SolarCity called it in 2014. Canadian Solar recently voiced its concerns during its first-quarter 2015 earnings call. Will there be a module supply shortage by the end of 2015?

The claim comes three years after the peak of severe module oversupply in 2012. After excessive capacity additions in 2011 and disappointing downstream demand in 2011 and 2012 that triggered a free fall in module prices, the upstream supply market achieved stability as a result of strong installation demand growth in 2013, stable demand in 2014, supplier consolidation, and conservative capacity addition measures.

To the supply shortage view's credit, the projected uptick in demand during 2015 will be the strongest the market has seen in the past three years, with annual installations estimated to grow 36 percent year-over-year, according to GTM Research’s latest Global PV Demand Outlook. And while we are starting to see more capacity additions, supplier mentality around capacity growth has not changed much since 2012.

According to GTM Research’s PV Pulse, total capacity is expected to increase at a much slower rate compared to demand growth, with total capacity growing at least 16 percent in 2015. The latest round of capacity announcements by major Chinese suppliers will be incremental, allowing suppliers to serve markets with tariffs through capacity additions in regions beyond China and Taiwan (e.g., Thailand, Malaysia, South Korea) and to keep capex low with modest expansions at existing Chinese facilities. Announcements such as Trina Solar’s stated intention to build a 2-gigawatt fab in India and JA Solar’s memorandum of understanding for manufacturing in India provide the promise of more capacity, but the lack of confirmation and specific timeframes demonstrate that capacity addition plans continue to be cautious.

At present, capacity additions are driven by a number of factors, including downstream demand visibility, current supplier supply strategy (asset-light vs. vertical integration), current financial ability, and the still-fresh sting of overly ambitious capacity expansion plans that led to market oversupply.

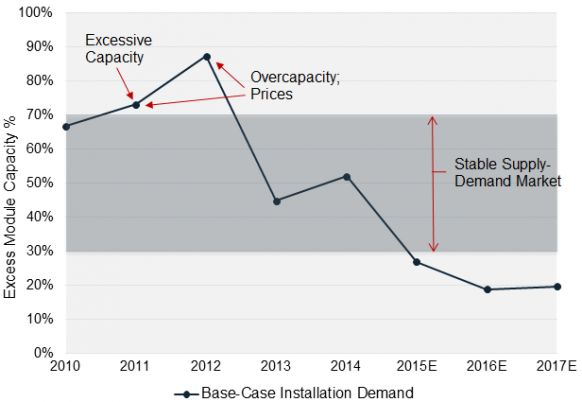

FIGURE: Module Excess Capacity Ratio, Installation Demand Forecast

Source: GTM Research PV Pulse, Q2 2015

The effect of strong demand pull-in and judicious capacity expansion will undoubtedly have an impact on the supply-demand landscape in 2015. The ratio between ramped capacity (a discount of total capacity, accounting for capacity ramp time, plant downtimes, and plant suspensions) and module demand should be in the range of 30 percent to 70 percent during healthy supply-demand years. A healthy market is characterized by a period during which the amount of supply relative to demand drives minimal price risk and there is enough ramped capacity to serve market needs.

This high tolerance for excess capacity can be explained by the presence of cost-uncompetitive capacity, less bankable suppliers, capacity over-reporting, and inventory in distributor warehouses. But if the ratio exceeds 70 percent (oversupply), there is a significant risk that module prices will decrease at a more rapid rate, similar to the trends exhibited in 2011 and 2012. If the ratio falls below 30 percent (undersupply), there is some risk that module prices will exhibit a stable to upward trend, most notably during the end of the financial year when strong regional demand pull-in occurs. Additionally, a ratio significantly below 30 percent increases the risk that the market will be underserved.

Using GTM Research’s base-case 2015 demand outlook of 55 gigawatts, the ratio between ramped capacity and module demand is forecasted to drop year-over-year, falling to 27 percent in 2015. While this is below the threshold of what we define as a stable supply-demand market, to say that the market is experiencing a module shortage is an overstatement. The current upstream market supply should be able to fulfill downstream market needs.

But 2015 market tightness will not be without consequences, and GTM Research is anticipating three major effects:

- Lead times for top suppliers are expected to increase, especially as strong end-of-year demand picks up in major markets.

- Module prices will increase in select markets, with some stability in others. For example, prices for Chinese modules in China are forecasted to incrementally increase, while prices for Chinese modules in the U.S. will fall. The U.S. price decline is driven by the expectation of lower anti-dumping tariffs on Chinese cells with final prices determined by suppliers' gross-margin expectations and the all-in module cost for a U.S.-bound product. It should be noted that the cost of U.S.-bound products is still higher than other markets, as it either includes tariff costs for products with Chinese cells or it’s coming from a tariff-free plant that is not yet capturing economies of scale.

- Top-tier suppliers' capacities may be fully booked by year-end. Major firms have already been running at full capacity in 2015. This is due in part to the anticipation of strong demand during the second half of 2015. Trina Solar claims it kept its fabs running through the Chinese New Year (traditionally an observed holiday during which capacity utilization falls). Additionally, JinkoSolar claims its new Malaysia facility, which commenced operations in May 2015, is fully reserved.

In terms of supply availability, the concern lies in 2016 and beyond. While annual demand is expected to increase at a more moderate pace compared to 2015 (estimated to grow 18 percent year-over-year to around 65 gigawatts in 2016), there has been no confirmation that capacity growth will match demand growth; little has been said or confirmed about 2016 capacity plans. Unless more capacity growth is announced, an increasingly tight supply-demand landscape has the ability to disrupt the status quo of annual module price declines.

***

For more insight on the global PV value chain, subscribe to GTM Research’s PV Pulse. From technology market shares and production costs to end-market shipments and component pricing patterns, the Pulse tracks the metrics and trends industry players need to stay ahead of the fast-moving PV supply market.