The U.S. and China remain locked in a difficult trade dispute on solar panel manufacturing.

Right now we're in a lull between the Countervailing Duties (CVD) and the Anti-Dumping (AD) judgments. That might not sound like much of a cliffhanger -- but the upcoming May 16 response of the Department of Commerce to SolarWorld's China-U.S. solar trade claim could have a serious impact on the U.S. photovoltaic market.

Here's a quick timeline of how we got here, what might happen this week, and what it will mean to solar professionals and the state of solar in the U.S.

The story so far:

October 19, 2011: SolarWorld and its consortium (CASM) make an official complaint to the Department of Commerce charging unfair trade practices by China in the crystalline silicon solar industry.

November 8, 2011: The Department of Commerce initiated anti-dumping (AD) and countervailing duty (CVD) investigations of imports of solar cells from China.

November through March: Accusations between the two parties ensue. CASE, an industry group opposing the tariff, is formed of Installers, project financiers, and Chinese solar panel manufacturers.

March 20, 2012: The Department of Commerce's preliminary verdict on unfair subsidies for Chinese solar panels was handed down, along with what amounted to low tariffs for the Countervailing Duties (CVD). The preliminary determination indicated the DOC’s intention to impose a duty of 4.73 percent on U.S. imports from Trina Solar, 2.9 percent from Suntech, and 3.59 percent from all other remaining Chinese manufacturers.

April 30, 2012: Manufacturing workers who lost their jobs when SolarWorld's Camarillo, Calif. plant shut down are ruled eligible for federal trade-adjustment assistance by the U.S. Department of Labor.

May 17, 2012: The U.S. Commerce Department will announce its preliminary decision in response to SolarWorld's anti-dumping (AD) petition. Any additional AD tariffs will be added to the CVD tariff.

Quotes from the players

"The processes involved in our cases are WTO-legal." Gordon Brinser, CEO SolarWorld Americas

"Do our trade laws work quickly enough to respond when autocratic nations seek to unfairly dominate an industry?" Gordon Brinser, CEO SolarWorld Americas

"It’s clear that SolarWorld is one of the most heavily subsidized companies in the history of the solar industry. If its crusade is truly about fairness, we urge the company to release a detailed list of all the subsidies and tax breaks it has received globally." Jigar Shah, CASE

The SolarWorld/CASM claim is "a jobs program -- for lawyers." Polly Shaw, Director of External Relations at Suntech America

Melanie Hart, a Policy Analyst on China Energy and Climate Policy at the Center for American Progress, said that fossil-fuel-backed U.S. political leaders are not supporting renewables, while China “has a forward-looking five-year strategy” and is “dedicating a lot of money to growing solar, particularly manufacturing.”

“Installers, importers, distributors, and developers,” will be affected by tariffs, and “nobody will benefit.” Many U.S. manufacturers and the entire consumer-oriented part of the solar sector benefit from low costs, he said, adding, “We should be competing with the traditional fossil fuel generators, not fighting amongst ourselves.” Ocean Yuan, Founder of Grape Solar

"As we see it, the most pressing question we face is clear: How can the United States continue to benefit from an open global marketplace as the vastly different system of state-sponsored capitalism in China emerges as an economic power and increasingly targets our strategic industries?" Gordon Brinser, CEO SolarWorld Americas

What's next?

The anti-dumping (AD) ruling gets decided on May 16 and announced on May 17.

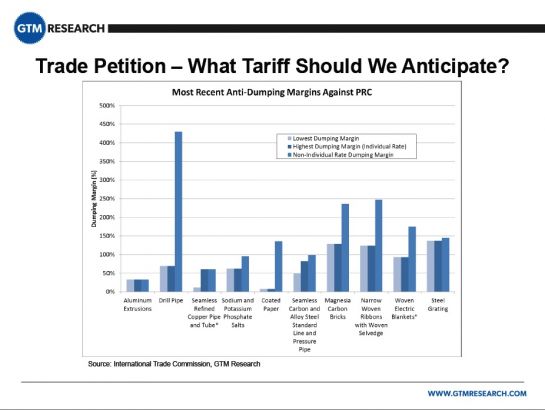

A ruling in favor of American manufacturers could hit Chinese manufacturers hard if the AD tariff is larger than the CVD tariff and similarly retroactive.

The U.S. government is going to mete out some punishment, and perhaps the EU and India will, as well. China will have to pay some retroactive fines and face a tariff. This has the potential to raise the cost of solar and stifle demand in the U.S. solar market, along with slowing the strong growth of the downstream market -- at least in the short term.

In the medium term, the tariff looks to force the regionalization of solar panel manufacturing. We’ll see modules bound for the U.S. assembled in Mexico, Malaysia, Indian, Korea or Vietnam -- all places where the total landed cost to the U.S. is today pretty close to China. Certainly Yingli, Suntech, Trina and others are in the process of adapting to this new normal.

One can already get price quotes from Chinese solar manufacturers for trade-compliant (as well as non-trade-compliant) product ready to be delivered through year-end, according to industry insiders.

An aggrieved China might take retaliatory measures on trade in the solar sector or in other markets. (See tariffs, chicken parts, below.)

The Department of Commerce defines CVD and AD

For the purpose of AD investigations, dumping occurs when a foreign company sells a product in the United States at less than fair value. For the purpose of CVD investigations, subsidies are financial assistance from foreign governments that benefit the production, manufacture, or exportation of goods.

For the AD segment, SolarWorld is going to have to reveal and prove its costs are higher than Chinese manufacturers and compare costs to a "reference country," according to Barclays.

What similar duties have done to industry in the past

A 2009, Obama-era trade decision on Chinese tire imports is often cited as a similar case. But the tire case was filed under Section 421, which is less about AD and CVD than it is about determining "market disruption" of domestic producers and imposes an import tariff as part of China’s Protocol of Accession to the WTO. In this case, the ITC suggested that President Obama impose a duty on the Chinese tires with an additional 55 percent duty in the first year, 45 percent in the second year, and 35 percent in the third year. The ITC also recommended consideration of Trade Adjustment Assistance (TAA) for impacted workers.

According to an April 27 article in the WSJ on import tariffs on those Chinese tires, analysts Gary Hufbauer and Sean Lowry of the Peterson Institute for International Economics, supporters of free trade, found, "the result of slapping heavy duties on Chinese imports was a stiff increase in tire prices. The vast majority of the tires sold in place of Chinese tires were made in other foreign countries. The additional spending on tires -- essentially the same effect as a tax -- meant that Americans had $1.12 billion less to spend on other things." The analysts say the tariff was a net job killer.

Plus, the Chinese struck back with a tariff on chicken parts.

Both sides claim victory on job creation and value creation

Gordon Brinser, the CEO of SolarWorld Americas, claims: “The U.S. trade case is supported by more than 180 solar companies representing more than 15,000 workers."

According to CASE members, CASE has surpassed CASM in the number of U.S. manufacturing jobs of its members. CASE U.S. manufacturing sources include REC Group, GT Solar, Suntech Americas, MEMC, et al. CASM's manufacturing jobs come from SolarWorld, MX, and Helios.

According to a survey conducted by the group, four of the founding manufacturers of the Coalition for American Solar Manufacturing purchased more than a combined $400 million in goods and services from other manufacturers and employers in 46 states in 2011. The four manufacturers purchased a total of more than $1 million in goods and services in 21 states and at least $50 million in four states: Oregon ($86 million), Pennsylvania ($74 million), Michigan ($60.8 million) and California ($50 million). The total helps employers cover payrolls in upstream sectors such as glass fabrication, polysilicon production and aluminum extrusion and downstream services such as auditing, laboratory analysis and transportation.

A report from The Brattle Group looked at 50-percent and 100-percent tariff scenarios and found that a 50-percent tariff will effectively shut the majority of Chinese imports out of the U.S. and result in a job loss of 15,000 to 50,000 -- even accounting for production gains in the U.S. The report also considers the impact of Chinese retaliation in importing polysilicon, which could result in a loss of 11,000 jobs in 2012, for a total of up to 60,000 jobs lost by 2014. The author of the report did acknowledge that there would be some gains among U.S.-based module producers -- albeit at higher module prices.

According to sources close to the CASE consortium, "70 percent of the jobs CASM claims to represent are associated with companies that sell and/or promote Chinese modules or are associated with China in some way. In addition, "The CASM member with the most jobs -- 3,500 -- is an industry association of general contractors with no indication as to how many are actually engaged in solar industry activities." Also, a number of CASM members don't appear to be involved in making, selling, or installing PV solar panels.

SolarWorld garners millions in subsidies

Amidst accusations of Chinese subsidies, SolarWorld has helped itself to tens of millions in subsidies:

- According to Handelsblatt, SolarWorld has received 130 million euros in direct subsidies in Germany between 2003 and 2011.

- According to the Portland Tribune, SolarWorld received an $11 million Business Energy Tax Credit in Oregon that it sold to Wal-Mart for $7.3 million in 2009. It then applied for a second round of tax credits and received an additional $19.4 million.

- SolarWorld received $19 million in preferential export financing from the Ex-Im Bank for solar projects in India.

Conclusions

I've tried to offer a balanced set of views on this matter. Now I'd like to weigh in with a few opinions.

- Of course China is subsidizing its solar industry. The inputs to making a solar panel (aside from materials) are energy, capital, and labor -- and China provides advantages to some of its solar firms in these inputs. China also has a Five-Year Plan that supports exports and provides incentives. This is also called having an actual energy policy with a long-term view.

- SolarWorld and CASM are fulfilling their duty to their shareholders by doing everything they can within the legal framework of the Department of Commerce to provide an advantage to their firm.

- The U.S. remains no better a place to build solar panels than it is to build iPhones. Tariff or not, it is unlikely that SolarWorld can survive as a U.S.-based PV module manufacturer in the long-term.

- If the U.S. downstream solar and Chinese manufacturing industries are lucky, the AD tariff will be modest. Obama, China hard-liners and SolarWorld can claim a victory, SolarWorld might get a reprieve, and downstream prices will not be markedly higher.

- GTM Research's Shyam Mehta said that only about 6 percent of the world's solar panels are made in the U.S., all in highly automated factories. In other words, solar panel manufacturing is not a labor- or jobs-rich industry in this country. The jobs are created in downstream solar industries such as installation and project development.