Kilowatt Financial has moved $250 million into rooftop solar through Clean Power Finance, and that's big news. But there's an emerging solar finance story tucked into that announcement as well, and it's about the need to understand the customer in finer detail in order to successfully finance solar or energy efficiency. The way Kilowatt frames it, it's closer to Nate Silver than it is to FICO score thresholds.

Kilowatt, a renewables funder specializing in credit analysis, has financed $400 million in solar and energy efficiency assets since 2011. Clean Power Finance (CPF) channels funding from solar finance investors to more than 250 solar channel partners through an online marketplace that serves a network of more than 20,000 solar companies, many leveraging a third-party-ownership financial model.

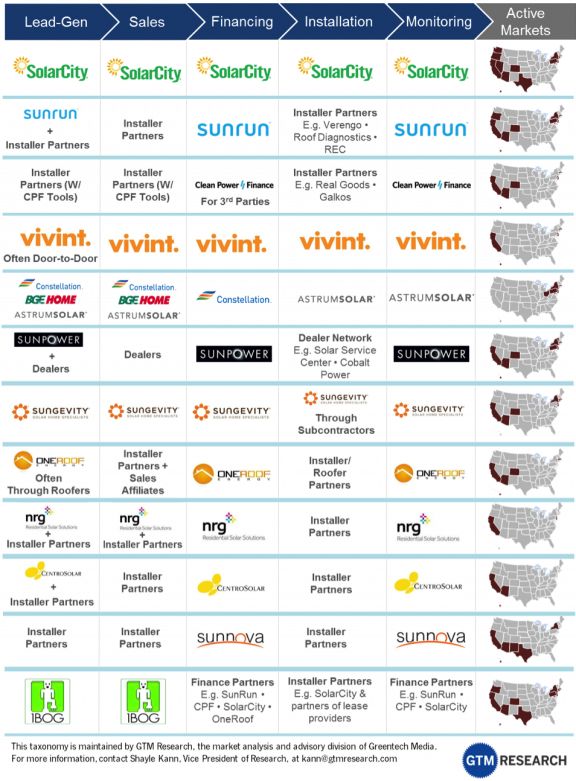

Kilowatt, backed by VC Kleiner Perkins, is betting on CPF’s platform over the structure of vertically integrated sector leaders SolarCity and Sunrun. And Kilowatt is betting on a new kind of solar customer that others may consider too risky.

CPF, also backed by KP, has raised $90 million in venture capital and equity since its 2006 founding and has raised nearly $1 billion in project finance funds for rooftop solar since 2011. “This quarter-billion-dollar milestone is a testament to Kilowatt’s consumer credit expertise and to the scale of the CPF network,” said CPF CEO Nat Kreamer.

Kilowatt’s founders were running a merchant bank, lending in all asset classes, when people from Kleiner Perkins’ Green Growth Fund told them in mid-2011 how challenging it was to find efficient financing for solar and energy efficiency customers.

Efficient financing means lowest-cost-possible interest rates delivered quickly and easily so the solar salesperson sitting in a prospective customer’s living room can close the deal, explained Kilowatt CEO Dan Pillemer.

The Kilowatt team determined three things about renewables and efficiency: consumers overwhelmingly favor them for their environmental and economics benefits; they are not a fad and they will increasingly require capital; and of two consumers with similar credit profiles, the one who wants financing for solar or efficiency “will exhibit superior repayment performance” over the one who wants a loan for a new patio or a vacation.

“Consumers love the product, it is a growing market, and borrowers will have relatively strong repayment tendencies,” Pillemer said. For Kilowatt to provide financial products in that market while helping the environment and creating jobs is “a dream come true.”

Kilowatt funds third-party ownership for solar through leases and power purchase agreements. It also lends to solar purchasers and for “anything home energy efficiency-related.” Leasing for efficiency upgrades, Pillemer said, isn’t as economically viable as loaning.

Solar’s future includes both the lease-PPA and the loan-to-own business models, he said. Third-party ownership offers funders tax benefits that homeowners typically cannot use. But its complexity and the declining cost of solar may, in the long run, compel some homeowners to explore solar ownership.

Consumers should understand “the economic ramifications of leases versus loans,” Pillemer said. Often, “it will come down to consumers’ personal interests: Do they want to maximize money over twenty years, or save more immediately and less over the long run? Do they have a desire to own the asset, or are they OK having someone else own and deal with the equipment?”

Kilowatt is focused on providing that choice: “I can’t understand how anyone can make a prediction about one [model] winning or losing right now.”

Kilowatt’s team decided “from day one” not to pursue the PPA-lease business models used by vertically integrated firms like SolarCity or SunPower.

“We realized we would get to market faster with more built-in operational integrity if we went through CPF,” Pillemer said. The firm gave up marginal profits across the process to focus on its core competence, because “we understand how to assess the quality of solar installations, but having lots of offices and salespeople and installers isn’t the best use of our time.”

Kilowatt’s time is instead directed at helping CPF’s installer partners identify potential solar customers.

“We’re data information and analytics nerds,” Pillemer said. While most lenders look primarily at a candidate’s FICO score, Kilowatt analyzes much more data, considering factors like income, demographics, and housing that allow the firm "to make better credit decisions.”

They may accept a low FICO candidate and reject one with a high FICO score. “FICO itself is two-year measure of risk,” Pillemer said. But solar is a long-term asset. And none of the providers he knows of are having “problems with loss or delinquencies.”

Another of Kilowatt’s key differentiators as a lender, Pillemer said, is that it has “skin in the game.”

While competitors must raise more than the system’s capital cost to provide a return to investors, Kilowatt raises a majority of the capital cost but invests its own money alongside that. “In every asset we originate, we have a significant amount of equity,” Pillemer said. As a result, more confident investors “provide capital to us more cheaply than to others.”

Looking ahead, Pillemer sees incentives for solar declining and the need for more returns to come from consumers. “The people who have the best understanding of the volatility and likely dynamics of ongoing consumer payments will have a better ability to drive down their cost of capital.”

When retail utility rates stop their recent rapid ascent, he said, “you’re going to see the dynamics around prediction and management of consumer behavior and payment become a lot more relevant.”