AEP Ohio likes the results of its gridSMART project so much that it wants to expand its combination of smart meters and distribution automation technology statewide. Consider it a chance for the utility, as well as current and potential future partners like S&C Electric, Silver Spring Networks and Utilidata, to prove out the merits of these technologies on a grand scale.

On Monday, the subsidiary of multi-state utility AEP announced it has filed a proposal [PDF] with the Public Utilities Commission of Ohio, seeking permission to spend about $290 million over four years to broaden its smart grid reach in the state.

The proposal, which would see customer bills increase by an average of $2 per month in riders to cover the costs, is among the first of the Department of Energy’s stimulus-grant-backed smart grid demonstration projects to expand to full-scale commercial deployment.

AEP Ohio won a $75 million grant in November 2009 for the $150 million gridSMART project, one of the largest of the DOE grants for demonstrations of smart grid technologies in novel combinations and configurations. Its new proposal doesn’t seek to expand on all of the thirteen technologies it tested in the project’s first phase.

But it does call for expanding its smart meter rollout to 900,000 customers, or about two-thirds of its Ohio customers, adding to the 110,000 meters deployed in its initial pilot phase. That advanced metering infrastructure (AMI) network will be used not only for meter reading, but also for sharing energy information with customers and helping to detect and pinpoint power outages.

It also lays out plans to install distribution automation circuit reconfiguration technology on about 250 distribution circuits serving about 330,000 customers -- a big jump from the 70 circuits serving 50,000 customers deployed in the pilot phase.

On the volt/VAR optimization (VVO) side, AEP Ohio’s plan calls for adding this technology to about 80 distribution circuits, on top of the seventeen circuits tested in the pilot phase. That will expand the technology’s reach to circuits serving about 119,000 customers.

While AEP Ohio didn’t specifically name companies it planned to work with in the expansion, it’s likely that previous gridSMART partners, including Redwood City, Calif.-based smart meter networking vendor Silver Spring Networks (SSNI), Chicago-based DA vendor S&C Electric, and Providence, R.I.-based VVO technology provider Utilidata, will be among them.

“We will be bidding out many of the components of this,” Terri Flora, director of communications for AEP Ohio, said in a Wednesday interview. That means that Silver Spring, S&C Electric and Utilidata aren’t guaranteed roles in the expanded project.

At the same time, “We have worked with these vendors in the past, we know what they’re capable of doing, and they’re familiar with our service territory,” she said -- all factors likely to weigh in their favor.

A Cost-Benefit Analysis, From Demonstration to Commercial Scale

AEP Ohio is asking PUCO to take up its proposal by the end of the year, though it’s possible that could extend into the first quarter of 2014, Flora said. Once approved, it would take about twelve months to plan the rollout and begin installation.

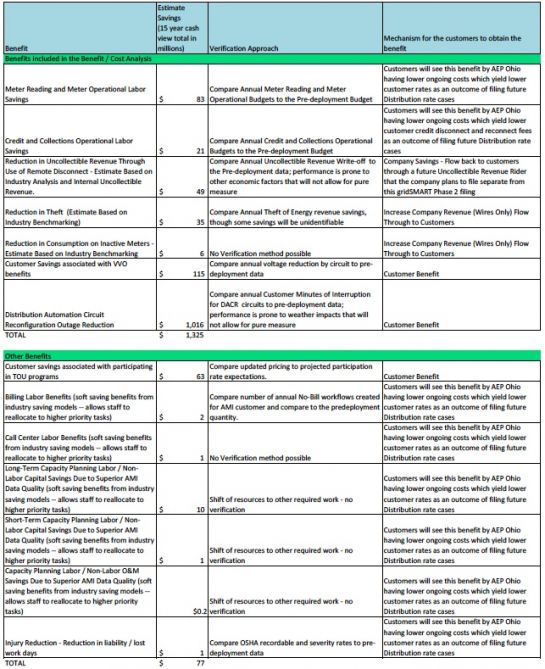

AEP Ohio also lays out cost-benefit figures for its expansion, part of its adherence to a state law, one of several of its kind being enforced in states across the country, requiring that analysis for new smart grid investments.

Those measures, at least in the utility’s projections, fall pretty clearly on the benefits side -- if its projections hold true. Over fifteen years on a cash basis, the utility is projecting a total cost of $465 million, including $329 million in capital costs and $136 million in operations cost. The benefits, on the other hand, add up to $193 million in operations and maintenance, $115 million in energy and capacity, and a whopping $1.016 billion in reliability improvements, for a total of $1.325 billion over fifteen years.

Here’s a breakdown of what AEP Ohio has laid out in its proposal to state regulators -- one of the first of what will likely be many more smart grid demonstration projects to make the move from experiment to business case.

Calculating the Value of DA and VVO

AEP Ohio’s distribution automation circuit reconfiguration (DACR) deployments with S&C Electric have yielded some clear and immediate benefits in terms of reduced outages and improved reliability metrics, adding up to about a 30 percent reduction in customer minutes of interruption, according to its proposal. We’ve covered how other automated switching and circuit restoration projects have yielded similar benefits around the country.

Beyond improved reliability, AEP Ohio estimates that expanding its DACR capabilities could “enable crew labor savings, up to two hours per event, and in some instances avoid service calls entirely,” leaving utility workers free to “perform additional proactive work on circuits in need of service, further enhancing reliability.” All told, AEP Ohio is relying on these benefits to deliver the $1 billion-plus in reliability benefits that make up the lion’s share of its overall benefit calculation.

Then, of course, there are the societal benefits of fewer outages that don’t last as long, which the utility estimated could add up to $71 million per year, based on Lawrence Berkeley National Laboratory methodologies. All of this will come at an estimated cost of $427,000 per circuit for its broader rollout, according to the proposal.

As for volt/VAR optimization, which manages the range of voltages at which distribution circuits operate to improve efficiency and reduce stress and strain on equipment, AEP Ohio has worked with both General Electric and Utilidata on those projects, Flora said. The costs of those deployments stands at about $250,000 per circuit, according to the utility’s proposal.

At present, Utilidata would appear to be the utility’s favored vendor for this technology, since GE's work with the utility on VVO wasn't continued. Utilidata has been working with AEP in Ohio and Indiana, and last year announced a joint R&D agreement to coordinate its AdaptiVolt technology to AEP’s grid operations systems.

So far, the utility has reduced energy use by 3 percent to 5 percent by using VVO to lower voltages along distribution circuits, while keeping end-user voltages within acceptable limits, Flora said. That can include using VVO for “always-on” energy efficiency, or to reduce peak demand to mitigate grid stress, both functions that a distribution utility is interested in. (AEP Ohio used Grid Command, a tool it developed with Battelle, to model and plan out much of its gridSMART distribution circuit work.)

VVO could also play a role in helping it meet its regulator-imposed energy efficiency goals, and is targeting $20 million in mandated efficiency spending to the technology for that purpose. As for customer benefits, the proposal estimates its VVO rollout could reduce customer bills by an estimated $115 million over fifteen years.

The Multiple Costs and Benefits of AMI Explained

Silver Spring, which deployed its networking technology in GE meters for AEP’s initial deployment, has used the gridSMART deployment not only to do its core job of automating the collection and management of meter billing data, but also to provide DA communications. While Silver Spring is also supporting DA in projects with Washington state’s Snohomish PUD and Singapore Power, its work in Ohio is its first and broadest project of this type. AEP Ohio also found benefits in using its smart meters to detect and pinpoint power outages, something that Silver Spring partners like Baltimore Gas & Electric have shown yields better and faster restoration after storms.

As for delivering energy information to customers, AEP Ohio won't be responsible for that anymore, though it intends to support it via its AMI infrastructure, Flora said. Under the state’s recent move toward utility deregulation, that task will be taken on by one of the state's retail electricity providers -- which does include AEP Energy, the retail arm of parent company AEP, as well as big competitor First Energy. Still, the utility projects a potential $69 million in customer bill reductions over fifteen years through enabling time-of-use pricing programs via its AMI network.

All told, AEP Ohio estimates that its cost-per-meter will fall from $210 for its phase 1 deployment to about $180 per meter for its expanded rollout. As for benefits, it’s expecting to save $6 million to $7 million per year on meter reading operations, or about $83 million over fifteen years. It’s also expected to reduce utility truck rolls by about 440,000 miles per year, which will result in additional savings on fuel costs, labor hours and emissions.

That doesn’t count the credit, collections and revenue enhancements through earlier theft detection, lower consumption on inactive meters and greater billing accuracy. Those are projected to lead to an additional $8 million to $10 million per year in utility benefits, or roughly $111 million over fifteen years. Nor does it count the harder-to-quantify benefits of improved customer service, billing and call center efficiencies, reduced personal injuries, and other operational savings, which could "represent an estimated $39 million in incremental net present value,” according to the utility’s proposal.

Capturing these expanded benefits at commercial scale will be critical for Silver Spring and competing AMI vendors, as they seek to grow revenues amidst a flagging North American market for new smart meter deployments. That makes AEP Ohio’s new AMI rollout proposal, along with those being subjected to cost-benefit regulations in Maryland, Illinois and elsewhere, well worth watching.

Here’s a chart from AEP Ohio’s proposal that lays out categories of benefits, along with the important warnings about how each can, or can’t, be verified by current methods.