Building energy management software has seen some ups and downs. The software has had a tough review from the customers it’s seeking to serve, and more than a few spectacular failures. At the same time, software is helping building owners and operators interpret data and divine insights to reduce energy bills and improve operations -- and startups with innovative approaches to the building-energy management puzzle have had apparently successful exits.

That makes it critically important to understand just what the difference is between all these different offerings going under the general term of building energy management software, or BEMS. GTM Research’s latest report, Energy Management Platforms for Commercial Customers: Applications, Trends and Competitive Landscape, helps to clarify the complex field.

In broad brush terms, the new report from GTM Research senior grid analyst Andrew Mulherkar covers a broad category of “software-based platforms designed to improve the ability of commercial customers to manage electricity consumption and generate financial value.”

That doesn’t include demand response management systems, distributed energy resource management systems, microgrid controllers, or other platforms used by utilities and third parties to manage and aggregate customer-sited energy resources. It also doesn't include the non-energy specific portions of building management, such as workflow management or maintenance logistics.

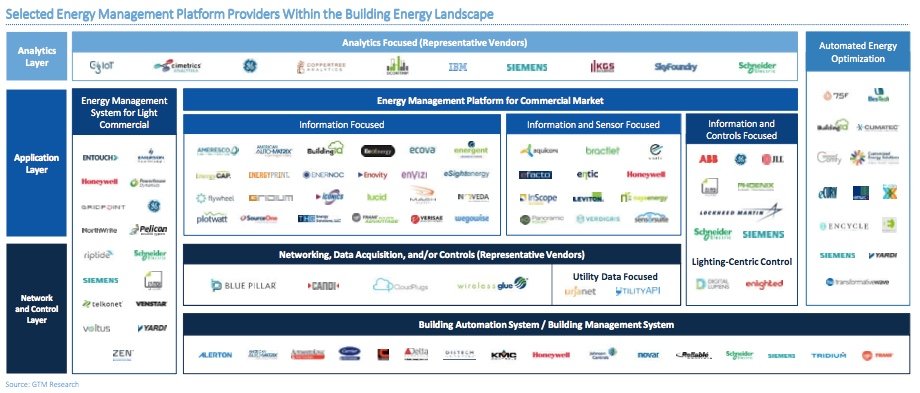

But that still leaves many different software applications to fill, from core energy equipment monitoring and data collection, to fault diagnostics and detection, to energy analytics and automated optimization. This chart names more than 60 companies involved in the space in one way or another, broken into three main layers -- analytics, applications, and network and devices -- and into information, sensor and control-focused subcategories.

Large commercial buildings have their own internal taxonomy, divided broadly into information, sensors and controls, with a subset of networking and integration experts addressing specific slices of the computing challenge, as Blue Pillar does with networking.

A separate category has been carved out for light commercial customers, which tend to bundle devices and apps into a lower-cost solution. Another is set aside for automated energy optimization, which tend to focus on particular technologies such as lighting, HVAC or IT loads.

Mulherkar warned, however, that any attempt to fit dozens of companies into neat categories is bound to be outpaced by events on the ground in this growing, ill-defined space. There’s a lot of overlap across applications, with various vendors competing and complementing each other in terms of where they’ve focused on making money.

Price points for BEMS offerings by the building, device and square foot

The pricing models for energy management software are all over the map -- but GTM Research has compiled some useful benchmarks from the publicly available data.

In terms of pricing based on property size, BuildingIQ has published prices of between $0.08 to $0.13 per square foot per year for its software-as-a-service offering -- a metric that makes sense for a company that's focused on managing HVAC systems. Number of buildings can be a useful metric for large customers, like EnerNOC, Gridium and Lucid, which have published prices that range from $100 to $1,000 per building per month, depending on size and complexity of each site.

More device and sensor-heavy deployments can charge on a basis of equipment complexity. Schneider Electric, for instance, has published prices ranging from $2,000 to $15,000 per site per year for its building analytics service. And vendors that focus on meter data tend to charge per meter -- startup WegoWise has advertised prices starting at $1.50 per meter per month.

Meanwhile, “a less common, but potentially more profitable, model is value-based pricing tied to the potential bill savings of a solution,” Mulherkar said. This concept goes beyond the cumbersome and limited performance-based ESCO type contracts of today, by tapping the exponential increase in available data and the cost curves of automation and networking to deliver far more verifiable measurements of the outcome of different investments.

They’re also built well for companies that want to act on behalf of their customers. “There are some customers that want to be in the driver's seat when it comes to knowing what’s going on in their facilities, and opportunities for energy and bill savings. And others that want to focus very exclusively on core operations, and prefer that energy management to be done by an external third party."

What makes for successful exits vs. flameouts in BEMS

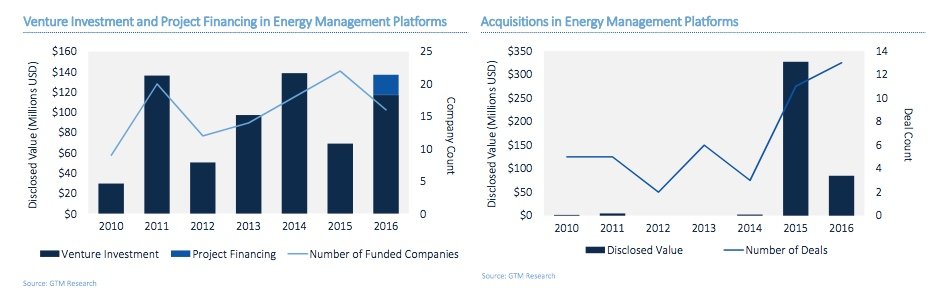

Greentech investors have flocked to the energy management software field, Mulherkar noted. Venture investment in the sector has topped $650 million since 2010, with 48 companies receiving financing over that time. “That speaks to how active of an environment it is, and how much potential the space has,” he said.

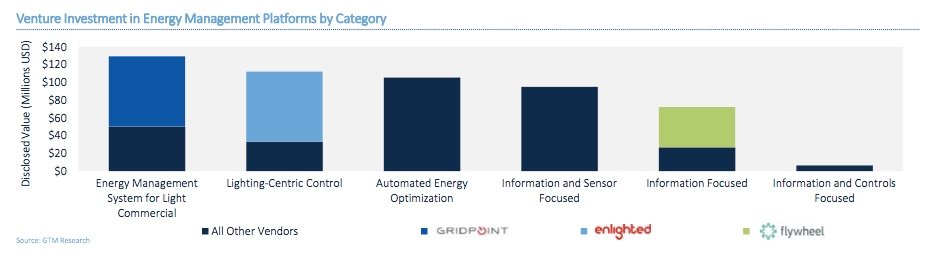

More than one-quarter of the sector’s total venture investment has gone into the light commercial sector, he noted, followed by lighting-centric control, advanced energy optimization, and information-and-sensor focused companies.

This investor enthusiasm has been bolstered by some of the successful exits in the space, he noted. Some noteworthy ones include GE’s purchase of Daintree Networks, Direct Energy acquisition of Panoramic Power, and Duke Energy’s taking of a majority stake in Phoenix Energy Technologies. All told, 45 companies or business lines were acquired by other companies from 2010-2016.

At the same time, “there have been quite a few flame-outs,” with more than a dozen companies in the space having faded away over the past six years, he said. Notable examples of, shall we say, less than ideal exits for investors include Serious Energy’s sale of its software assets to Trane, while others like GridPoint and SCIenergy (now Flywheel) have struggled to gain visible market traction after raising large amounts of money.

The most public evidence of the sector’s struggles to date, however, has come from EnerNOC, the Boston-based demand response leader that sunk much of its fortunes on its Energy Intelligence Software (EIS) suite of SAAS and supported services. Last month, EnerNOC announced it may seek a sale of some or all of this software business, citing much slower than anticipated sales growth and the financial situation in its core demand response business.

The energy software startups that have succeeded to date have tended to focus on doing a particular task, or connecting a particular part of the building energy landscape, particularly well. Building energy data analytics is also fertile ground for software, with the proliferation of smart meters and ever-cheaper sensors from companies like Switch Automation, a startup that’s working with big real estate partners like Forest City, integrating building data sets and controls for remote oversight.

Meanwhile, companies that have sought to integrate multiple applications into a services-based offering, such as EnerNOC or SCIenergy before its rebranding as Flywheel, have had to contend with competitors like Siemens, Honeywell, Johnson Controls and Schneider Electric, all of which are selling BMS platforms with the latest software and hardware, and services built on their ESCO expertise.

Connecting to the grid edge where the buildings are

That makes the BEMS market a critical focus for utilities, grid operators and third-party distributed energy resources (DER) providers. To date, that integration has just begun, Mulherkar said. “I don’t want to suggest that energy management exists in a silo. Increasingly it doesn’t,” he said. But it doesn’t incorporate the grid-focused tasks of DR or DERMS -- and likewise, DR and DERMS platforms don’t do all the things that a good BEMS should do.

Importantly, building software has several ways to pay its way that aren’t available to energy-focused business structures, such as HVAC maintenance alerts, work order management, or tenant comfort management, he said. “Given that these systems are meant for viewing by the commercial customer itself, not the utility or DR provider, I think that these ancillary benefits of fault detection, work order management, budgeting, are not only helpful but will become more necessary over time.”

In other words, BEMS vendors will succeed by giving the building owners and operators what they need, whether it’s as complex as complete access to every data point and device interconnection, or as simple as a monthly check. In that sense, success in the market is less about market share, and “more of an enhanced customer interaction play,” Mulherkar said.

It’s also intrinsically more of an energy efficiency play, given that’s where the big savings lie, he said. But “once you can better understand the way a customer is using energy, it’s not just about opportunities for energy efficiency. It’s opportunities for demand response, for solar, for energy storage. It’s a baseline that’s helpful to build other energy services offerings.”

Greentech Media’s annual Grid Edge World Forum, being held June 27-29 in San Jose, Calif., will offer these two disparate yet interconnected industries an opportunity to rub elbows and share ideas. The three-day conference will feature a who’s-who of utility, grid and distributed energy executives, entrepreneurs and insiders, GTM Research’s latest market and policy updates, and a natural point of contact for people working on ways to connect DER-enabled customers to the grid at large. Click here to learn more.