Southwestern Electric Power Company this week released a request for proposals for up to 1.2 gigawatts of wind resources, six months after the cancellation of its ambitious Wind Catcher project.

SWEPCO, a subsidiary of American Electric Power (AEP), said it will accept proposals of 100+ megawatts until March 1. Projects should be put into service before December 15, 2021 to take advantage of at least 80 percent of the federal Production Tax Credit.

AEP nixed the Wind Catcher project in July, after a regulatory tussle and an ultimate rejection from the Public Utility Commission of Texas. Despite that high-profile setback — Wind Catcher was to be the largest U.S. wind project at 2,000 megawatts — analysts at the time said the wind industry was healthy.

This latest move suggests SWEPCO agrees. Its latest integrated resource plan, filed in December with the Arkansas Public Service Commission, includes the 1,200 megawatts it plans to add through this latest RFP and calls for a total of 2,000 megawatts in nameplate wind capacity through 2038.

That would make wind 24 percent of SWEPCO’s nameplate capacity mix — up from 8 percent in 2019 — with natural gas accounting for 27 percent and coal accounting for 25 percent. WoodMac analyst Anthony Logan said the viability of soliciting wind into 2023, "while exciting, doesn’t necessarily inform how the market will look in the rest of the country," because "this region has just about the cheapest wind in the country."

In announcing the RFP, SWEPCO’s President and COO Malcolm Smoak said the utility “continues to see strong customer interest in more renewable energy.” In a recent presentation, SWEPCO said it expects to select final projects between March and July.

Wood Mackenzie Power & Renewables affirmed the positive outlook for the wind industry in research released Wednesday. Despite the loss of Wind Catcher, WoodMac expects the U.S. market to add 23 gigawatts of new capacity through 2020.

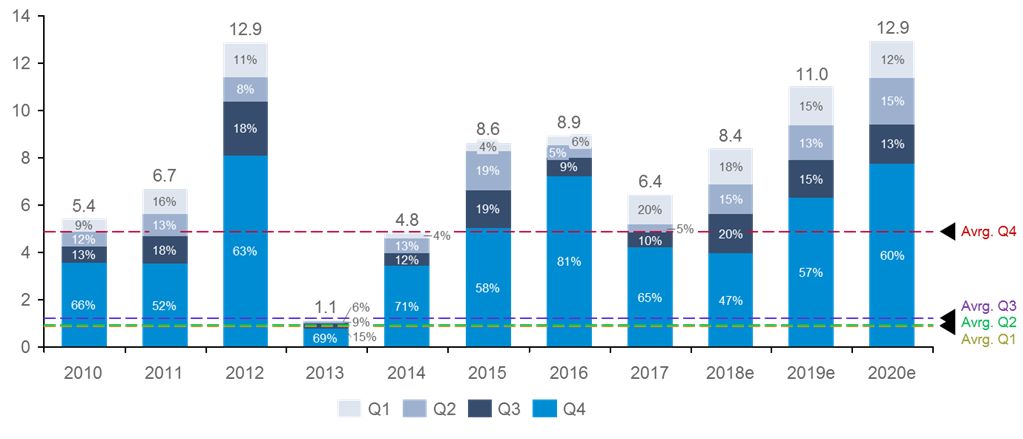

U.S. Historical and Forecast Wind Capacity Installations, 2010-2020E

But WoodMac also said that coming supply chain challenges threaten the wind industry’s growth.

Analysts said bottlenecks in supply could lead to the delay or cancellation of 23 percent of capacity additions expected in the next two years. The situation may jeopardize $2.1 billion in revenue.

“These supply chain constraints will escalate deployment risks for all wind energy participants — increasing the likelihood of higher costs, missed deadlines, lost production, and fewer PTCs if projects can’t be commissioned in time,” said Dan Shreve, head of global wind research at WoodMac.

The report notes that much of the wind industry has not anticipated the severity of these supply chain constraints and the associated losses.

The risk is especially high in 2020, when WoodMac forecasts 12.9 gigawatts of installations as installers rush to meet the PTC deadline. Though 2012 saw the same capacity installed, WoodMac said increases in turbine size will result in more transportation challenges.

Through 2020, blade lengths will have increased by about 34 percent, from an average of 44 meters in 2012 to 55 meters in 2020. That means getting equipment from point A to point B requires special trailers, drivers and even vehicle escorts. WoodMac says that in addition to working on a PTC extension, the industry needs a forward-thinking action plan to maintain its positive position.

For SWEPCO's RFP, Logan notes that the "unusual" requirement that turbines be sourced from GE, Siemens Gamesa or Vestas could lower execution risks.