A new proposal from Arizona’s ratepayer advocate seeks to resolve the hostility between utilities and solar advocates over net energy metering.

Regulators “will look to us because their main function is to make sure residential ratepayers get fair treatment, and net metering is going to affect all ratepayers,” said Residential Utility Consumer Office (RUCO) Director Patrick Quinn. “We don’t lean toward the utilities or the solar installers.”

Net energy metering reduces rooftop solar owners’ utility bills by subtracting the retail value of the electricity their systems send to the grid. Utilities claim this is a cost shift to non-solar-owning ratepayers’ bills.

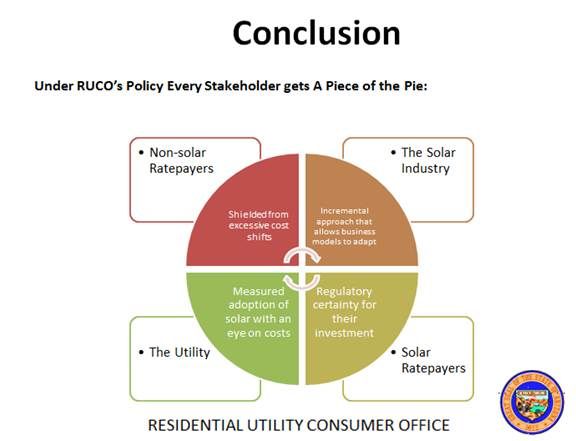

The RUCO plan just filed with the Arizona Corporation Commission is about the proper compensation for customer-sited generation, explained RUCO consultant Lon Huber. It was designed to balance the near-term cost shift that is utilities’ chief concern and the long-term benefits that advocates say that rooftop solar provides. “It keeps net metering 100 percent intact by putting a patch on the rate design specific to solar owners.”

RUCO proposes to increase Arizona’s existing lost fixed cost recovery (LFCR) charge for solar owners. This sends “price signals to solar adopters without needing to modify the rates used by the majority of non-solar residential ratepayers,” the proposal says. “More solar for less money should be the aim.”

“We strongly disagree with any assertion that net metering is a cost shift,” said former Arizona Republican Party Chair Tom Morrissey and former Republican Congressman Barry Goldwater, Jr., in a joint statement made on behalf of solar advocacy group TUSK. “A rate case is clearly the more appropriate venue for addressing these issues.”

If it weren’t for a “stay out” provision in the last Arizona Public Service rate case, this issue would be worked out that way, explained Quinn. But new rates for APS, which is Arizona’s biggest utility, won’t go into effect until 2016, and “we need to fix net metering now.”

The RUCO proposal will go before the Arizona Corporation Commission immediately. Its decision on net metering, due next month, is expected to influence regulators’ pending decisions in Colorado, Hawaii, California, Georgia, and other states.

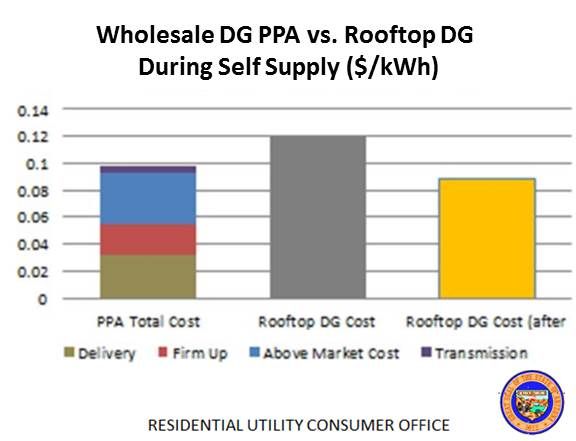

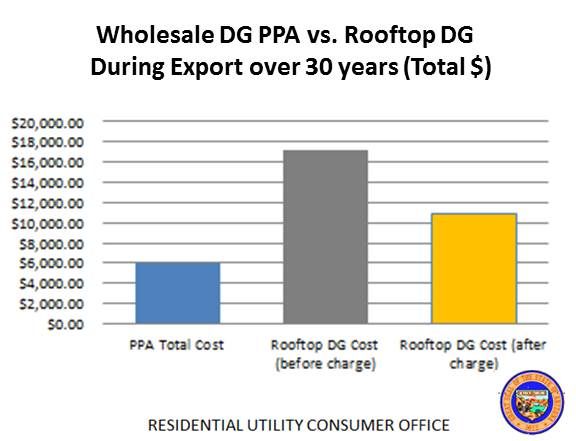

Rooftop solar is like energy efficiency when it is used as self-supply and never touches the grid, Huber explained. But it is like an intermittent generation source when it exports electricity to the grid. This dual role makes valuation complicated. “Wholesale distributed generation can get a power purchase agreement at approximately $0.085 per kilowatt-hour,” Huber said. “Why should rooftop solar be compensated at a retail rate of $0.14 per kilowatt-hour?”

Without considering the value of rooftop solar’s capacity to reduce peak demand, the RUCO proposal says, “policymakers are left blind when determining the real cost and benefit.” The correct price signal to the market “will encourage the installation of systems that produce more power at peak times and incentivize deployment.”

RUCO’s proposal “only looks at capacity value, but it can be expanded.” It defines the cost shift as “the average fixed costs a customer pays before and after solar.” That was calculated through an in-depth process of bill analysis.

The calculation of solar benefits was made by comparing “the levelized cost of energy from a deferred combustion turbine in 2017” without fuel costs against “the marginal capacity value of solar PV” and transmission benefits as defined in an APS-commissioned study.

“When a $3.00 per kilowatt charge is placed on a system,” the RUCO study concludes, “rooftop solar on APS rates is in the same ballpark as an $0.085 per kilowatt-hour PPA, assuming a 30 percent export rate for rooftop solar production.” This makes it “a fair allocation of costs and benefits to solar and non-solar customers.”

RUCO recommends phasing in the charge. It should begin at a twenty-year locked-in rate of $1.00 per kilowatt for current system buyers. “RUCO believes that anything more aggressive than $1.00 per kilowatt could start to trigger rapid declines in installs and significantly hurt the industry.”

Monies from the charges would not go to utilities, but to non-solar residential ratepayers as lowered LFCR charges, Huber noted.

The charge should escalate $0.50 per kilowatt for every 20 megawatts of rooftop solar installed in Arizona, the proposal recommends, with each new charge level also fixed for twenty years. “Once the market can handle a $3.00 per kilowatt charge, rooftop solar is cost-neutral (i.e., unsubsidized) to non-solar residential ratepayers over twenty years.”

The twenty-year fixed charge “facilitates financing, because the charge does not move for twenty years,” the proposal explains.

Regulators should periodically review the capacity valuation, the proposal adds, so they can adjust charges based on new cost-benefit calculations or on the value of new technologies like tracking systems or smart inverters. “The platform could use market signals to encourage innovation,” Huber said.

Sunrun, SolarCity (SCTY), and APS declined to comment without details of the RUCO proposal. SolarCity Policy and Electricity Markets Director Meghan Nutting noted that the proposal comes “late in a discussion that’s already been occurring for months."

Solar customers save $5.00 to $10.00 per month on their utility bills through no-upfront-cost leasing programs, SolarCity CEO Lyndon Rive recently told The Arizona Republic. A hypothetical $2.00 per month fixed fee “would be a hit,” Rive said, “but the industry could survive and we could continue to grow.”

The RUCO proposal’s hit, though bigger, is far from the $50.00 per month charge included in APS’ proposed net metering fix.

The ACC’s net metering debate is scheduled for November 13.