A fire sale of Abengoa projects around the world is looking increasingly likely as the Spanish infrastructure developer faces bankruptcy.

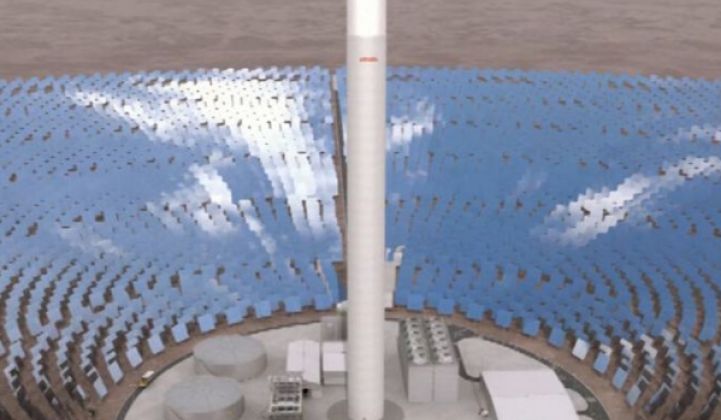

Abengoa was already planning to sell its Khi Solar One concentrating solar power (CSP) plant in South Africa back in September, according to a shareholder market update filed with Spanish financial regulator the Comisión Nacional del Mercado de Valores.

The selloff was intended to deal with a €9 billion ($9.77 billion) debt, alongside a further cash injection from investors.

But last month, refinancing talks fell apart, forcing Abengoa to file for preliminary creditor protection and a sale of its assets more likely as part of bankruptcy proceedings.

One source close to the company said he did not think current projects such as Khi Solar One or Atacama 1, a 210-megawatt hybrid CSP and PV plant in Chile, would be halted. “They are projects that are based on pretty solid project finance,” he said. “They might go ahead under a different owner, though.”

It is still not certain if Abengoa will file for bankruptcy. The creditor protection filing gives it four months to reach an agreement with creditors.

“My impression is that Abengoa will end up being rescued, perhaps with a soft credit from the Official Credit Institute [a public bank managed by the Spanish Ministry of Economy and Competition] or through political pressure on the banks to give it financing,” said Daniel Perez, of the Holtrop law firm in Spain.

So far, the government has not come to Abengoa’s rescue. Abengoa’s demise is a thorny issue for Spanish Prime Minister Mariano Rajoy. Caving in to a bailout request might weaken his chances of re-election in national ballots this month, reported Bloomberg.

At the same time, however, the loss of about 7,000 Spanish jobs at Abengoa won’t bolster confidence in Rajoy’s pledge to boost employment across the country.

Rajoy's administration introduced sweeping cuts to renewable power support in Spain, slashing the profitability of Abengoa's projects across the country. As a result, Abengoa is fighting the Spanish government’s subsidy cut in international arbitration courts, acting through a Luxembourg subsidiary.

The extent to which government cuts have contributed to Abengoa’s downfall is an open question. “You could argue either way,” said a source.

Nevertheless, the potential loss of one of Spain’s biggest and most international infrastructure firms represents a serious challenge for Rajoy’s pre-election narrative of economic recovery.

So far Rajoy’s administration has gone on the defensive, with Industry Minister Jose Manuel Soria and Economy Minister Luis de Guindos both hinting at financial mismanagement and slamming executive payouts at Abengoa.

Given Rajoy’s reluctance to act quickly, it is unlikely any further action will be taken until after Spain’s national elections on December 20.

Current polls suggest Rajoy will win, but he will need to form an alliance with a rival party in order to gain a majority -- a move that could impact a potential Abengoa bailout.

Whatever happens, it seems probable that the developer will have to sell assets in order to cut its massive debt, which some observers believe could be as much as €20.2 billion ($22 billion) when the liabilities of all of its 887 subsidiaries are taken into account.

At the top of the list is Abengoa’s 50 percent stake in the U.S. YieldCo Abengoa Yield. The YieldCo has taken a battering in recent months as a result of wider troubles with YieldCos in the American market. As previously reported, Abengoa Yield is already seeking to distance itself from its parent.

Other assets highlighted in Abengoa’s September market update include Khi Solar One and Shams-1, a 100-megawatt parabolic trough CSP plant in the United Arab Emirates.

“Abengoa is immersed in a process of negotiation with its main financial creditors to refinance and restructure itself with the aim of preserving the activities of the company," said Abengoa’s press office in a written statement to GTM.

The company is looking at different options for 250 projects across 50 countries: “All the decisions will be taken to protect the main interests of the company and its viability in the long term."