The total number of smart meters around the world is expected to almost double over 2017 levels by 2024, opening up new opportunities for customer-side control and analytics.

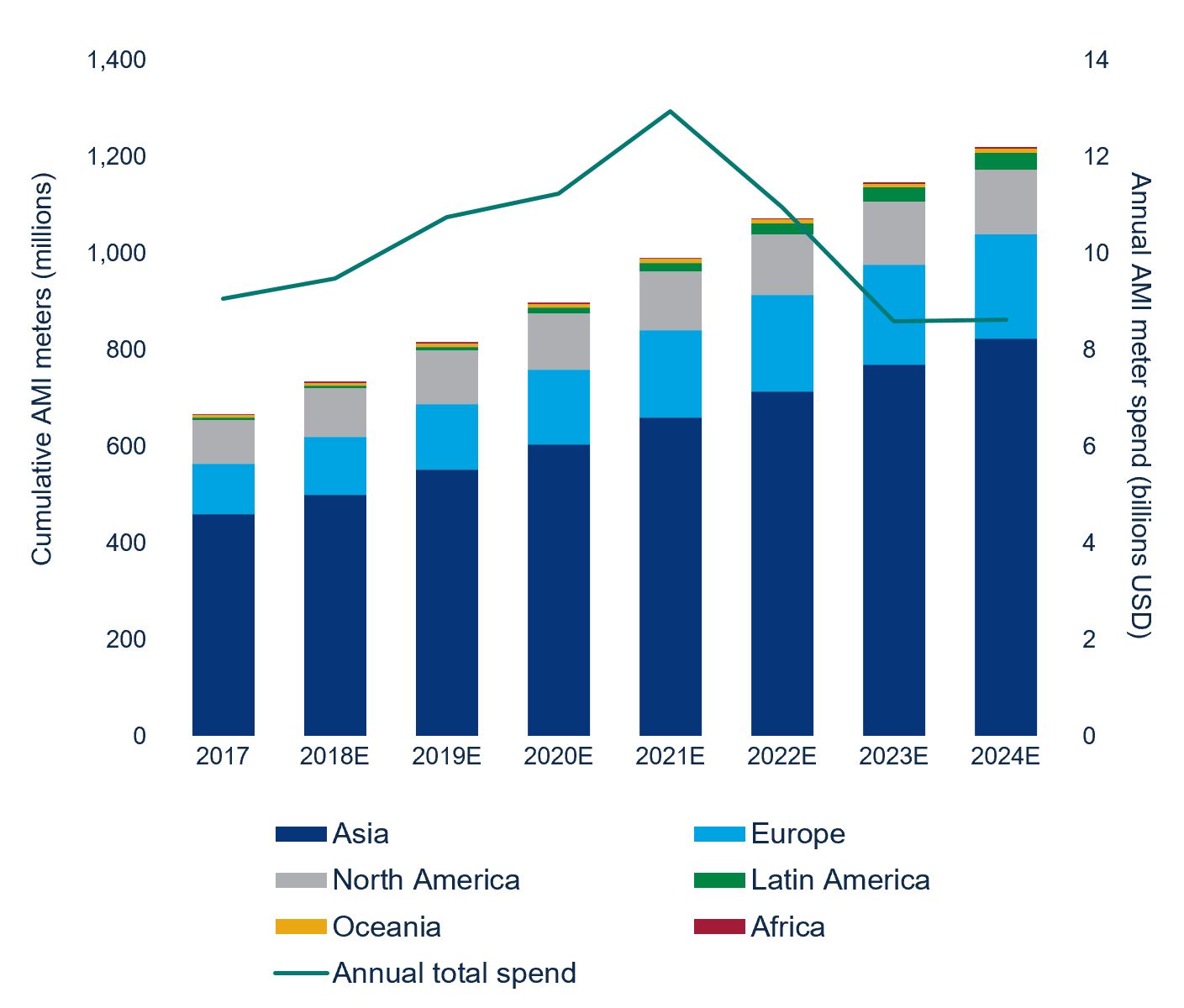

The global smart meter total will rise from 665.1 million in 2017 to more than 1.2 billion by the end of 2024, according to a new Wood Mackenzie report. Accordingly, the cumulative global expenditure on advanced metering infrastructure (AMI) will almost double over the same period, rising from $73 billion in 2017 to $145.8 billion in 2024 (all values USD).

The growth of AMI globally is an important factor in the rise of customer-side flexibility, defined by WoodMac as the orchestrated impact of distributed generation and energy management tools on customer load shapes.

Where AMI is prevalent, utilities gain better visibility into power supply and demand. In areas with high distributed energy resource penetrations, AMI can support better integration of solar power and distributed energy resources into the energy mix, including the orchestration of DERs as an aggregate flexible resource.

AMI can allow renewable penetration to climb higher than would otherwise be possible, because the additional data made available can serve as the foundation for more advanced analytics and provide guidance on optimization of behind-the-meter resources. At the same time, customers can also rely on smart meters for useful insights into their own power consumption and generation.

AMI penetration is poised to rise significantly over the coming years in both developed and developing markets. Some countries have taken the lead in smart meter penetration, while others are moving more slowly.

Asia to drive AMI market growth through 2024 and beyond

Source: Wood Mackenzie Power & Renewables

Asia will be the biggest market for smart meters over the next five years, accounting for approximately two-thirds of the global AMI installed base through 2024.

China is the key market driver in the region. The country already accounts for more than half of all smart meters installed globally. The State Grid Corporation of China — the country’s main power distribution and transmission utility — deployed 476 million smart meters between 2011 and 2017.

India will emerge as an increasingly significant actor in the Asian market, thanks to the recent introduction of a centralized AMI procurement and financing process. As a result, India is projected to surpass Japan as the second largest AMI market in Asia by as early as 2023.

Wood Mackenzie also expects significant AMI growth in the United States and Europe over its forecast period, with smart meter penetration reaching 82 percent and 74 percent, respectively, by 2024.

When looking beyond the aggregate data, however, both the U.S. and the European Union are a mixed bag for AMI deployment, with penetration advancing at different speeds.

Many U.S. utilities have developed plans to deploy AMI, but regulators’ reactions have been mixed across the country.

One example: In January of this year, Virginia’s State Corporation Commission rejected a section of Dominion’s grid modernization plan that included the installation of approximately 2.1 million smart meters. The commission deemed the cost of deploying smart meters too high given the projected benefits, but also gave the utility an opportunity to present a new plan with a revised cost-benefit balance.

Meanwhile, other large utilities like Duke Energy and Long Island Power Authority are implementing plans to install millions of AMI meters over the coming years.

Similarly, AMI deployment is uneven across Europe, even though the European Union has set goals for smart meter implementation by 2020 for many countries. As of 2019, Italy and Sweden have already started to deploy second-generation meters, while countries like Germany and Poland have only recently begun to roll out AMI meters for the first time.

Latin America and Oceania will remain comparatively small markets over the next five years, though WoodMac expects a notable uptick in countries including Colombia, Mexico and Brazil.

Based on current data, Wood Mackenzie expects the African AMI market to remain small relative to the continent's population, with only modest smart meter implementation through 2024.

***

For more on the proliferation of advanced metering infrastructure in the United States, refer to Wood Mackenzie's AMI Global Forecast 2019-2024: H1 2019. For analysis of residential customer-side flexibility in the United States, refer to this research insight.