Grid-scale battery technology startup Ambri just raised $35 million from new investors KLP Enterprises, the family office of Karen Pritzker and Michael Vlock, and Building Insurance Bern, the Swiss Insurance company, along with existing investors Khosla Ventures, Bill Gates and French energy giant Total in this C Round. Ambri has also had support from the Deshpande Center and the Chesonis Family Foundation, as well as grants from the Office of Naval Research.

The inventor of the core technology for the battery is Donald Sadoway, MIT professor of materials chemistry, with technology inspired by the economy of scale of modern electrometallurgy and the aluminum smelter. Sadoway used seed money from within MIT to invent the liquid metal battery, using a technology called Reversible Ambipolar Electrolysis. Ambri raised a $15 million Round B from Khosla Ventures, Bill Gates and energy company Total in 2012.

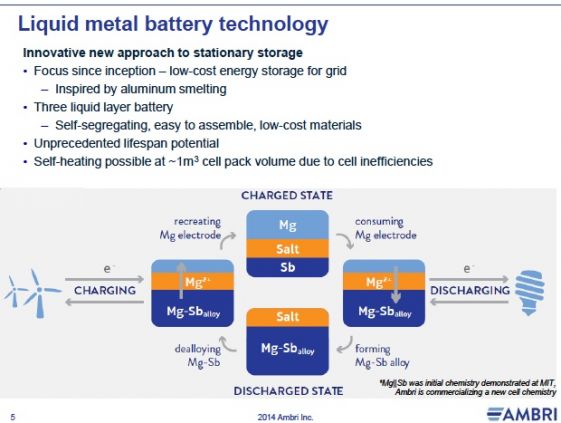

In a presentation earlier this year, Ambri's CTO, David Bradwell, said a grid-scale battery needs to be resilient, safe and low-cost. The three layers in the Ambri battery are self-segregating, cheap to manufacture and earth-abundant. The materials used in the original design were magnesium and antimony separated by a salt -- but "we needed higher voltage and lower temperature," said the CTO, and so the firm has a new, undisclosed chemistry that was developed with the help of ARPA-E funding.

Ambri looks to move its energy storage system toward commercialization and construct its first commercial-scale battery factory with the new cash. The firm is working on prototype systems in Massachusetts, Hawaii, New York and Alaska, with project partners such as First Wind, Hawaiian Electric, and Con Edison.

Phil Giudice, Ambri’s CEO, spoke to GTM of the ability for storage to "separate generation from demand" and make for a "better electrical system."

Andrew Chung, partner at Khosla Ventures and a board member of Ambri, told GTM, "What will drive the energy storage market is total cost of ownership." He suggested comparing lithium-ion batteries and their limited lifetimes to the 25- or 30-year life of Ambri's product. Chung attests to having demonstrated building one of the batteries himself and points out "the simple manufacturing process" and "use of cheap and safe materials and significantly longer lifetime compared to other approaches we’ve seen." Chung actually funded Ambri earlier in his career while at Lightspeed Venture Partners with a $100,000 grant in the very early days of the startup.

Chung said that Khosla Ventures is "not afraid to put a lot investment behind 'holy grail' categories." He added that the investment firm had "scoured the earth" for storage technology and only publicly revealed funding in LightSail and Ambri, with Ambri the lone chemically-based grid-scale approach in its portfolio.

The KV partner said that total cost of ownership will make or break this industry and that that is the advantage of the Ambri battery, "a product that can be made with simplicity and elegance."

Both the VC investor and the startup CEO spoke of energy storage as the solution to managing the variable nature of solar and wind on the grid and keeping the grid stable. But neither the investor nor the CEO could draw a direct line between their product and a genuine utility asset purchase -- aside from the claim of deferring generation build-out and construction of peaker plants. That's due mostly to the still-forming regulatory landscape around energy storage applications. The bet is that the regulatory picture will be become clearer as the technology and pricing continues to improve.

Chung points out that Ambri has been able to develop its technology and reach the point of pilot programs and initial production on a relatively small amount of funding. He's optimistic about the startup's "very viable first markets."

Ambri investor Vinod Khosla is not a big fan of lithium-ion batteries and has funded a number of other energy storage companies including Pellion, LightSail, QuantumScape, and Seeo. Aquion, funded by KPCB, ATV and Foundation Capital, is developing a saltwater electrolyte-based system. Eos has a zinc-air battery with some customer traction. Stanford University technology can be found in Huggins Group battery startup Alveo Energy. There are dozens more startups aiming for utility-scale energy storage working with compressed air, mechanical systems, flow batteries, and other electrochemical means.

There is a load of VC investment thinly spread in this field -- and a familiar reckoning awaits.

Keep in mind that while these startups struggle for their first megawatt of energy storage production, AES has installed more than 100 megawatts of energy storage. Incumbents with heft, such as S&C, Siemens, ABB and GE, are deeply engaged with this problem as well.

Ambri CEO Giudice noted that Hawaii is now dumping 30 percent of its wind energy, while distribution feeders on Oahu are overgenerating. "Our storage in a place like Hawaii can create economic benefits. When Hawaii gains experience, it will serve as a test case for California and Texas," he said.

As for storage scaling up to meaningful levels, Giudice said, "You will be amazed at how fast this will happen. From here, the ramp will be phenomenal."

***

In March we reported on a presentation given by Ambri's CTO and co-founder, David Bradwell, at Infocast's Energy Storage Week. Here it is.

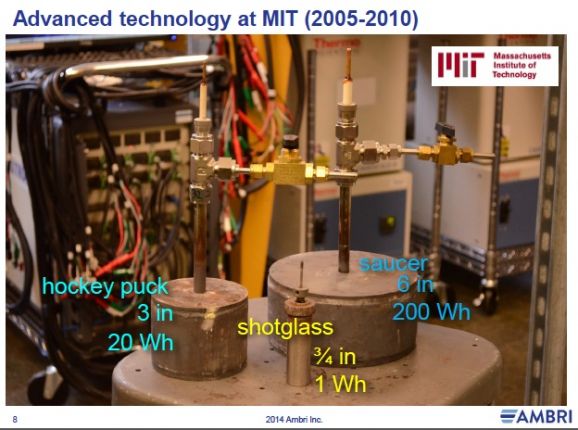

Prototype units started as the "shot glass," followed by the 3-inch, 20-watt-hour "hockey puck," and then by the 6-inch, 200-watt-hour "saucer." The commercialized product will use a 6-inch square.

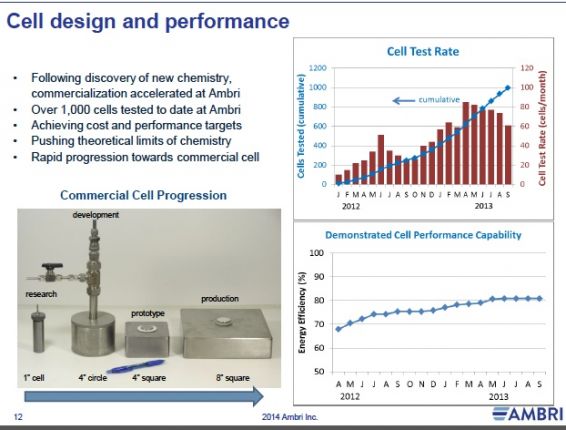

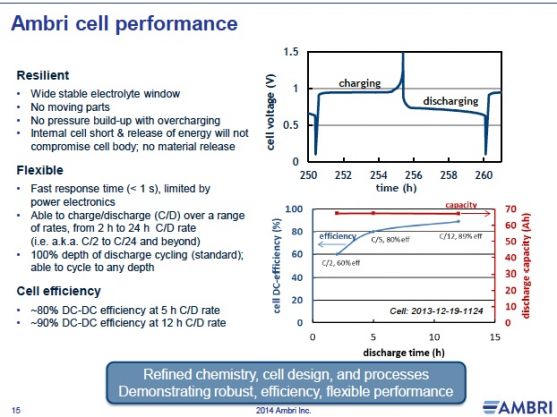

Bradwell notes that the batteries achieve 1,000 cycles of continuous deep cycling with negligible fade. There are no moving parts, pumps or valves in the design.

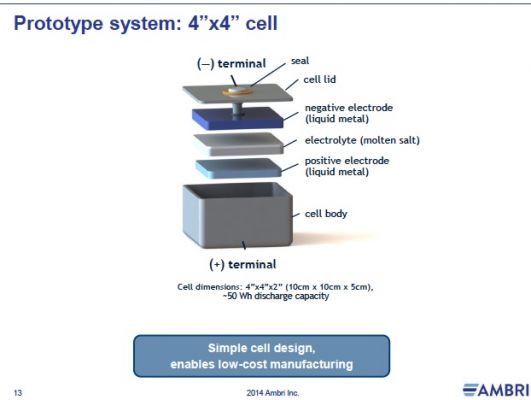

The cell is contained in a 4-inch-by-4-inch stamped stainless steel housing with no nanoscale microstructures or difficult-to-synthesize materials, according to the co-founder.

The cells have a DC-to-DC efficiency of 80 percent at a five-hour charge/discharge rate and an AC-to-AC efficiency of 70 percent to 75 percent.

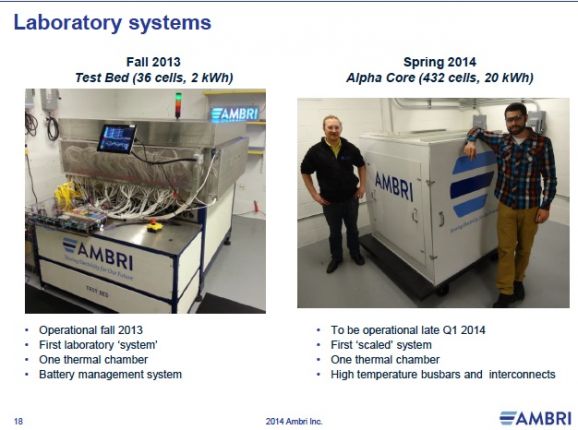

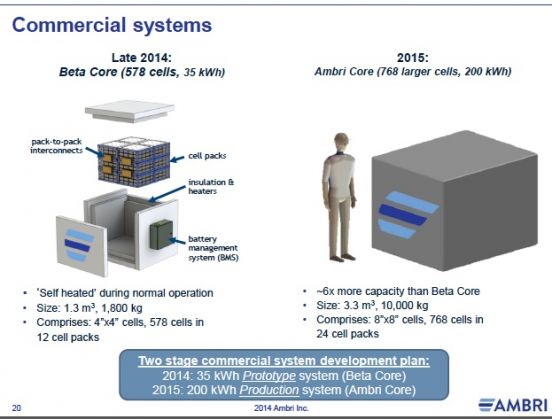

Ambri hopes to have its first scaled 20-kilowatt-hour units operational early this year, with 35-kilowatt-hour commercial units coming in 2015. A larger system will reach 200 kilowatt-hours in 3 cubic meters. The 10-ton weight of that unit will serve as an effective theft deterrent, joked Bradwell.

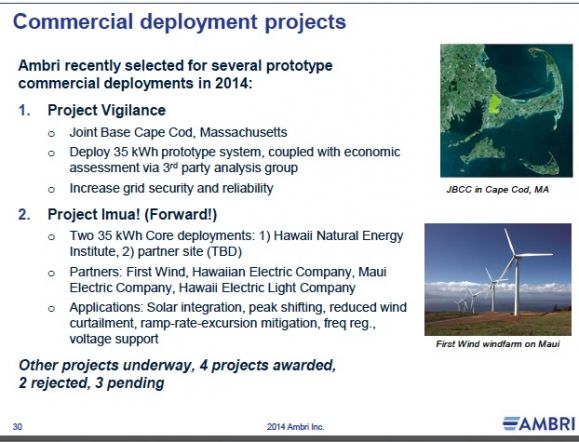

The company's pilot project in Hawaii will have two cores installed this year in partnership with First Wind and HECO, with funding from the DOE- and ONR-sponsored Hawaii Energy Excelerator. The goal is to improve integration of solar power and reduce wind curtailment.

Another project at Joint Base Cape Cod will see deployment of a 35-kilowatt-hour prototype to improve grid security and reliability.

Bradwell noted that all manufacturing processes and robotic cell assembly had to be developed by Ambri. He claims a lower manufacturing cost and lower employee-per-square-foot-of-factory ratio than that of lithium-ion battery technology. The CTO also suggested that Ambri's pricing will fall between that of pumped hydro and compressed-air energy storage.

MIT's Don Sadoway on Ambri technology