Startup Bright is looking to change the way Mexico's homeowners buy solar power. The firm aims to build a software and finance platform that would allow Mexico's solar installers to provide something like a residential "solar subscription."

The 5-person firm just won Y Combinator's first investment in the solar market. Bright founder Jonah Greenberger said, "Y Combinator has so much data on what works and what doesn't." He spoke of the entrepreneurial preparation gained at Stanford University, but also said, "Y Combinator takes it to a whole new level -- and that's why we took their money, so as not to make the mistakes that thousands of other companies have made." (Dropbox and Airbnb are two of the 2,000 companies that have drawn seed funding and incubation from Y Combinator.)

The startup has also received investment from The Collaborative Fund and executives at Sunrun.

A solar subscription in Mexico

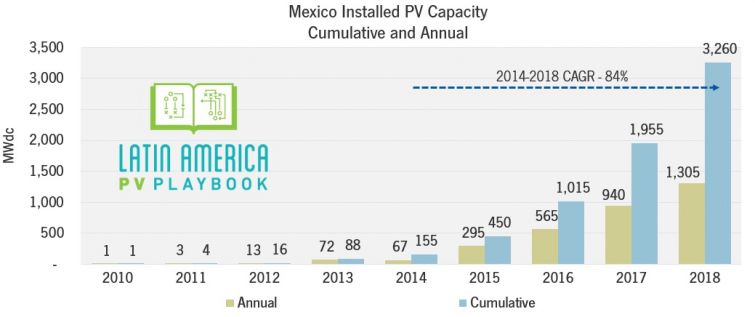

Mexico installed just 67 megawatts of PV in 2014 according to data compiled by GTM Research, but its solar market has been likened to the California market of five or six years ago; by all accounts, it's poised for remarkable growth. (See GTM Research's Latin America PV Playbook for more on this topic.)

Greenberger was in Mexico when we spoke with him on the phone.

The founder, previously a director at Chevron's cleantech practice, suggests that post-2008 mortgage crisis, Mexicans are debt-averse and unwilling to enter into a 20-year contract, so Bright's contracts last for one to four years. He said that the contract is less like a power-purchase agreement, and "more like a Comcast cable subscription." He adds that the inverter manufacturers are providing a remote disconnect so the company "can turn off the system in case of default."

Because "only a small percent of the population has a credit score," the company's analytics focus is on which customers pay their bills, with a preference for higher-income clients in households with net metering. Using standardized solar system sizes, Bright is starting in Mexico and looks to move to Chile and Brazil. Greenberger describes the company's model as being more like software/finance platform Clean Power Finance and less like vertically integrated installer/financier SolarCity. There are already a number of solar leasing companies in Mexico, such as Envolta, as well as large installers such as eSun Energy.

Mexico has a growing GDP and electricity demand that is driving a need for up to 22,000 megawatts of new capacity by 2025, according to GTM Research. Net metering was enacted in Mexico in 2007 and is administered by the Comisión Federal de Electricidad (CFE), Mexico’s state-owned electric utility.

Retail electricity pricing in Mexico is two-tiered; typically, up to 150 kilowatt-hours will cost 6 cents to 10 cents per kilowatt-hour. In most regions, once you consume over 250 kilowatt-hours per month, the DAC rate (“De Alto Consumo,” or high consumption rate) is triggered, bumping up the price to as much as 22 cents per kilowatt-hour.

Greenberger said, "The utility model is broken in the U.S., but it's far more broken in other countries." In the developing world, there's "inadequate customer service," and "generation is mostly fossil fuels." He added, "If people in the U.S. don't trust their utility, then people in Mexico really don't trust their utility."

"We want to provide a utility alternative in developing nations," Greenberger said. The founder added that the firm views the homeowner, not the installer, as the customer, and it wants to provide new services and be "a trusted partner that customers love."

He contends that Bright will offer cheaper, cleaner power and "much better customer service." Greenberger adds, "In a country where bank lines often go around the block for routine transactions -- coming in with a service where we care about the customer is shocking."

Greenberger also suggests that the cost to install solar in Mexico is going to be cheaper than in the U.S. because of cheaper labor and soft costs.

"We're trying to merge local-culture [models of] sales and marketing with U.S. best practices from folks that have worked in the best customer service companies in the country. We can scale faster than SolarCity because the markets are much more economic and we are piggybacking on local installers," said Greenberger.

The founder of Bright says his firm can provide "emerging-market return with non-emerging-market risk" by investing low-cost U.S. debt in relatively safe emerging market economies.

Greenberger said, "We just got started. Our goal is to do 50 rooftops by April 1 and 500 by year-end." That would be a good start for a small firm about to face many cultural, corporate and financial learning opportunities.

Adam James, GTM Research's Latin America solar analyst, has reported that "the Mexican distributed generation market is "extremely attractive"; he also suggested that there is an opportunity for a SolarCity presence in the country.

According to James' research, as reported in the Latin America PV Playbook, "The current competitive landscape in Mexico comprises approximately ten to 15 companies performing ~80 percent of distributed generation installations, with the final ~20 percent spread out among several hundred smaller companies. None of these companies have a national presence, although several are growing at an impressive rate and have operations in multiple regions, including eSun, Desmex, Conermex, and Powerstein."

Residential rooftop solar was ripe for innovation on the way to scale in the U.S.

Now other regions could be going through that same transformation.

Figure: Mexico Installed Capacity

Source: GTM Research's Latin America Playbook

***

GTM Research has a webinar on The Four Key Issues Shaping Latin America’s Solar Market scheduled for March 17 at 2 p.m. ET.