After 40 years of making fuel cells, FuelCell Energy could be ready to hit the big time.

The company has existed out of the limelight in an industry where higher-profile companies, such as Bloom Energy, are making big names for themselves. But a recent decision by the California Public Utilities Commission to permit two of the state's big three utilities to use natural-gas fuel cells in customer deployments may shine a brighter spotlight on the Danbury, CT company.

PG&E will install a 1.4-megawatt fuel cell from FuelCell (and a 200 kilowatt Bloom System) while Southern California Edison will install two. Both utilities still have to finalize these projects, but the path is open.

"It's a huge step," says Trevor Rodd, FuelCell's West Coast director of business development. "The utilities consider us a real alternative now."

In an industry that lives and dies on energy efficiency, FuelCell tells a good tale. The company's molten carbonate fuel cell boasts 47 percent efficiency at turning fuel to electricity. That efficiency rises to as much as 90 percent if the cell's heat is used to warm buildings or pools. (Molten carbonate cells run hot.)

That puts it close to or ahead of competitors such as Ceres Power, ClearEdge and Panasonic, all of which fall in the 80 to 90 percent efficiency range when heat and power are combined. In these fuel cells, roughly half of the energy comes in the form of heat.

Bloom's Bloom Box generates electricity at a higher 50 to 57 percent efficiency -- or about twice the level of the overall power grid -- because of its unusual structure that relies on ceramic plates made of zirconium oxides to transfer electrons. But its server doesn't generate much heat -- the heat produced gets used internally by the box.

Whether a customer will choose FuelCell, Ceres or Bloom likely depends on their energy needs. Ceres, Panasonic, Oorja Protonics and ClearEdge produce fuel cells for homes and small businesses while Bloom and FuelCell aim for industrial customers, and a dividing line exists between whether customers need just power or power and heat.

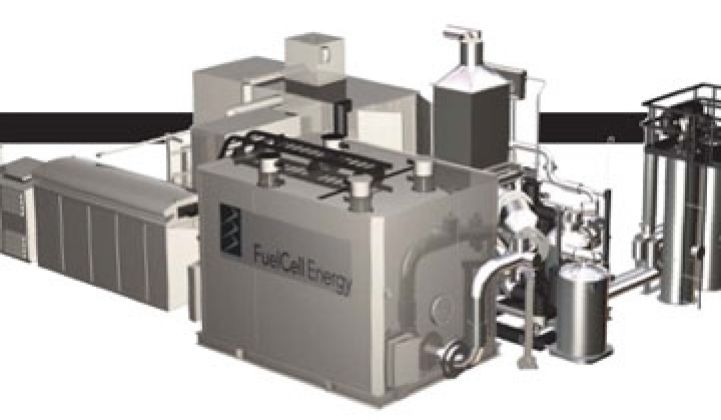

FuelCell offers much greater capacities than Bloom and the other companies, with its largest cell generating 2.8 MW of power compared with Bloom's 100 kW. And the fuel cells are equally flexible with their choice of fuel.

The two 1.4 MW cells PG&E may use at California State University, East Bay and San Francisco State University run on natural gas, turning the fuel to hydrogen before generating electricity.

Others of the 75 fuel cells the company has in operation around the world sit alongside wastewater treatment plants and draw fuel from the methane, or biogas, coming from the facilities. FuelCell has another project with the U.S. Navy that will involve a diesel-powered fuel cell installed on a battleship.

Even after four decades of work with the Department of Defense, FuelCell is hardy a household name in the industry. That may change. Since opening to commercial business in 2003, the company has placed 50 fuel cells in California alone. Now with its first deal with a U.S. utility a step closer to completion, that number could rise -- and with it, the company's fortunes.