The following is the second article in a series on GTM Research's latest solar report, Innovations in Crystalline Silicon PV 2013: Markets, Strategies and Leaders in Nine Technology Areas. To read the first article, click here.

The woes of the upstream PV industry have hit manufacturing equipment vendors particularly hard. Just in the two weeks, industry titans Applied Materials, GT Advanced Technologies, and Meyer Burger reported heavy losses in their PV equipment divisions. With all the overcapacity in the industry, why would any existing PV company invest in new manufacturing equipment? And why would any potential new player want jump into this mess?

The answer has to do with the pace of crystalline silicon (c-Si) PV innovation, largely driven by the industry’s equipment and materials vendors. This is also an area in which the U.S. is strong -- far stronger than in the cell/module manufacturing area where the news, policymaking, and government support have been overly-focused.

The U.S. is home to world-class PV equipment makers such as: Amtech, Applied Materials, BTU, Coherent, Despatch, DEK, GT Advanced Technologies, Newport, Sierratherm (Schmid), TP Solar, and Spire. It is also home to the operations of leading PV materials companies such as: 3M, Ceradyne, Cookson, Diamond Wire Materials Technology (Meyer Burger), DOW, Dow Corning, Dupont, Ferro, Flexcon, Guardian, Hemlock, Madico, PPG, STR, REC, Saint Gobain, Tyco Electronics, Technic, and Ulbrich. Domestic vendors also abound within the downstream balance-of-systems portion of the value chain.

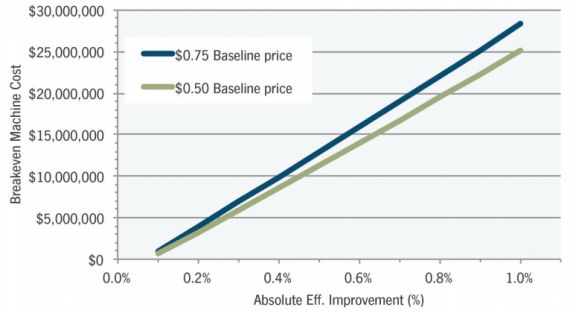

Innovations leading to higher module efficiencies have a strong leveraging effect on the total cost of an installation and its levelized cost of electricity, justifying an improvement of roughly $0.06 per watt in module selling price for every full point in absolute efficiency improvement beyond the average industry baseline. Conversely, falling behind the industry incurs a penalty in selling price that may have an even steeper slope. The power of the efficiency lever often justifies the very best in processing equipment, and the cases in which lower-cost/lower-efficiency solutions make sense are becoming increasingly rare.

My own impulse when I heard about Suniva choosing Varian's (now part of Applied Materials) ion implantation technology for its solar cell diffusion equipment was to question such an expensive choice. But even when taking into account a conservative three-year depreciation time on the equipment, the analysis shown below for a 2,400 cell/hour, relatively expensive cell processing step indicates that most equipment changes yielding a 0.2 percent or greater improvement in efficiency can be justified. Ion implantation promises far higher improvements than this as well as other benefits, and the major equipment vendors happen to be U.S.-based or -owned (Applied Materials, Intevac, Amtech).

FIGURE: Break-even Machine Cost as a Function of Efficiency Improvements for Two Different Module Selling Prices: High-cost Step

Source: Innovations in Crystalline Silicon PV 2013: Markets, Strategies and Leaders in Nine Technology Areas

Other examples of new equipment with short payback times abound within all segments of c-Si PV manufacturing, for example:

- Diamond wire sawing for monocrystalline ingot wafering

- The latest metallization firing furnaces from Despatch or TP Solar

- Schmid TinPad for eliminating rear silver paste

- NPC or Meyer-Burger stringers for soldering 4 or 5 interconnect wires per cell

- Meyer-Burger or Schmid wire array solutions for cell interconnection

And coming soon -- lower cost n-type and reduced-oxygen p-type mono ingots grown with GT Advanced Technologies’ HiCz equipment. This technology is a critical enabler for for new cell architectures on n-type wafers and for rear dielectric passivation on p-type cells with a reduced level of light-induced-degradation. New low-cost atmospheric plasma dielectric deposition systems from Schmid are an enticing match for these cells.

In reporting on the recent PVSEC tradeshow in Frankfurt, industry press and commentators criticized the lower attendance and lack of new products and innovation. These individuals were perhaps more interested in reporting on a cohesive doom-and-gloom story than on capturing reality. Booth after booth displayed exciting new and improved materials, processing/characterization equipment, and end products.

To those who get thrills by “revolutionary” approaches, perhaps they didn’t see as much as they wanted, but for those technologists who appreciate the evolutionary approach that carries our industry forward -- every 0.1 percent improvement in module efficiency, every $0.005 per watt reduction in manufacturing cost, every tightening of the efficiency distribution curve, every 0.1 percent improvement in yield -- the show was a cornucopia of riches for which four days were far from adequate.

The pace of innovation within c-Si PV is accelerating, with more engineers than ever focusing on reducing costs and improving performance. Those companies with the ability to upgrade their lines and invest in new equipment will have significant competitive advantages going forward. This is, of course, difficult to accomplish for companies struggling to stay afloat at all. Those companies with the operations experience, economies of scale, and the ability to invest in the best new equipment will be the future industry leaders.

Which technology innovations will drive c-Si PV forward? And which strategies are equipment and material players employing to gain traction for their technologies? Click here to get the latest from GTM's Innovations in Crystalline Silicon PV 2013 report.