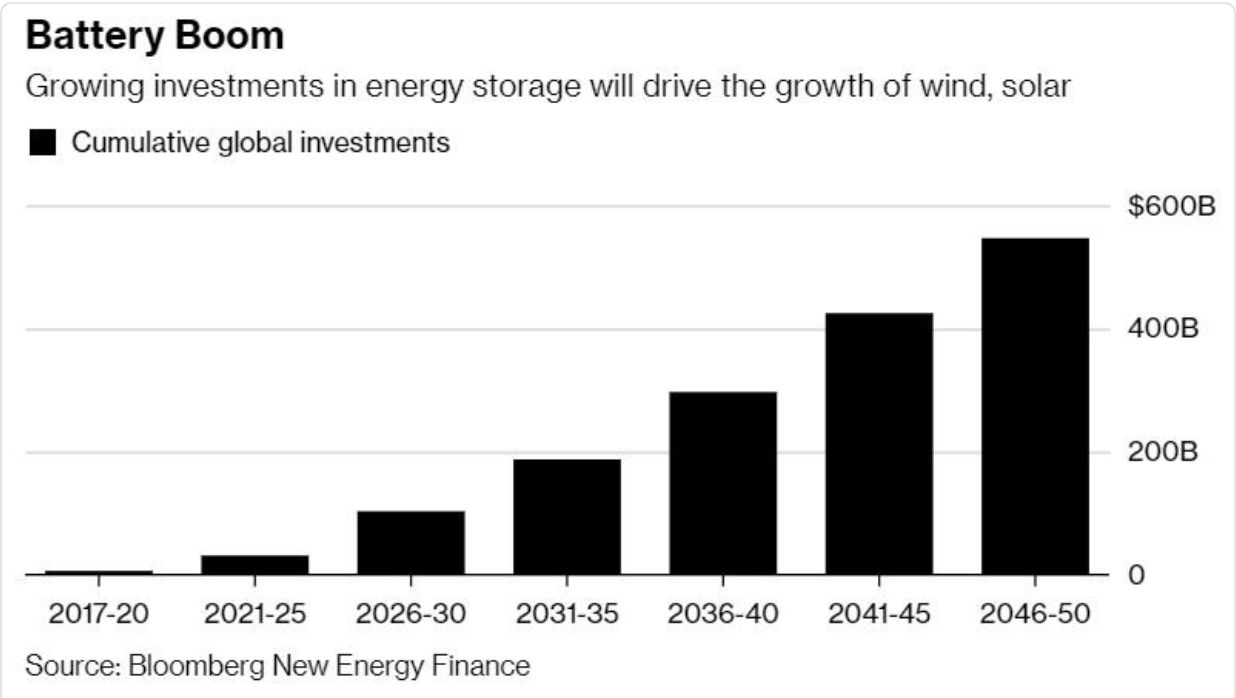

Battery storage continues to be an integral component to reaching that high penetration. By 2030, BNEF projects stationary battery prices to drop to $70 per kilowatt-hour.

Global investment will reach half a trillion dollars, leading to a "battery boom."

As more renewables make their way onto the grid, batteries will provide essential load balancing that makes it possible to add the amount of wind and solar that BNEF projects. Falling battery costs make that support possible at a widespread scale.

At the same time, though, BNEF suggests the power of batteries will remain somewhat limited through their timeframe.

“What can they do to help those renewables go deeper?” said Henbest. “We think they can do some, but not all.”

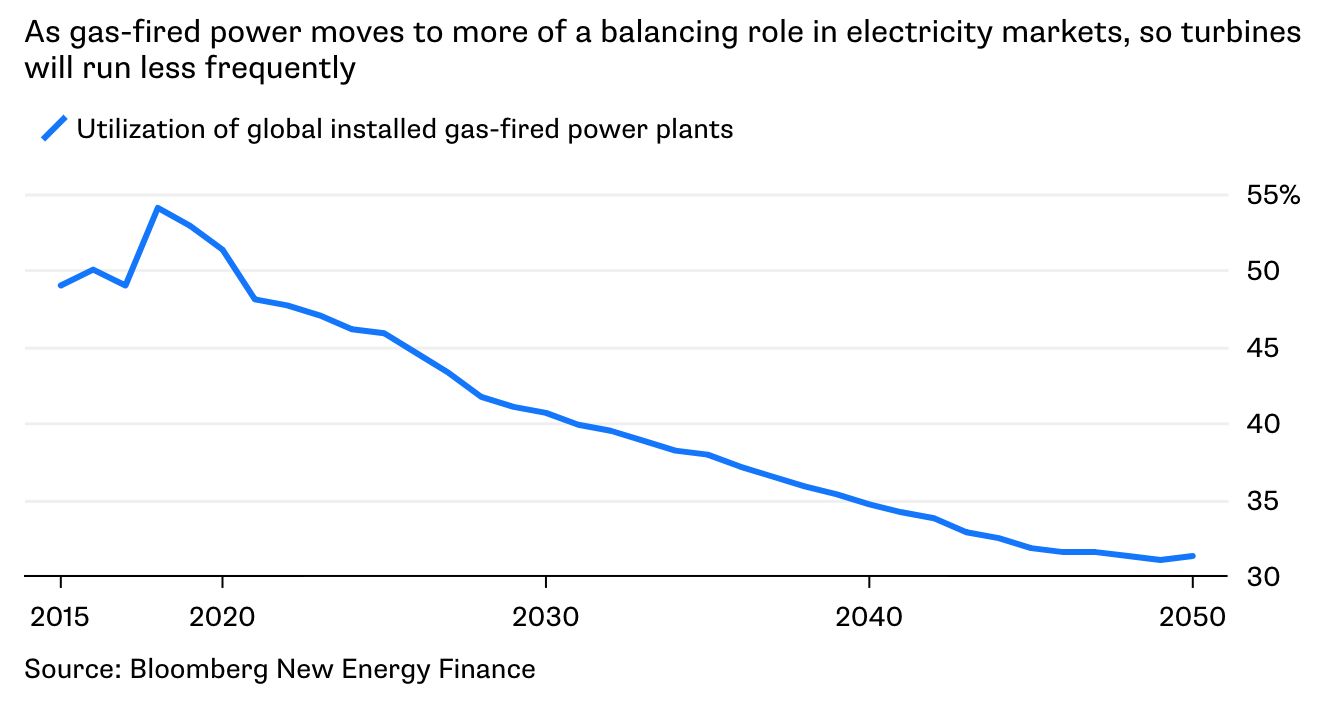

That’s where gas comes in, especially in areas like the U.S. where it’s currently cheap and plentiful and can provide a "balancing role" for batteries and renewables.

According to Henbest, “gas is more about value than volume.” That will lead to a preference for peakers that can meet demand on days when baseload clean energy cannot.

Gas consumption won't increase greatly, though, because plants will run less frequently, at lower capacity or only for peaking demand.

At the same time, curtailment of renewables will become more common because of excess renewables capacity providing redundancy to the system in the way that fossil fuel resources do today. Fossil fuel plants will also become less appealing looking ahead as fewer megawatt-hours of usage make it increasingly difficult to pay off the initial capital expenditure.

Looking ahead, the energy transformation will still include the generation sources we recognize today if at different levels. But one in particular will not fare well. BNEF calls coal “the biggest loser.” Its use for electricity will peak in the next decade.

It’s the same case for U.S. nuclear, as BNEF envisions a future where the two energy resources “have almost disappeared from the electricity mix.”

--

Join us at GTM Forum: Wind & Storage as we gather with industry experts from the energy storage and wind industries to examine technological and regulatory developments, business model innovations, and investments in resources.