Bankrupt lithium-ion battery maker A123 is headed for the auction block next week, setting the stage for an international bidding war over the assets of a once high-flying, government-backed green technology startup now fallen on hard times. Beyond would-be U.S. rescuer Johnson Controls and previous Chinese suitor Wanxiang, we’ve seen more than two dozen other parties jump into the fray.

All have different ideas of which parts of the Waltham, Mass.-based company’s core assets they’d like to buy. But parties to the Dec. 6 auction, ordered by U.S. Bankruptcy Judge Kevin Carey earlier this month, will have to contend with some severe political uncertainty in making their plans.

That’s because the U.S. government, which has given A123 about half of the money in a $249 million grant awarded in 2010 to help it build its Michigan factory, filed court documents this week stating any sale of A123 assets associated with that grant should have to get federal approval.

While the filing by principal deputy assistant attorney general Stuart Delery didn’t specify whether the government opposed or supported any specific bidders, the move is widely seen as an attempt to forestall a foreign takeover of A123. The prospect of China getting ahold of U.S. government-backed technology has raised an outcry from Republicans in Congress, who have already demanded investigations of A123 and other struggling, Department of Energy grant-backed companies in the wake of Solyndra’s bankruptcy.

China’s government, which isn’t exactly friendly with the U.S. on green technology trade issues right now, gave its approval this week to automotive technology giant Wanxiang’s plan to buy A123 outright. That proposal is in conflict with Johnson Control’s proposal to buy A123’s automotive energy storage and management business, including its DOE grant-backed Michigan factory, for $125 million. Other companies, including Germany’s Siemens and Japan’s NEC, have expressed interest in taking part in next week’s auction, according to news reports, and 25 parties have filed confidential statements of interest.

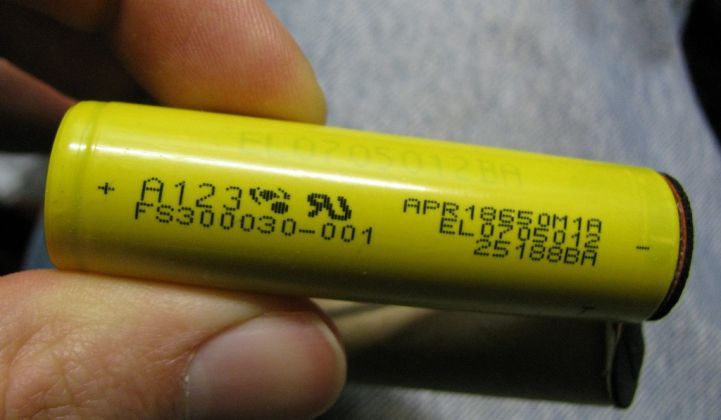

A123, founded in 2001 and funded by about $200 million in venture capital investment, went public for a $2-billion-plus valuation in 2010, only to crash and burn amidst consistent losses, slow growth for its electric vehicle battery business, and a fatal recall of batteries supplied to key EV partner Fisker Automotive.

Indeed, the fate of Fisker and A123 seem to be increasingly intertwined. Earlier this week, Fisker announced that it has idled production of its Karma plug-in hybrid sports cars due to A123’s reduced output, though it hopes to see the situation improve after next week’s auction brings clarity to who actually owns the business.