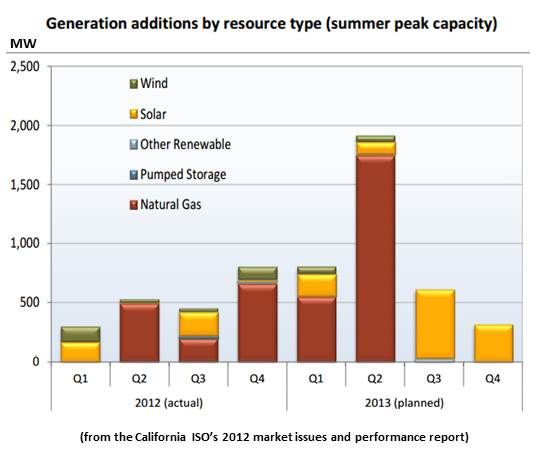

Almost all of the new generation capacity in the California transmission system operator’s queue for the second half of 2013 is solar -- 97 percent, to be exact.

There are 1,633 megawatts of new generation capacity in the 2H 2013 queue, according to the 2012 Annual Report on Market Issues and Performance from the California Independent System Operator (the ISO). Of that, 1,581 megawatts are new solar and 52 megawatts are biomass.

By the end of the first half of the year, the ISO will have added 3,391 megawatts of nameplate capacity, of which 2,296 megawatts will be natural gas, 565 megawatts will be wind and 530 megawatts will be solar.

However, what is in the ISO’s queue is not necessarily what will end up in the state’s energy mix, REC Solar Director of Governmental Affairs Ben Higgins pointed out.

But in this report, California ISO Manager of Monitoring and Reporting Keith Collins noted, “the ISO has done its best in determining which projects have a high probably of coming on-line instead of just taking generation in the queue as-is.”

This is likely a very good indication of the new generation the marketplace will build to replace the 2,200-megawatt deficit caused by the San Onofre nuclear facility outage and the mandated closures/retrofits of fossil fuel plants that over-consume the state’s water resources. And it is a strong indication of the kind of building that will be driven by the state’s 33 percent by 2020 Renewable Portfolio Standard.

“This is the shape of things to come,” observed V. John White, executive director of the Center for Energy Efficiency and Renewable Technologies (CEERT). But it raises two important questions. First, what kind of natural gas plants will be added? And, second, are we getting a lumpy renewable energy portfolio that is heavy on solar and light on everything else?"

The gas plants could be more of the traditional facilities that are not suitable as currently configured to meet the demands of the future, White said, because they have to run at a 40 percent minimum capacity and take 90 minutes to ramp up. Or they could be the newer, quick-start, fast-ramp technology. Alternatively, they could be among the once-through-cooling plants that overuse the state’s water resources and are required by state mandate to be retrofitted or shut down by 2016.

The ISO’s report suggests the necessary expenditures may not be made in the natural gas sector because the falling price of natural gas will not support new building. “The 2012 net revenue estimates for hypothetical combined-cycle and combustion-turbine units continued to fall substantially below the estimates of the annualized fixed costs for these technologies. For a new combined-cycle unit, net operating revenues earned from the markets in 2012 are estimated to be about $38 per kilowatt-year in Southern California, compared to potential annualized fixed costs of $176 per kilowatt-year.”

“What we want is a diverse renewables portfolio that includes solar PV, wind, geothermal and CSP with storage,” White said. “Procurement of the future has to be integrated. As time goes on, we need to smooth this out and include demand response, energy efficiency, storage, and even out-of-state resources.”

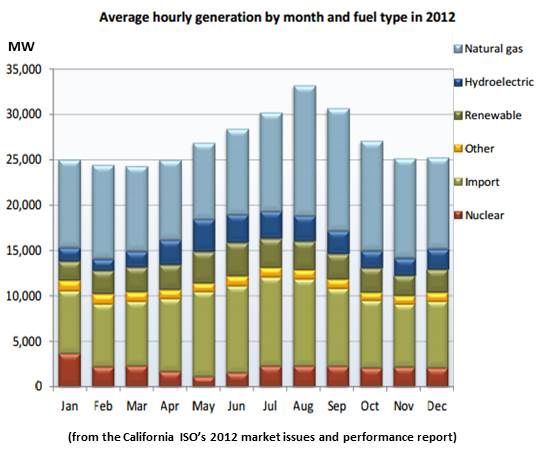

The ISO’s total estimated cost of meeting California’s load in 2012 was $8.4 billion. That is just under $36 per megawatt-hour, a 2 percent drop from the 2011 cost of just over $36 per megawatt-hour. The main factor in the decline was a 30 percent drop in the price of natural gas.

Normalized for that price drop, the total 2012 estimated wholesale energy cost increased 28 percent, according to the report, from $33 per megawatt-hour to over $42 per megawatt-hour.

Among the factors causing the price increase, the report said, were:

- Higher average and peak summer loads

- Less in-state hydroelectric generation

- The 2,200-megawatt San Onofre outage

- Increased transmission congestion

Among the factors that kept the price rise down, it said, were:

- Increased imports from the Southwest and the Northwest

- Over 2,000 MW of new generation capacity

- High day-ahead scheduling relative to actual loads

- Increased effectiveness at meeting local peak load

Among the ISO’s recommendations, the report noted that “[f]or many existing resources, net operating revenues may not even cover the unit’s going forward fixed costs. This capacity is increasingly uneconomic to keep available or retrofit without some form of capacity payment.”

What is needed is “an enhanced forward procurement process,” Collins said. And the report’s authors are “supportive of the ISO’s efforts to begin a detailed design of a multi-year capacity market.”

“Utilities need to think about more ways to meet demand than just buying the cheapest energy resources,” White said. “They need to think about paying for the kind of gas plants and other generation sources that will be there when we need it.”