Increasingly, investors who manage solar assets are taking on wind assets.

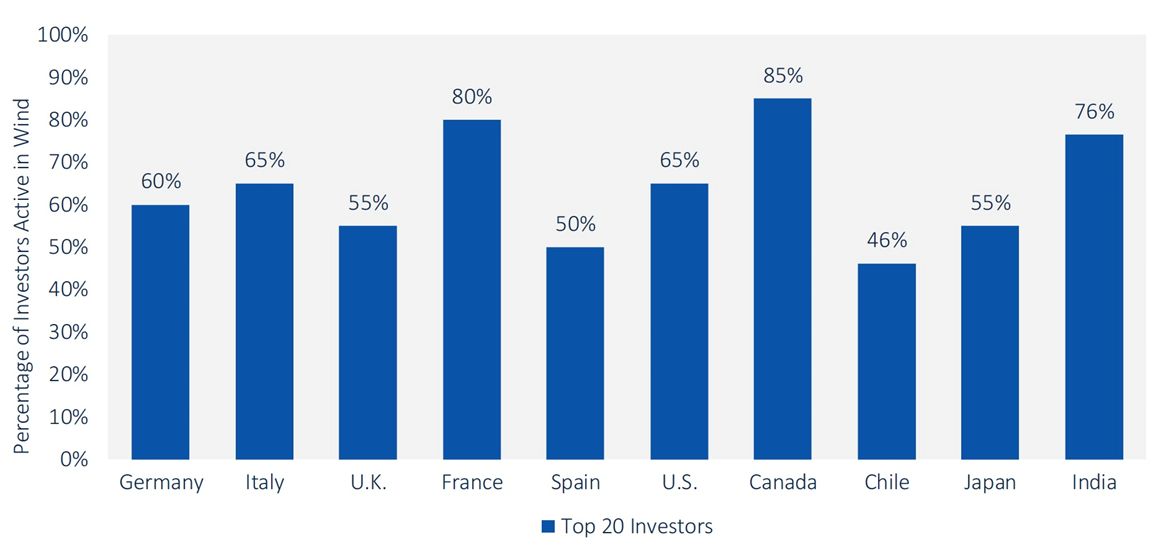

The level of overlap between the two sectors varies by market. According to GTM Research and SoliChamba's new report on solar asset management, there are numerous countries where top PV investors are also investing in wind. They include: Canada (85 percent); France (80 percent); and India (76 percent). Remarkably, all markets exceed 50 percent, except Chile.

FIGURE: Percentage of Top PV Investors Active in Wind, by Key Country

Source: Solar PV Asset Management 2017-2022

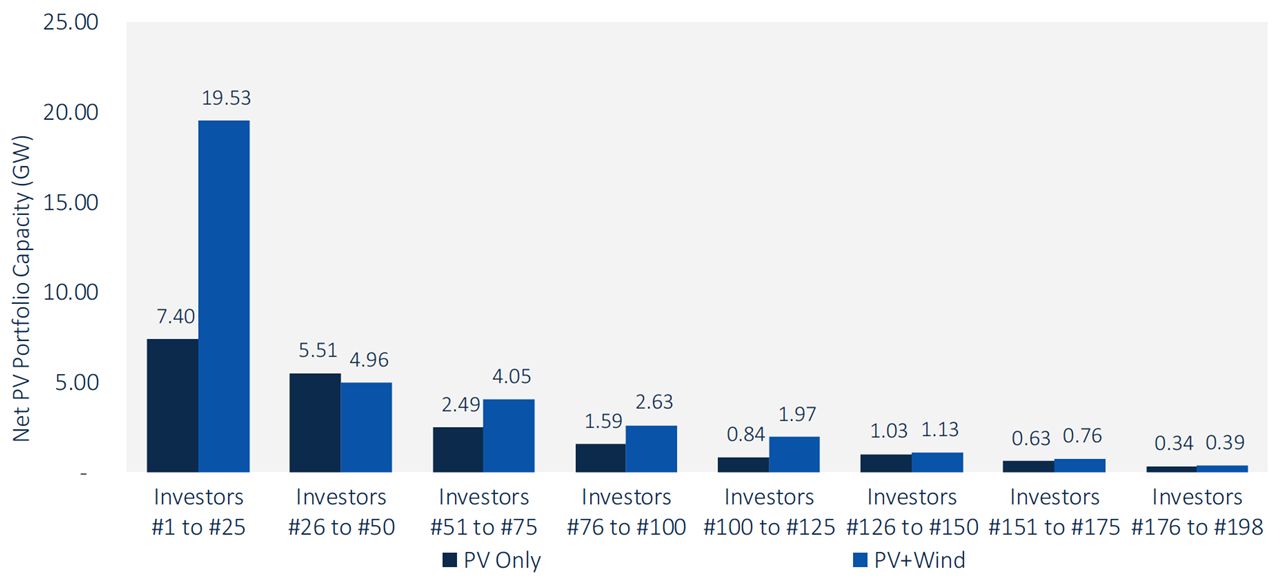

Overlap between the two industries also varies by portfolio size. The figure below shows the net capacity split between PV portfolios held by PV-only investors and those held by multi-technology players investing in both wind and solar assets.

Multi-technology players account for most of the capacity for every single investor ranking group, except ranks 26 to 50. In fact, portfolios from multi-technology investors make up 35.4 gigawatts of net capacity across all investors analyzed in the GTM Research report -- approximately 80 percent more than PV-only investor portfolios (19.8 gigawatts). This capacity dominance mostly comes from the top investors: 72 percent of the 25 leading players are multi-technology investors.

FIGURE: PV-Only vs. PV + Wind Investors in Net GW by Investor Ranking Group

Source: Solar PV Asset Management 2017-2022

Asset managers and software markets also overlap

Among 46 third-party asset managers analyzed in the report, 50 percent are also managing wind assets, and these firms make up 61 percent of the capacity managed by analyzed vendors.

On the software side, half of the 10 vendors analyzed in the report consider the wind industry as a core market, a quarter claim they serve the wind market but see it as non-core to their business, and the other quarter is planning to offer a solution for wind in 2017 or 2018.

For asset management service providers and software vendors, solar and wind convergence seems to be increasing for a simple reason: The two industries are very similar from a business standpoint, and the move from one industry to the next appears logical.

Technical aspects remain more distinct

On the operations and maintenance (O&M) side, the crossover between solar and wind is less noticeable.

Most PV O&M providers are only managing solar plants, although a few large players are managing wind plants as well, like BayWa r.e. Operation Services and EDF Renewable Services.

There are fundamental technology differences between wind and solar plants that make the jump from one industry to the next much more difficult for O&M providers than for investors or asset managers. However, there are strong similarities as well, particularly in the AC portion of the plant, and players that manage both assets may be able to leverage economies of scale in their operations center infrastructure.

Despite the differences in technology, monitoring software is an area where the two industries appear to be converging at a faster pace. In 2015, meteocontrol acquired the DaWinci wind monitoring platform from iTerra; in 2016, Power Factors acquired Ekhosoft, a platform monitoring both wind and solar plants. Several providers of wind supervisory controls and data acquisition systems entered the solar market in recent years, like BaxEnergy and more recently Envision.

GTM and SoliChamba will be watching this trend closely in future editions of their annual Global PV Monitoring and Megawatt-Scale PV O&M reports.

***

For more information about asset management markets, service providers, and software, check out the new report Solar PV Asset Management 2017-2022: Markets, Investors, Asset Managers and Software.