The rapid commercial and technical progress of Axiom Exergy's "refrigeration batteries" flies in the face of investor bias against early-stage greentech and energy investing.

Axiom Exergy's co-founder Amrit Robbins started the firm in his garage in 2014. And today, only three years later, the firm has transitioned from pre-revenue startup to a revenue-generating company with a major supermarket customer -- Whole Foods. He called it an "inflection point in our lifespan, as we look forward to entering the next phase of rapid growth."

GTM has covered Axiom Exergy's funding, technology and business plan in the past. Here's a recap:

- The firm has 12 employees and has raised more than $3.5 million in funding from investors including Element 8 Fund, Victory Capital, the MIT Angels, Propel(x), the Sierra Angels, Tesla CTO JB Straubel, and other undisclosed investors.

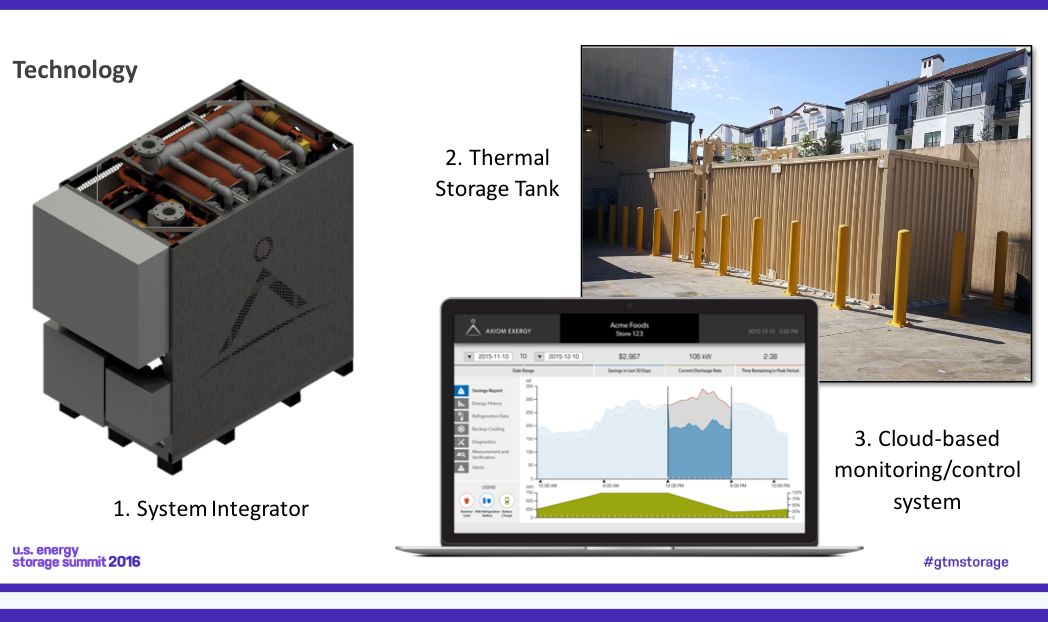

- Axiom’s technology is long-scale thermal energy storage that leverages existing refrigeration and does not require any retrofits. Axiom’s energy storage system takes the extra capacity from the refrigerator to freeze a tank of salt water overnight. (The basis of the technology is similar to what Ice Energy does with air conditioning.) During afternoon electricity peaks, the refrigeration battery uses the frozen salt water to provide refrigeration to the store’s units, which reduces or eliminates the need for compressors or condensers.

- The sales proposition is a savings-as-a-service model with no upfront capital on a five- to 10-year contract.

Robbins said, "We take a fundamentally different approach -- rather than sell stacks of batteries, we transform the world's cooling infrastructure into intelligent connected energy storage assets."

"We are selling to grocery stores, and life is hard for these folks," said Robbins who has experience in grocery store energy management. They are plagued by razor-thin margins of about 1.3 percent over the last 10 years, according to the co-founder. "And they are spending more on energy -- about three times more energy per square foot -- than other average retailers. They are scrambling to reduce costs by just a few basis points -- and energy is a huge opportunity," he said.

Robbins noted that refrigeration consumes up to 60 percent of the energy of a typical supermarket and that companies are dealing with more volatility and increasingly high peak demand charges. He claims Axiom has taken "old, forgotten refrigeration systems and transformed them into energy storage assets that are intelligent, cloud-connected and cost-effective." He added, "We enable them to operate that asset really flexibly and intelligently for the first time."

Robbins claims his firm has "$6 million in sales" to major national supermarket chains and utility companies.

From inception to market in three years?

Compare Axiom's three-year time-to-revenue with the decade-long materials development slog encountered by a company with a new battery or fuel cell chemistry. Examples, sadly, are common in defunct energy storage firms such as Aquion, Imergy or Enervault.

Yes, it's an apples-to-oranges comparison -- Axiom is integrating existing technologies, while folks at Ambri, Sakti3, Quantumscape, etc., are looking to harness the power of the periodic table in a new way. Additionally, Axiom is selling directly to an end customer, while battery suppliers are selling to battery or system integrators.

And in the case of Axiom Exergy, the customer happens to be Whole Foods, which seems willing to take on the risk of a startup supplier and a new technology.

Robbins said, "Whole Foods is really excited about this because, number one, it's reducing their energy bills. Number two, it's increasing resiliency. And number three, to some degree, it's future-proofing their stores against what's happened in the [power] market over the last 15 years and what is projected to happen."

According to Robbins, Whole Foods' Global Energy Coordinator Aaron Daly "was so excited about the potential of our solution that he asked to receive our first pilot project."

"We've needed to show that, yes, we're a small company, but we can deliver value to blue-chip companies. Whole Foods has been there to give us a full-throated endorsement," Robbins said, adding, "We're already working with them to develop the next regional rollout at additional Whole Foods locations."

Tristam Coffin, director of sustainability and facilities at Whole Foods, observed that the refrigeration industry had been "stagnant" for the last 50 or 60 years and that it was worth promoting innovation in this sector. Coffin was "looking forward to sharing information and data on our experience and hopefully seeing more of these installations going on at more Whole Foods Markets and throughout the industry."

In the compressor room at Whole Foods

The ice container at the Los Altos, Calif. site is located near the loading dock and looks like a shipping container. The controller, along with all the other Axiom hardware, is located in the supermarket's compressor room, behind the dumpster and up the stairs. We were there in mid-afternoon -- and that's when refrigeration systems are working their hardest during peak traffic and peak outside temperatures.

Robbins led the way and said, "I think what you're looking at is the only [supermarket] compressor rack that we know of in North America or the rest of the world [that's idled in the middle of the day]. It's not running. You can feel it; you can hear it -- it's not running at all. This is the ultimate goal."