There are now more than 1 million solar systems installed on residential rooftops across America. That's not some arbitrary milestone. It means that there are nearly as many solar electric systems serving U.S. homes as there are permanent backup generators.

In fact, there's a very clear overlap between the solar market and the backup generator market.

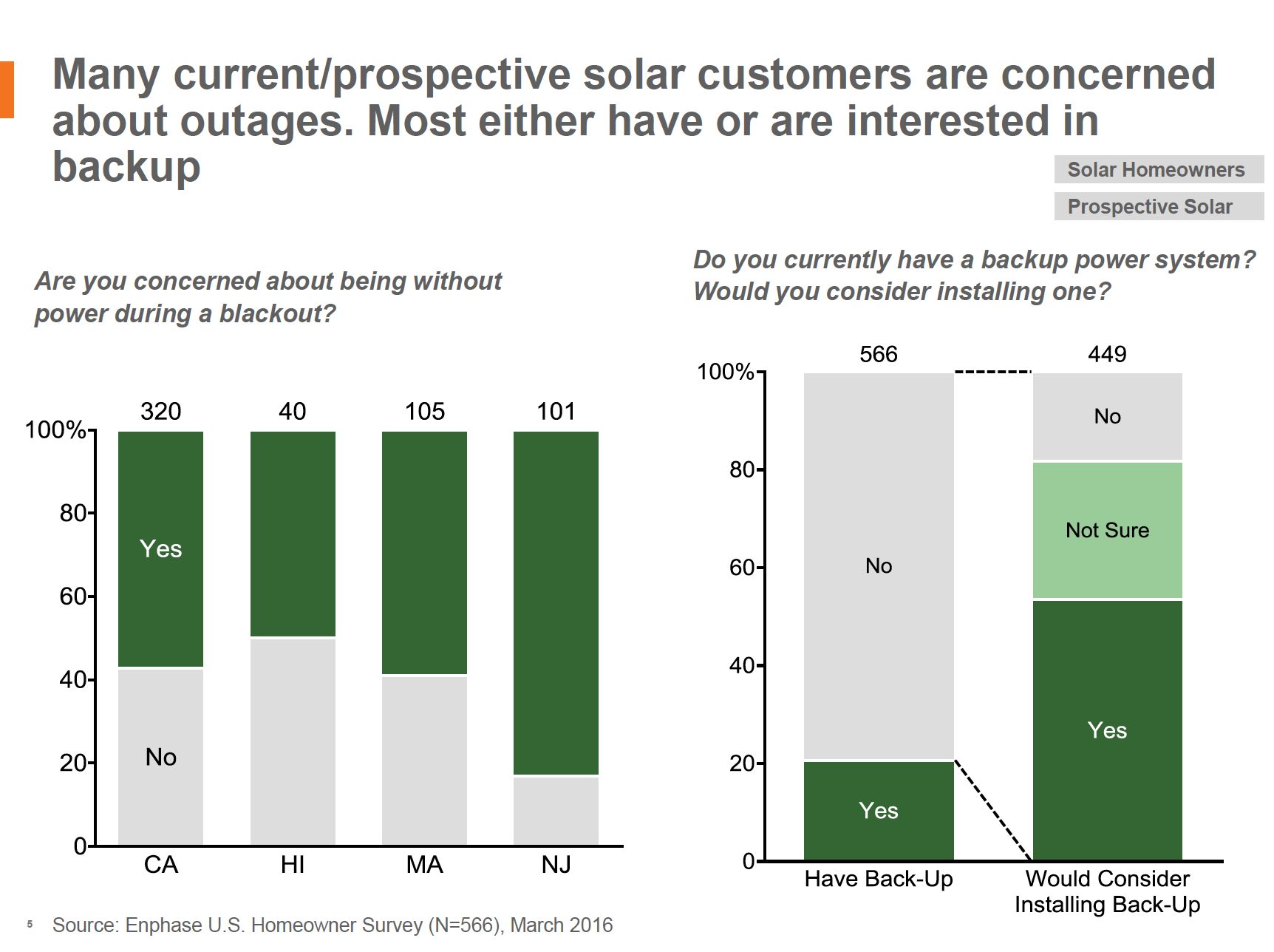

The microinverter company Enphase recently set out to measure that overlap by surveying 566 homeowners in California, Hawaii, Massachusetts and New York who either have solar systems or are looking to invest in solar.

"We realized that as an industry, we need to understand homeowners and evaluate whether the need for backup was actually there," said Brian Korgaonkar, principal of the new energy solutions group at Enphase.

According to the results, the demand for backup is most certainly there. Enphase is now releasing details.

The company found that 20 percent of respondents already have a backup power system. And of the remaining homeowners, 50 percent said they are interested in backup generation.

Then came the more important question: Would homeowners would be willing to ditch those fossil-fueled machines in favor of a sleek battery mounted on their wall?

Judging by the tens of thousands of reservations that Tesla received for its Powerwall -- and the amount of hype around residential batteries in general -- it would appear that battery storage is a natural replacement for the growing market for permanent and portable generators.

But in reality, no. The survey results show that current battery offerings can't meet the needs of most consumers looking for backup generation -- even those who are environmentally motivated.

"It became abundantly clear that a battery isn’t the right solution for backup," said Korgaonkar.

So what does the survey prove exactly? And what do the results mean for the way manufacturers and installers should be selling residential batteries?

Enphase wanted first to figure out how many solar customers are interested in backup generation. Using the research and polling firm Phoenix Marketing International, Enphase asked homeowners in large solar PV markets -- those already with solar or those considering solar who make $40,000 or more annually -- about their appetite for a backup power system.

In each market, a majority of customers expressed concerns about losing power. Many already have a backup system or are interested in getting a backup system.

That's a good start. Homeowners want more reliability. That opens up an opportunity for battery suppliers, in theory.

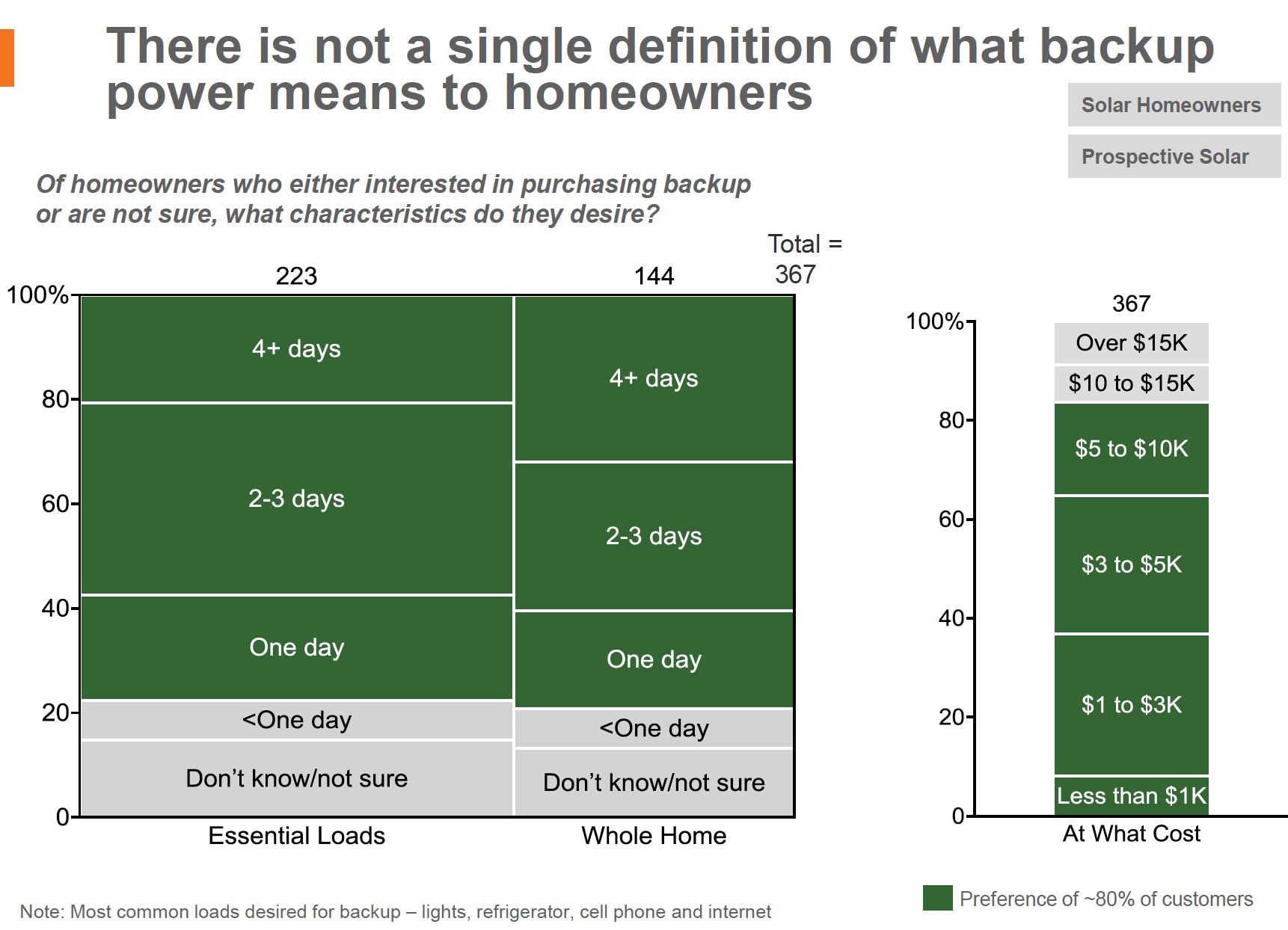

But it's not that simple. Although people have a wide range of expectations for backup systems, the majority of respondents fall into one broad category: They want multiple days of backup power, and they want it for less than $10,000.

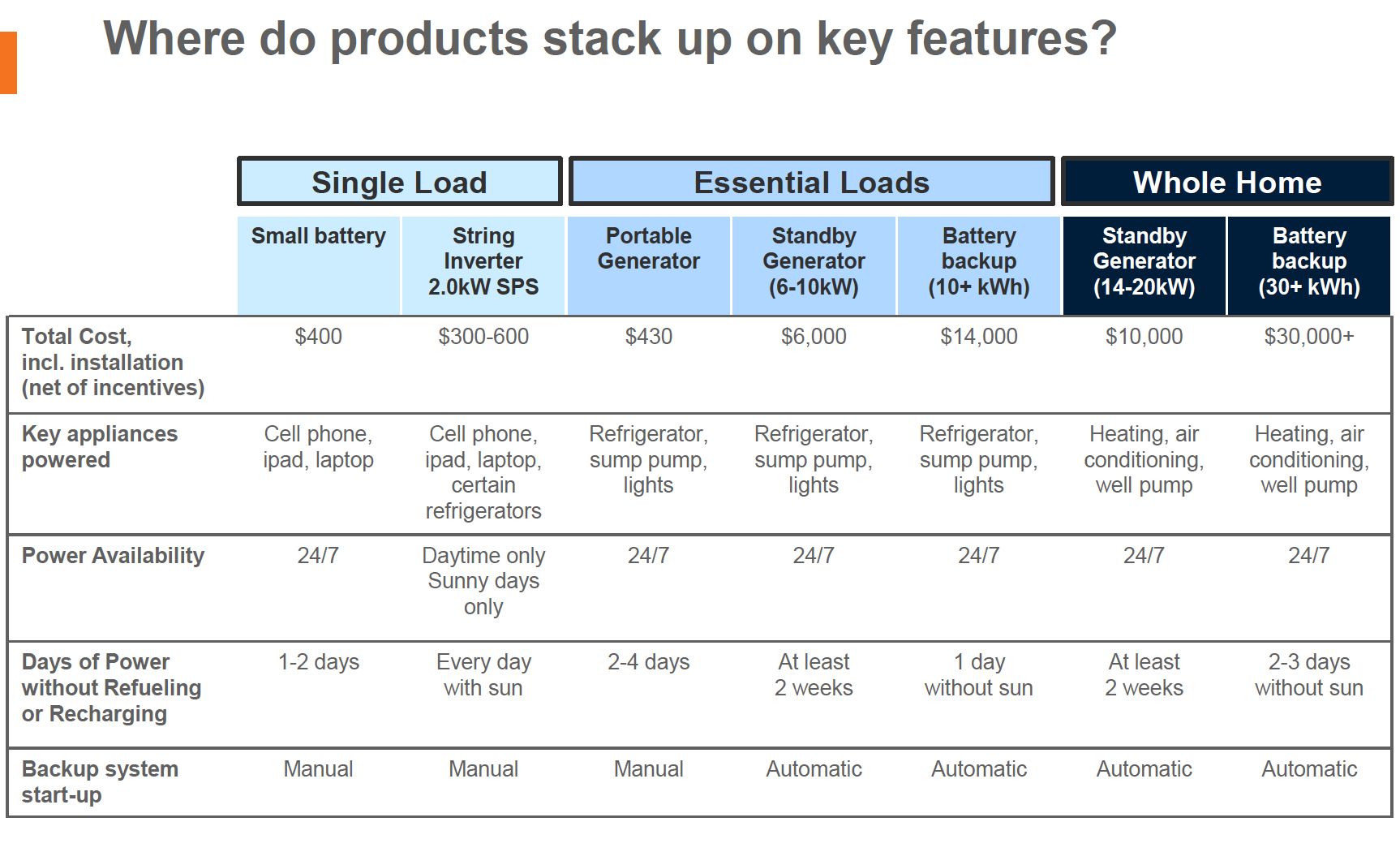

This is where the results start looking bad for batteries. When comparing consumer preferences to the price and capabilities of typical battery storage systems, the two don't align every well. Batteries either don't offer enough days of power or they cost too much.

"You see multiple segments and differences around what people are willing to pay. But when you dig further, it becomes clear that from a feature perspective, batteries don't stack up," said Trevor Wende, Enphase's senior director of energy solutions for the Americas.

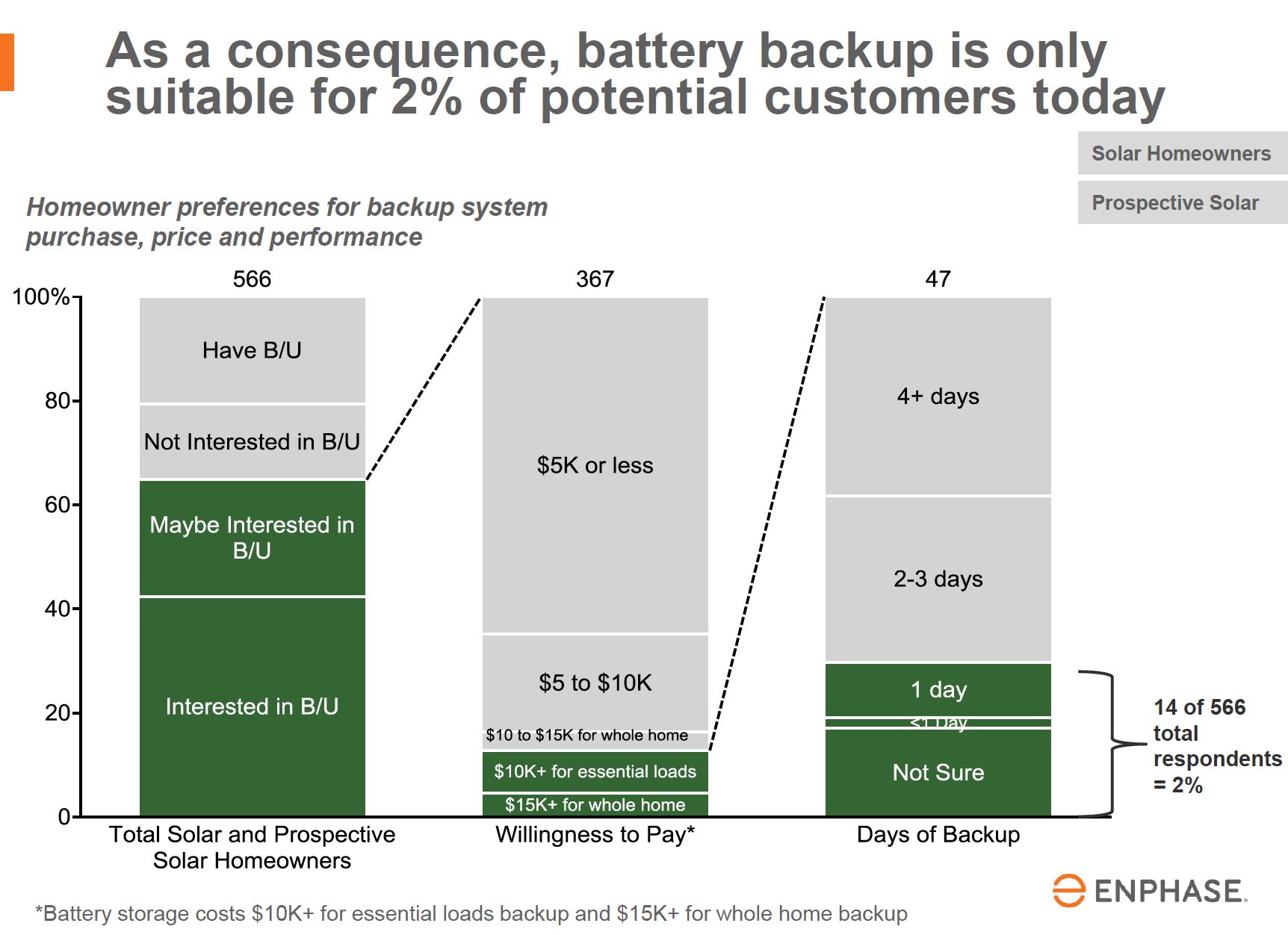

When consumer preferences were sliced and diced, Enphase found that batteries only fit the needs of 2 percent of customers surveyed.

"From a price and performance perspective, only generators can do what consumers want," said Wende.

Enphase also uncovered another surprising trend. Environmentally motivated consumers are just as likely to purchase portable and standby generators as the rest of the country overall -- showing that reliability and cost are more important than any other factors.

“When it comes to backup power, practicality trumps image, even amongst green-minded customers,” said Korgaonkar.

These findings seem simultaneously to reinforce and contradict what's happening in the market.

Earlier this year, Tesla discontinued its 10-kilowatt-hour Powerwall model that was designed for backup power. The economics of the 500-cycle lithium-ion battery didn't make sense compared to standard generators or lead-acid batteries.

Tesla and SolarCity have instead targeted their focus on using batteries for solar self-consumption and for grid services as they aggregate more systems.

Just this week, Greg Smith, a technical trainer with the German company Sonnen, admitted that selling batteries as an economic alternative to traditional generators is "an emotional sell, totally an emotional sell." Interestingly, Smith said the "overwhelming number" of Sonnen's battery systems are sold for backup purposes -- but not because they're cheaper than generators.

Korgaonkar and Wende think the residential storage industry (if one can even call it an industry at the current juncture) needs to broaden its focus. Sure, some customers might respond to an emotional sell. But the vast majority of homeowners are thinking practically. Batteries still don't meet their standards.

"There are plenty of other use cases emerging where you are using the battery on a daily basis. That’s how you generate economic value -- and that’s still a strong story," said Korgaonkar.

The problem, however, is that unsophisticated residential rate structures and wholesale market design in the U.S. still don't properly value distributed storage. So even though batteries are becoming cost-effective in some regions, the use cases are still fairly limited.

But Enphase believes these markets will evolve. The company continues to pour R&D and marketing resources into a home energy management platform that prominently features batteries, which can be used for optimizing solar consumption, shifting loads, and, eventually, providing grid services.

Recognizing that just selling backup power won't cut it, other companies are doing the same.

"I think what we’re seeing now is that manufacturers and installers are moving away from just talking about backup. And it actually reflects the same thing we found out," said Korgaonkar.