"Applied Materials stock hit five-year highs on Tuesday after the chip-making equipment giant agreed to buy Tokyo Electron in an all-stock deal valued at more than $9 billion," according to the San Jose Business Journal.

Applied is the number-one builder of semiconductor manufacturing equipment; Tokyo Electron is number three. ASML is number two. And Applied, like many in the semiconductor equipment industry, is facing difficult times. Applied also has a strong offering of c-Si wafer and cell processing equipment.

But here's the real reason we're covering the merger.

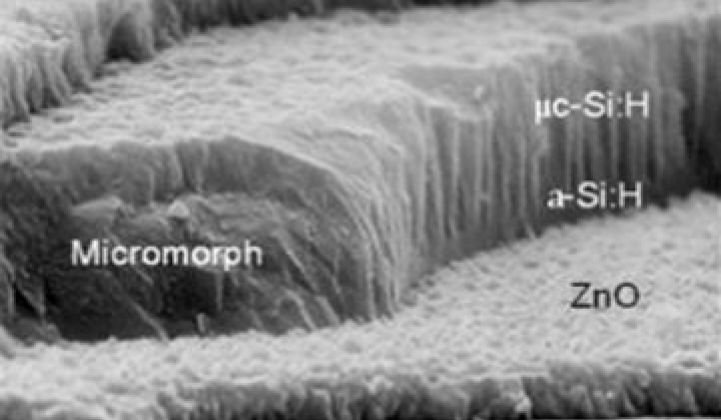

Way back in July 2010, in a bit of drama, Applied Materials discontinued its SunFab line of amorphous silicon (a-Si) thin-film solar panels and cut about 500 workers. As we've reported, Applied entered the amorphous silicon solar business in 2006 through acquisitions and envisioned factories that would produce gigawatts' worth of large-scale solar panels each year. The center of the strategy was SunFab, a factory-in-a-box product. The company landed early clients like Signet Solar, Suntech and Masdar PV.

But low efficiencies (below 11 percent), high costs, and cheap Chinese crystalline silicon doomed a-Si and the SunFab effort, and by 2010, Applied had cut its losses and killed the business.

Meanwhile, in March 2012, the a-Si equipment division of Oerlikon, a Swiss conglomerate owned by a Russian oligarch, was divested to TEL in a $275 million deal.

With this acquisition, the now-larger Applied Materials is once again the provider of a-Si equipment for solar panels. Applied gets to try a-Si all over again. The TEL a-Si business still has a few customers, such as Russia's Hevel.

Amorphous silicon solar technology has a troubled commercial track record. In addition to Applied, other defunct a-Si producers include OptiSolar, Sencera, and ECD. Sharp entered a JV with Enel and ST Microelectronics in a-Si a few years ago and still has the vestiges or its a-Si business. Also struggling to remain competitive in amorphous silicon and its variations are Xunlight, HelioSphera, and NanoPV.