In the aftermath of South Carolina’s nuclear plant abandonment news, solar supporters are making their case for a more renewable-energy-heavy electricity mix.

“Most of the conversation right now is about taking a fresh look at the best paths forward,” said Vote Solar’s Scott Thomasson, in a recent interview. “We just want to keep solar as a key part of the discussion.”

The Palmetto Conservative Solar Coalition is thinking along similar lines. PCSC Chairman and former South Carolina Congressman Gresham Barrett held a press conference this week to discuss the future of residential solar in South Carolina in the wake of the pending VC Summer nuclear plant shutdown -- and with net metering caps looming.

“We in South Carolina are facing an energy crisis,” said Barrett. “This VC Summer debacle has left consumers with massive rate increases and literally no energy to show for it. Not to mention the 5,000 jobs that are gone with the stroke of a pen.”

In contrast, growth in the solar industry -- and the residential solar sector in particular -- stands to create jobs in the state, while giving customers a say in where they get their energy from and how much they pay for it, Barrett said.

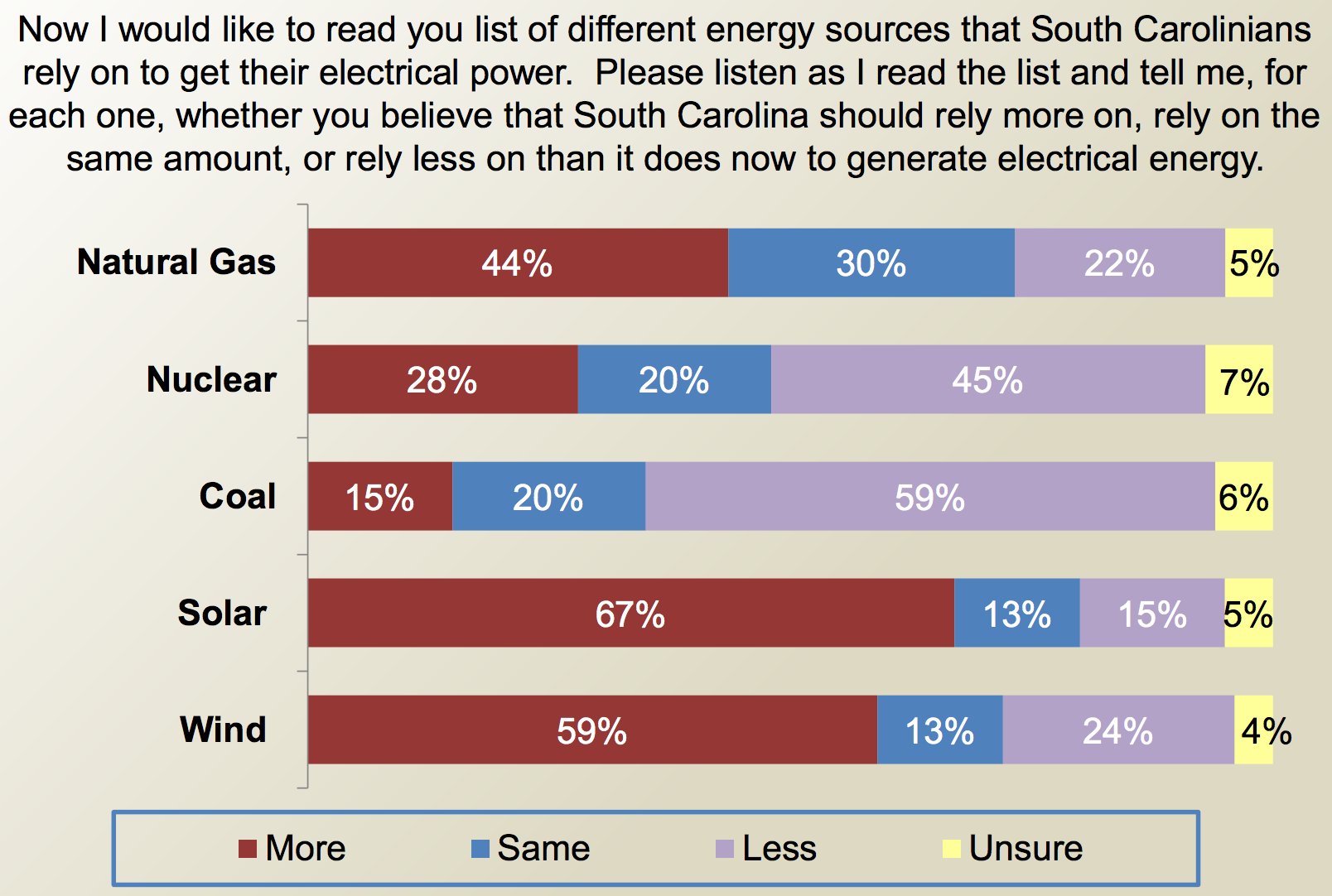

A new survey conducted by the Republican strategic research and consulting firm The Tarrance Group, commissioned by PCSC and The Alliance for Solar Choice, found that more than two-thirds of South Carolina voters believe the state should rely more on solar energy to generate electric power, while substantially fewer voters believe that the state should become more reliant on sources like coal and nuclear power.

“This poll will make it clear that people are going to hold their policymakers accountable for the direction our state takes with energy, and based on the data…they want solar to lead the way,” Barrett said.

The Tarrance poll interviewed 500 registered voters in South Carolina from August 5-7, just days after utility Santee Cooper and South Carolina Electric & Gas pulled the plug on the VC Summer nuclear reactor project. SCE&G’s parent company, SCANA, has since withdrawn its petition to abandon the plant expansion as the state government considers alternatives that could salvage the project. For its part, however, SCANA stands by its position to close the facility, having already spent $9 billion on the project to date.

When asked specifically about rooftop solar and whether or not it’s “an important part of providing choice and competition in electricity,” 82 percent of respondents said they agreed that it is, 15 percent disagreed and 4 percent were unsure. Support spanned across categories of age, race and gender, and even across party lines.

“In today’s highly charged partisan environment, there’s not much that can unify a state or electorate, but this really does,” said Dave Sackett, founding partner of The Tarrance Group.

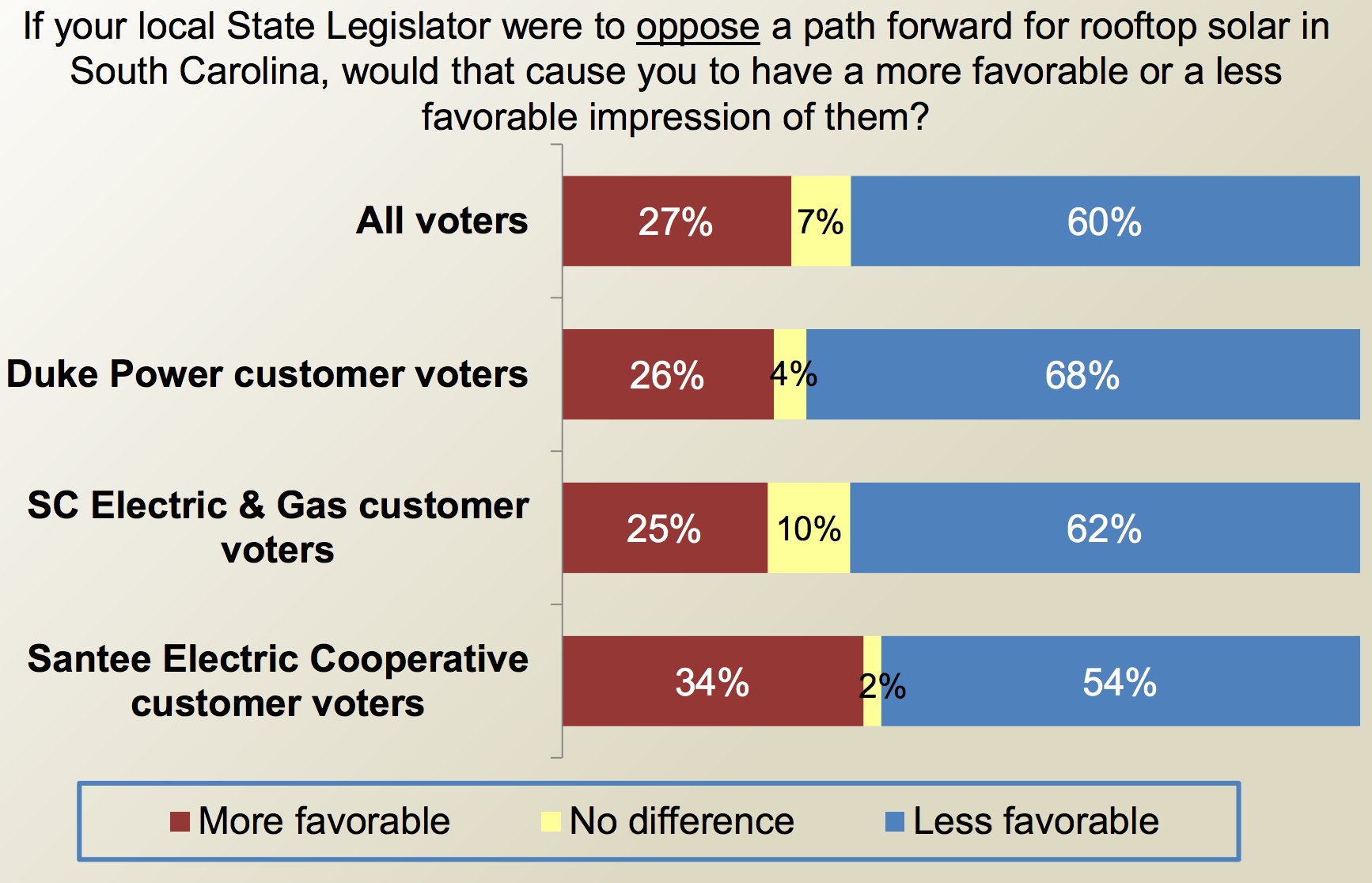

This isn’t the first poll to find cross-party support for solar, but it’s one of the latest to underscore the technology’s bipartisan appeal. Following from that, 60 percent of survey respondents said they would have a less favorable view of their local state legislator if they were to “oppose a path forward for rooftop solar in South Carolina.”

The debate about the future of energy in South Carolina happens to come as the state's utilities approach their 2 percent caps on net-metered solar projects. When state lawmakers approved third-party ownership and net metering as a part of Act 236 passed in May 2015, it created around 3,000 jobs virtually overnight, said Barrett. If net metering is not extended, the state stands to lose those jobs (as Nevada did), on top of the 5,000 jobs South Carolina just lost at the VC Summer nuclear plant.

Lifting the net metering caps will require legislative action. In general, the state Senate has been very pro-solar, but the House leadership has been reticent, said Barrett. Rooftop solar advocates hope lawmakers will take up net metering next session as they respond to the state’s broader energy issues.

“What we’re seeing now more than ever is that rooftop solar, because of the uncertainty, has to play a critical role in South Carolina’s future,” said Barrett.

But, nuclear debate aside, “There are a lot of people out there who want the ability to make their own choices, not only for their power, but to lower their power bill.”

Massachusetts finalizes SMART regulations

Up the coast from South Carolina, solar advocates in Massachusetts had mixed reactions this week to final regulations under the Solar Massachusetts Renewable Target (SMART) program, filed on August 11 by the Massachusetts Department of Energy Resources (DOER). SMART will serve as a replacement for the state’s Solar Renewable Energy Credit (SREC 2) program, which was temporarily extended in March.

Overall, the new program will support 1,600 megawatts of new solar generating capacity broken down into eight blocks (200 megawatts each), with base compensation rates and adders declining 4 percent with each successive block. The amount of capacity each utility must purchase is proportional to the total electric load they serve in the state. How compensation rates are set makes the plan unique -- and complicated.

Sean Garren, Northeast director for Vote Solar, described the SMART model as a “contract for differences,” in which DOER establishes a compensation base for each of the blocks, and then projects are given “adders” or “subtracters” based on their specific attributes. So, say the base compensation rate is 23 cents per kilowatt-hour and you have a community solar project that’s already benefiting from net metering at 17 cents per kilowatt-hour. In this case, DOER will compensate the difference through SMART.

The arrangement would be similar for a larger solar project registered as a qualified facility under PURPA that’s using the state’s avoided-cost methodology. As rates and incentives change over time, the SMART compensation calculation will also change accordingly.

“That provides a lot of consistency and understanding for developers and financiers in terms of what they’re getting for the life of the program," said Garren. “It also gives the state an understanding of what they’re compensating solar at. With SRECs…it’s a lot harder to predict what the state is paying for solar.”

But a big question with SMART still remains: What will the total compensation base be? To determine that, DOER decided to hold a 100-megawatt competitive solicitation for projects sized between 1 megawatt and 4 megawatts. Bids are capped at 17 cents per kilowatt-hour. The average of the accepted bids will then be used as the base compensation rate for the first block of the program.

One concern for solar developers is that the average price could be very low, because low bidders can expect to make more later on if they win the auction. Solar advocates were hoping DOER would set the base value by studying what the average prices are for existing solar projects; that way developers would already know exactly what the compensation rate would be. But policymakers opted for the auction.

“We definitely remain concerned about how the compensation solicitation works out, because it is so critical to the success of the program,” Garren said.

Another concern is net metering -- for a couple of reasons. First, because distributed solar projects are only guaranteed SMART payments for 10 years, it means they will be generating valuable clean solar power for many years after SMART compensation ends. Without a net metering policy in place, these projects won't receive any form of payment for the services they provide to the grid.

The Massachusetts legislature raised the state's net metering cap by 3 percent last year, to 7 percent of the utility's load for private projects and 8 percent for public projects. But utilities are already approaching or have already hit the new cap, and so far there is no long-term replacement.

This uncertainty has prompted a second, more immediate net metering concern. Because National Grid’s cap has already been hit and the SMART program likely won’t be active until halfway through 2018, it's starting to put a damper on solar development in the state. This is specifically a problem for community solar projects, since residential rooftop installations are exempt from net metering limits in Massachusetts.

A consortium of solar advocates said that it is critical that net metering limits are lifted in order for the state’s solar market to continue expanding. Previous policies helped establish Massachusetts as one of the strongest solar markets in the nation, with more 15,000 jobs in the state. "In order to provide the certainty workers will need to keep solar growing, the governor and legislature should raise the caps on solar net metering immediately and continue to work with the industry and advocates as this program is implemented,” Garren said.

“Net metering is a fair compensation mechanism,” he added. “If we start moving smaller community solar projects away from that to something that underestimates the value of solar it runs a risk to the whole solar industry, because we’re assigning a faulty value and that can come back to bite you down the road.”

Jeff Cramer, executive director of the Coalition for Community Solar Access (CCSA), said his organization is concerned about a DOER proposal to allow projects to receive a form of compensation other than net metering, in order to avoid the cap issue. In general, more options are good, but it’s currently unclear what that net metering alternative would look like.

“We remain concerned by the lack of detail regarding the alternative bill crediting mechanism, without which the SMART program will be unable to support community and low-income solar,” Cramer said.

While solar advocates have cited several issues, they also noted several positive changes were made to the final regulation from a draft proposal published in June. Specifically, DOER “eliminated the hard cap on adders, increased the competitive procurement ceiling price and made positive changes related to environmentally responsible siting of solar projects,” the solar consortium said in a statement.

“We look forward to continuing to work together to improve the SMART program during its implementation and at the Department of Public Utilities,” the Solar Energy Industries Association, Solar Energy Business Association of New England, MassSolar, Vote Solar, NECEC and CCSA said in a joint statement.

Regulators rubber-stamp Arizona's rooftop solar settlement

It’s taken years of negotiation, and not all of it cordial, but utility and residential solar industry stakeholders in Arizona have finally reached a settlement on how to compensate rooftop solar.

The Arizona Corporation Commission (ACC) approved the comprehensive and widely supported agreement on Monday as a part of Arizona Public Service's latest rate case. The agreement has backing from ACC staff, the Residential Utility Consumer Office, advocates for limited-income consumers, rooftop solar organizations and dozens of other stakeholders. The settlement, first released in March, was approved this week with modifications, but they do not materially affect the overall economic terms of the deal.

The rate case specifically allows for:

- A 3.3 percent overall revenue increase, effective Aug. 19 (this is APS’ first base-rate increase in five years, and will increase the typical monthly residential bill by 4.5 percent, or about $6 per month)

- A $10 million to $15 million per year investment in an AZ Sun II rooftop solar program, in which limited- and moderate-income customers would receive a monthly credit to allow APS to install rooftop solar systems on their homes

- A $15 million refund of surplus energy efficiency program funds to customers

- Increased program funding, annual crisis bill assistance and a simplified monthly bill discount for limited-income customers

- 20 years of grandfathering for existing private solar customers

- Four new off-peak holidays, increasing the total number to 10

The settlement plan dismisses APS' original request to implement mandatory demand rates for all residential and small commercial customers. Instead, it gives all new distributed solar customers the option to take a demand-based rate or a time-of-use (TOU) rate. It also allows non-solar customers to adopt a demand or TOU rate, but does not require that they select an alternative. However, after May 1, 2018, all new APS customers will move to a time-varying rate by default.

With respect to rooftop solar compensation, the APS rate case adopts the export rate calculation from Arizona’s value-of-solar proceeding. Under the “resource comparison proxy" model, future solar customers will be compensated for their excess electricity with a credit starting at 12.9 cents per kilowatt-hour. Each year, the utility will redo the resource proxy calculation, and adjust customer compensation accordingly. The utility cannot lower the credit by more than 10 percent in a single year, however.

Arizona solar customers are currently compensated for their excess solar generation at rates between 13 and 14 cents per kilowatt-hour. An APS spokesperson confirmed the current rates are available to new rooftop solar customers until August 31, and will be locked in for 20 years. All new solar customers will take the settlement rate and select one of several new time-sensitive rate plans.

APS will begin communicating with all electricity customers starting this fall about how they can pick a new rate plan. The time-sensitive rate options -- required for new solar customers and available to non-solar customers -- include:

- An updated time-of-use plan that will become the standard rate for future customers

- Two optional demand rate plans, plus a pilot demand rate for customers with certain types of technology at their homes, all of which would provide even more opportunities to save

- Additional savings for customers with two more off-peak hours on weekdays (3 p.m. to 8 p.m. instead of noon to 7 p.m.) and four more off-peak holidays

- A plan that includes a super off-peak period of 10 a.m. to 3 p.m. on weekdays in winter to encourage customers to use more electricity at midday when solar production is abundant and demand is low

“Our entire rate review has been open, collaborative and inclusive of a broad range of customer classes and stakeholders,” said Don Brandt, chairman, president and CEO of APS, which serves about 2.7 million people in 11 of Arizona’s 15 counties. “Nearly 15 months after we filed our initial proposal, we have a resolution that benefits our customers and positions Arizona as a leader in smart energy policy.”

Anne Hoskins, chief policy officer at Sunrun, was less enthusiastic in her response to the new arrangement.

"While Arizona does not serve as a model to encourage innovation in distributed energy, the joint agreement between the solar industry, APS and other stakeholders is more proof that rooftop solar is inevitable,” she said, in a statement.

"Parties ultimately spent years reaching this compromise on rates for the solar customers of Arizona's biggest utility. We hope Tucson Electric Power, the state's second largest regulated utility, which submitted a proposal to charge solar customers almost four times as much as APS, will revisit their approach to valuing rooftop solar,” she added. “We urge the Arizona Corporation Commission to hold TEP accountable with a more reasonable approach."