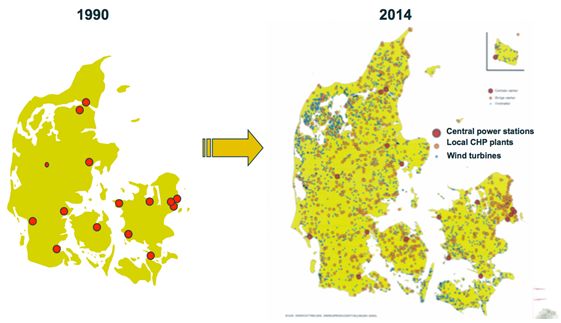

The nameplate capacity of renewables constitutes 85 percent to 90 percent of coincident peak demand in Denmark, with wind alone providing 40 percent of Danish demand in an average hour. Denmark, like most countries around the world, was traditionally powered by large centralized generation facilities. In 1990, 15 of these facilities provided the vast majority of the power for the bulk of the country.

According to a recent report by GTM Research, Ancillary Services at the Grid Edge: Distributed Energy Resources in Denmark, Denmark is today peppered with distributed generation along its medium- and low-voltage grid.

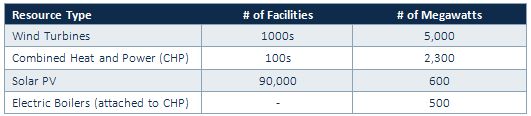

FIGURE: Renewable and Distributed Generators in Denmark

Source: GTM Research and Energinet.dk

This victory for environmentalists continues to create challenges for Denmark’s transmission service operator, Energinet.dk.

Source: Energinet.dk (presentation by Henning Parbo at Cambridge University, 2014)

The geographic dispersion of these resources, lack of control, and varying degrees of metering and telemetry create balancing, ramping and grid stability concerns for central planners. These problems are being addressed on several fronts.

Interconnection with nearby transmission service operators

The increasing interconnectedness of European transmission systems provides Denmark with the ability to export or import energy and power resources to neighboring Norway, Sweden and Germany when generation imbalances lead to excesses or shortages in power. HVDC interconnections alone account for the export of up to 3,000 megawatts during the hours with the strongest wind.

These transmission connections provide a relief valve for over-generation, but the increasing penetration of wind power in northern Germany continues to create additional concerns, as that region lacks sufficient transmission to offload power to southern German load centers, leading German transmission service operators (TSOs) to offload German wind over-generation toward Denmark. This creates a difficult situation for these TSOs, as geographic proximity can lead to coincident wind speed peaking and result in generation peaking.

Letting wind compete

Negative wholesale prices are not uncommon during low-load, high-wind conditions. In 2014, feed-in tariffs expired for older wind farms, but remained in place for new offshore projects. These offshore projects are paid a fixed rate unless wholesale prices are negative, in which case no payment is provided.

Onshore facilities continue to receive support in the form of a fixed credit provided for each megawatt-hour produced. Additionally, commercial wind curtailment allowed these legacy providers to compete in downward regulation in both Denmark and Germany in 2014.

Leveraging combined heat and power

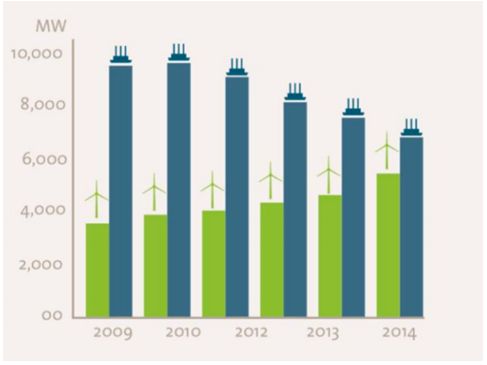

In response to the oil crisis, Denmark has built out a large amount of combined-heat-and-power (CHP) facilities and has transformed its utility industry with large shares of wind power. Co-production of electricity and heat has dropped significantly because energy-based electricity sales are unprofitable, while heat is produced on separate units. Today, the CHP units have changed their role in the electricity market; they provide 2,300 megawatts of backup for wind power, and around 500 megawatts of ancillary services.

According to Energinet.dk's Chief Ancillary Services Economist, Henning Parbo, the increasing share of renewables with zero marginal costs continues to push real-time prices down and is driving conventional units out of the electricity market. He also says that the role of thermal power plants is changing toward providing flexibility and backup, spurring a debate for capacity markets.

FIGURE: Denmark Wind and CHP Capacity

Source: Energinet.dk

A decrease in wholesale prices has driven many of these CHP facilities out of the electricity market. However, some facilities are adapting ramping capabilities and control of CHP electric boilers to deliver different kinds of ancillary services.

Some of these facilities are testing the use of IEC 61850 standard to provide the communications protocols to these facilities to participate in downward frequency response in the real-time market. This solution is providing a needed revenue boost for these CHP facilities, as spot-price-adjusted capacity payments (similar to feed-in tariffs) are set to expire in 2018.

DERs in the future

Distributed energy resources (DERs) are likely to play an increasing role in the regulation of the overall grid. Early projects such as Vesta's 1.5-megawatt battery storage system are being tested, but to date, battery storage projects have had little effect on ancillary services markets.

Vesta’s 1.5-megawatt battery, like Duke’s Notrees project in Texas, was originally intended to balance a local wind park, but now it sells primary regulation into the more lucrative ancillary services market. According to Parbo, “this system is outstanding at delivering what we ask for. However, the liquidity in the daily frequency reserves auction is fine, and there is no price floor with regard to frequency regulation.”

The process of bringing these resources into the market has been hindered by current regulatory structures that do not differentiate between primary regulation resources based on performance, or enable third-parties to aggregate and bid into the TSO without balancing responsible parties.

Energinet.dk is considering a shift from hourly energy market periods to a 15-minute resolution in the future, following the lead of the four German TSOs. “We estimate that this will improve the frequency to a certain degree. The so-called hour shift problems will be less significant,” said Parbo.

***

Grid Edge Executive Council Members gain access to all of GTM Research's reports. Learn more about becoming a member here.