In a marketplace with viciously plunging solar module costs, what strategy best serves a startup solar cell manufacturer?

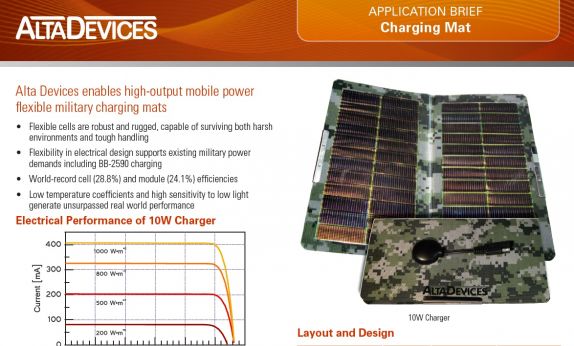

Well, if you're Alta Devices, you stay away from rooftops and solar fields, at least for now, and go after military and portable markets -- where efficiency is crucial and price-per-watt is much less important.

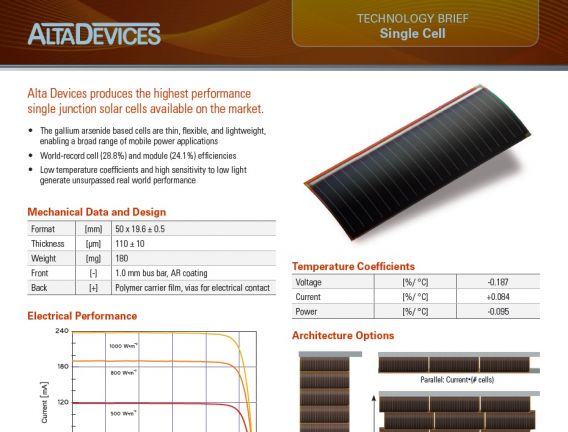

Alta has made technical strides in flexible gallium arsenide (GaAs) photovoltaics, setting records for the materials system and able to boast NREL-verified 28.8 percent cell efficiencies for a single-junction solar cell. (The theoretical maximum solar cell efficiency limit for a single-junction device, the Shockley-Queisser limit, is 33.5 percent. SunPower's crystalline silicon Gen 3 cells have efficiencies in excess of 23 percent.)

Alta Devices uses an epitaxial lift-off (ELO) technique pioneered by Eli Yablonovitch that produces flexible layers of GaAs that are one micron thick. Substrate re-use and cost is an issue in this type of technology, as it is with Crystal Solar and Solexel. Alta still has to scale and scrub away cost in the face of technical and economic challenges with ELO and the firm's novel MOCVD processes.

Late last year, Chris Norris, the firm's CEO, spoke of a 10-watt iPad cover in the MIT Technology Review, which reported that Alta had "started selling solar panels to the military to power small unmanned aerial vehicles, and by the end of next year it plans to start selling an iPad cover powerful enough to make plugging in unnecessary."

This week Alta announced "reference designs" for solar chargers using the company's cells in portable power, military, automotive, and unmanned systems. Reference designs are presumably provided to ease integrating Alta's cells into an OEM's end product. So, Alta is now in the high-efficiency solar cell business. And maybe in the charger business.

These applications suit the high efficiency and light weight of Alta's thin-film solar cells. Recall that these are also applications pursued by CIGS vendor Global Solar, amorphous silicon vendor ECD, and organic solar cell vendor Konarka, may they rest in peace. What Alta does have that GSE or ECD or Konarka didn't is the potential to bring really high efficiencies to these applications.

All of this has to be done at a reasonable cost -- although one could imagine selling prices closer to $10 per watt in these niche markets instead of the current $0.75 per watt in the rooftop solar business. These portable power products don't have to carry twenty-year guarantees, either.

Norris, in an email, told GTM today that lifetimes for this type of product are "two or three years typically. For these types of applications, the method and materials used to encapsulate the films are the primary factors in how long the product will last. That's a choice of economics and requirements. Our films, as you know, have very long lifetimes and are fundamentally suitable for 25+ year lifetime utility installations and use in space."

The CEO said, "We have about 2 megawatts of capacity in place in our pilot line located in Sunnyvale. We have been shipping small volumes throughout 2012 and will be focused on fully ramping the pilot line in 2013." He had told GTM earlier that the firm remains "agnostic" about whether the end-product is a cell, a flexible module, or a rigid glass module.

Alta Devices has raised $120 million from investors including KPCB, NEA, August Capital, Crosslink Capital, DAG Ventures, NEA, Presidio Ventures, Technology Partners, Dow Chemical, Aimco, Good Energies, Energy Technology Ventures, and Constellation Energy.

Can GaAs and Alta ever transition onto the rooftop? Can GaAs production scale big?

Or is Alta limited to these niche markets? Can these niche markets provide the growth and heft that a VC-funded startup needs? Other solar startups with cell-level innovations such as Solexel or Silevo are going after module markets rather than portable power, a choice with its own set of challenges.

The CEO said, "Overall, we're pleased with the progress we've made technically. Our efforts are transitioning away from fundamental technology development and toward yields and equipment productivity. We're excited about the multitude of opportunities we've found (and continue to uncover) to solve problems and create value by generating energy solutions for things that move, can be carried or worn. While our current focus is airborne and ground-based solutions for the military, markets such as consumer electronics, transportation and other forms of portable energy generation are future opportunities."

Norris noted, "You would be surprised at how large these 'off-grid' markets can potentially be -- gigawatts. And there are dozens of sub-markets in this greater bucket of 'off-grid' energy, of different sizes and margin/pricing requirements. We think there's a way to systematically develop products for these markets that matches the market to the different levels of scale as we grow the company over the coming years. For a company like us, it's the holy grail -- the ability to profitably address a few unique markets while the technology is immature, and then methodically expand into larger markets as we gain learning and create more manufacturing scale."

Here are the specs for Alta Devices' 24 Percent Efficient Solar Charging Mat:

And the firm's GaAs solar cell.