Concentrating photovoltaic equipment manufacturer Amonix has bought Sunworks Solar and appointed one of Sunworks' co-founders as its new CEO.

Brian Robertson became Amonix's chief executive last month, he said Tuesday. The Seal Beach, Calif.-based Amonix has been around since 1989 and reportedly has seen its equipment in more concentrating solar power projects than any other manufactures in the world.

Amonix also has appointed two other Sunworks' executives to its management positions. Guy Blanchard, also a Sunworks co-founder, will be vice president of sales and corporate development. Matthew Meares, who previously worked on sales and project development at Sunworks, is now director of project finance at Amonix.

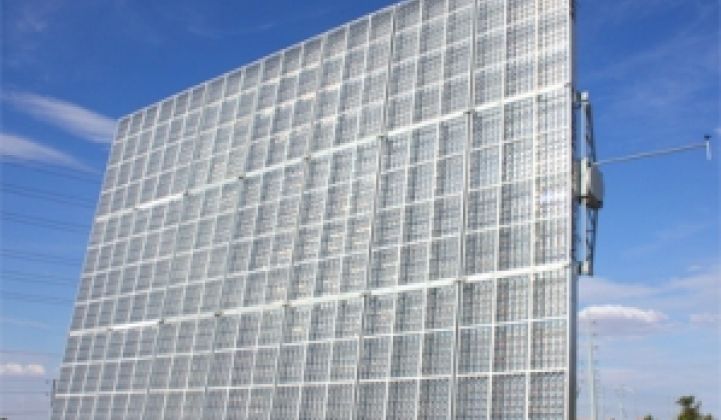

Concentrating photovoltaic (CPV) systems make use of mirrors and lenses to concentrate the sunlight onto solar cells to boost the cells' electricity production. Amonix uses acrylic lenses and mounts it 55-foot long solar panels on trackers to keep them facing the sun, Robertson said.

The acquisition reflects Amonix's interest in bringing on managers with lots of experiences in solar rather than expanding to a new sector in solar. The companies declined to disclose the purchase price.

Robertson co-founded San Francisco-based Sunworks in 2008 to manufacture amorphous silicon solar panels. Earlier this year, the company was in talks with the state of New York about building a 75-megawatt factory there (See Sunworks Solar Steps Out With Thin-Film Factory Plan).

But stands out on Robertson's resume, however, are his ties to SunEdison. He was president of SunEdison, one of the largest solar power project developers in the United States, before starting Sunworks.

SunEdison develops and owns solar energy systems and sells the resulting electricity under long-term contracts to mostly businesses, utilities and government agencies. Silicon wafer maker, MEMC Electronic Materials (NYSE: WFR) bought SunEdison for $200 million in cash and stock last month (see MEMC Invests in Another Installer: Tioga Energy).

Blanchard, on the other hand, was a managing director of Fortress Investment Group's Drawbridge funds before he co-founded Sunworks. Meares was with Germany-based HSH Nordbank before Sunworks and worked on loans and equity deals in the power business at the bank.

Amonix doesn't plan to become an amorphous silicon solar panel maker, Robertson said. Sunworks never built that factory in New York, he added.

Robertson has replaced Vahan Garboushian, who founded Amonix about 20 years ago. Garboushian remains the company's chief technology officer and chairman.

The company has been installing projects for 15 years, making it a pioneer in a solar sector that has seen a series of startups in recent years (see CPV Pt. 1: Stuck in the Middle).

The company has seen nearly 13 megawatts of equipment being used by developers worldwide. Most of them are in Spain, including a 7.8-megawatt one in the Navarra region. Other projects are located in Arizona and Nevada (see map).

Concentrating photovoltaic developers say their technologies could deliver cheaper solar electricity than power from conventional solar power panels because they use lenses to concentrate the sunlight to squeeze more power from solar cells. They typically use more expensive solar cells that can convert sunlight into electricity at higher rates, but they use only slivers of them to cut costs.

This type of solar energy systems is suitable for dry, sunny climate like the American southwest. Robertson said the systems don't require any heavy use of water, unlike the solar thermal power projects that have been proposed in the desert.

"We think CPV will end up taking market share from" solar thermal power developers, Robertson said.

Amonix has a factory that can assemble 30 megawatts of solar panels per year. Each solar panel is consisted of the acrylic Fresnel lenses and multijunction solar cells with gallium-arsenide and other semiconductor compounds. The company main solar cell supplier is Sylmar, Calif.-based SpectroLab.

Amonix designs its own trackers but hire another manufacturer to make them. Robertson declined to name the contract manufacturer.

Each tracker can hold up seven panels, which collectively have 72 kilowatts of generation capacity, Robertson said.

"It's bigger than any other tracker in the industry, and the design has been perfected over 15 years of field deployment," he said.

Amonix recently raised $40 million, according to its filing with the U.S. Securities and Exchange Commission last month. The company's website lists MissionPoint Capital Partners as an investor.

Photo: courtesy of Amonix