Legal challenges halted several major pipeline projects across the U.S. in recent days, underscoring a seismic shift facing the U.S. utility industry: the rise of renewables as a potentially less costly and risky alternative to fossil fuels.

Over the weekend Dominion Energy and Duke Energy, two of the country's biggest utilities, canceled their Atlantic Coast Pipeline project, citing costs that have ballooned to as much as $8 billion and ongoing legal challenges from landowners and environmental groups. The pipeline's legal challenges include an April federal court decision overturning Nationwide Permit 12, a federal permit authority allowing pipelines to cross waterways and wetlands, which threatens the viability of projects including the massive Keystone XL oil pipeline.

Then on Monday the U.S. District Court for the District of Columbia ordered the Dakota Access Pipeline to shut down its oil shipments from the North Dakota shale fields by next month for failure to meet federal permitting requirements. The decision is a blow to the Trump administration, which reversed an Obama administration decision to deny the permits.

Various other pipelines, such as Permian Highway project in Texas, the Mountain Valley Pipeline from West Virginia to southern Virginia, and the PennEast project from Pennsylvania to New Jersey, may face legal challenges based on the Nationwide Permit 12 decision, said Dulles Wang, director of the North American gas team at Wood Mackenzie.

The Atlantic Coast Pipeline's cancelation marks the natural-gas market’s “third high-profile victim in the last six months,” Wang wrote in a Monday note. The others include Williams Co.’s Northeast Supply Enhancement and Constitution Pipeline projects, which were withdrawn after facing permitting denials and public opposition from New York state.

“The setbacks speak to the difficulties of building new pipeline projects in the northeast U.S., even when there is actual consumer demand that supports these projects,” Wang said.

The legal victories for environmental groups on technical permitting issues are part of a broader fight against the global warming impacts of expanding fossil fuel infrastructure. The Federal Energy Regulatory Commission has so far denied challenges based on the greenhouse gas impacts of pipeline projects, but groups including The Sierra Club and the Environmental Defense Fund continue attacking those decisions in court.

For utilities and energy companies, the mounting challenges to pipeline projects may serve as an incentive to shift from plans to rely on natural gas as a bridge fuel, and toward a less risky role building ratepayer-financed electric infrastructure to serve an increasingly renewable-powered grid, analysts say.

A shifting cost-benefit equation for gas vs. renewables

“If you look at the last six to seven years, electric utilities were seeking to acquire gas utilities as a hedge against anemic electric load growth,” Rob Rains, analyst at Washington Analysis, said in a Monday interview. Today, “companies like Duke, Southern Company, Dominion, are moving back to electric, in the face of sustained public policy and consumer interest in low-carbon energy.”

These three utilities are among others planning to eliminate carbon emissions by 2050, including Xcel Energy, DTE Energy, PSEG, Arizona Public Service, and NRG Energy.

The role of natural gas in meeting those targets remains an open question. Even among the utilities with net-zero targets, most still plan to build new natural-gas plants to supply round-the-clock energy demand, and none have yet committed to closing their existing natural-gas power plant fleet.

New natural-gas-fired power plants don’t face the same legal challenges as interstate gas pipelines, but they’re under pressure. The Sierra Club and Bloomberg Philanthropies’ Beyond Carbon Campaign is lobbying against new natural-gas power plants, warning they may become stranded assets unable to compete cost-effectively against renewables and storage.

While intermittent wind and solar power can’t be dispatched to meet peak grid needs, they can be paired with large-scale battery installations that can. Falling costs and greater economies of scale are already making this combination cost-competitive against natural-gas peaker plants in certain markets.

Completely decarbonizing the U.S. power grid through this replacement strategy could cost up to $4.5 trillion over the next two decades, according to a 2019 Wood Mackenzie analysis. But halting construction of new natural-gas plants doesn’t need to carry such high costs. A recent study indicates the U.S. could combine a 90-percent-renewable-powered grid with a 13 percent decline in wholesale electricity costs by 2035.

The "war on gas" moves beyond pipelines

Beyond public pressure, there may be a growing economic incentive for utilities to shift from natural gas to renewable electricity. "The costs keep dropping” for renewable energy, Rains said. And regulated utilities that earn a guaranteed rate of return on electric infrastructure investments have an interest in expanding that rate base via large-scale projects, he said.

In a Sunday statement, the CEOs of Duke and Dominion expressed regret for canceling the Atlantic Coast Pipeline, which they said would have brought much-needed reliable and cost-effective energy supplies to their regions. At the same time, both utilities are increasingly looking to renewable energy to supply a significant portion of their future power supplies, both because the states they operate in are increasingly demanding it and because it’s becoming an increasingly more cost-effective alternative.

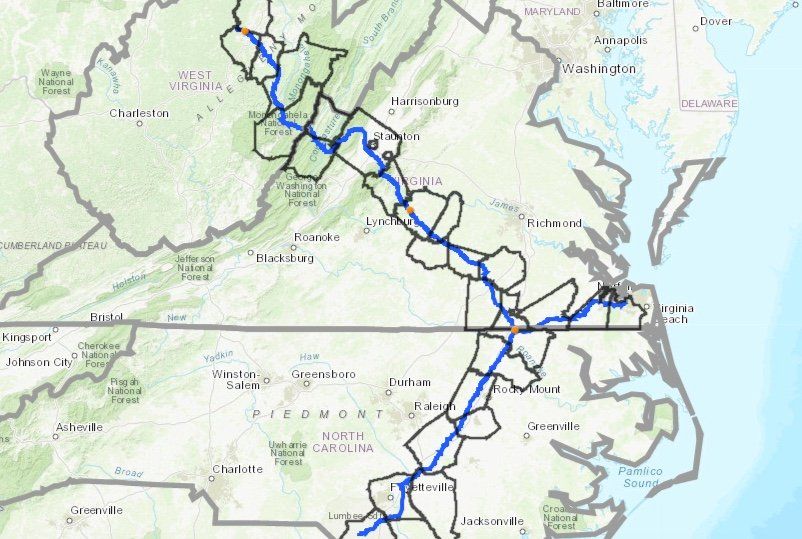

The Atlantic Coast Pipeline would have cut across three states. (Credit: Dominion)

Dominion’s home state of Virginia passed a mandate of 100 percent clean energy by 2045 this year that will force the utility to close coal plants by mid-decade and greatly reduce natural-gas use in decades to come. Sunday’s decision to sell its multistate natural-gas business to Berkshire Hathaway will better position Dominion to expand its regulated utilities’ growing clean energy ambitions, including gigawatts of offshore wind, solar power and energy storage.

While Duke’s home state of North Carolina hasn’t taken the same step as Virginia, Duke has pledged to eliminate its carbon emissions by 2050 and is heavily engaged in renewables both through its competitive Duke Renewables subsidiary and in its regulated utility territories.

“The war on gas is shifting beyond interstate gas pipelines, and down to the distribution level, through building codes and ordinances,” Rains said. Cities in California, Massachusetts, New York and other states are seeking to replace natural gas with electricity for new buildings.

Meanwhile, California utility Pacific Gas & Electric has declared support for a potential statewide ban on natural gas in new buildings to “avoid investments in new gas assets” that might be left stranded by the state’s push for a zero-carbon economy by 2045.