Over the past two months GTM Research has begun to survey the solar power landscape in a world with fewer incentives.

Specifically, we have been focused on analyzing project economics after expiration of the 30 percent Investment Tax Credit (see here and here for parts I and II in this series). Our core assumption has been that solar markets will tend to reach an initial tipping point when developers can offer customers a PPA at less than retail electricity prices. And if the PPA has an escalator, it should be less than historical increases in retail rates. We can determine when this will occur by comparing the levelized cost of energy (LCOE), a measure of total generation cost in dollars per kilowatt-hour, over the lifetime of a PV system, to retail electricity prices.

Our first two articles focused on broad comparisons across states. While useful for general purposes, this fails to account for the many quirks in individual state and utility territories. For a next step, we’re undertaking a deep dive at the state level, starting with Arizona, a market which is closely approaching “post-incentive” status. Arizona Public Service (APS) claims to be in near-term compliance with the state’s Renewable Energy Standard (RES) for distributed generation and argues that a purely compliance-based budget for 2013 would not warrant further cash incentives. However, in the interest of obtaining the least-cost renewable kilowatt-hours to meet overall RES requirements, the Arizona Corporation Commission (ACC) is suggesting a budget of around $10 million for incentives. The majority of this funding will go toward residential PV, at an upfront incentive level of $0.10 per watt. Once this $10 million is expended, which may be as early as mid-2013, residential PV incentives will drop down to zero. For commercial solar, the ACC staff recommends a production-based incentive cap of $0.065 per kilowatt-hour, about 30 percent lower than the 2012 cap.

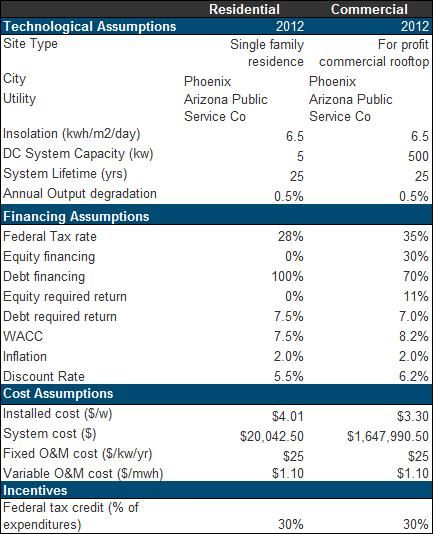

Our model assumptions for the AZ market in 2012 are as follows:

Source: GTM Research

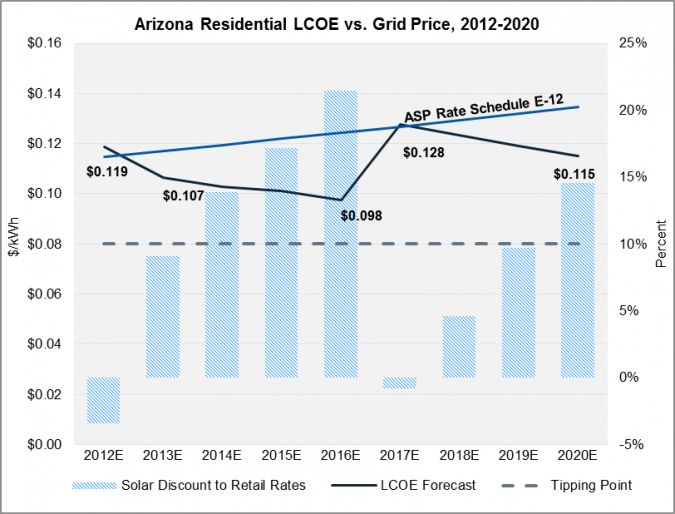

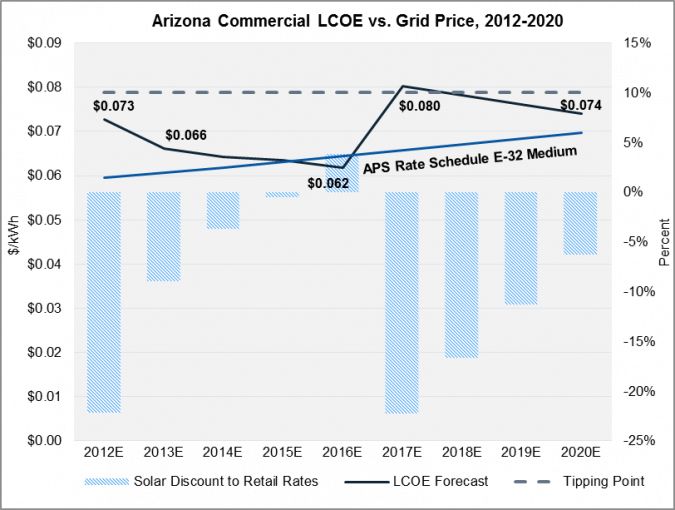

In order to depict a “post-incentive” world, our model does not incorporate state-level incentives. A 30 percent ITC is applied through 2016, after which it is stepped down to 10 percent for commercial projects and removed completely for residential systems. To determine the viability of distributed generation in the Arizona market, we compared the real LCOE of solar to calculated generation charges for two APS rate schedules. Through this analysis, we can estimate at what point in time developers can offer a PPA to customers at less than retail prices, with an escalator equal to inflation -- we assume that the benchmark for a good deal is generally 10 percent to 15 percent savings for the end customer.

It should be noted that the viability of solar is driven almost entirely by rate design. The avoided costs for solar generally assume little to no savings for demand and standby charges, as these savings cannot be guaranteed. Demand charges, calculated on a per-kilowatt basis for a customer's maximum registered power demand, reflect the cost of transmission and distribution facilities built to meet customers' peak power demand. Time-of-use rates contribute favorably to avoided costs—they can deliver a price break on demand charges and allow higher priced energy charges offset by solar generation.

Source: GTM Research

APS’s standard residential schedule, E-12, has a tiered rate structure, with higher tariffs applying to higher levels of energy consumption. In this scenario, the LCOE of solar will be below calculated electricity prices next year. We expect solar to become cost-effective starting in 2014 when generation costs are over 10 percent less than electricity charges. After the expiration of the ITC in 2016, the discount dips below our assumed tipping point, recovering to economical levels by 2020.

Source: GTM Research

Commercial customers with an average monthly maximum demand between 100 and 400 kilowatts are eligible for a general service rate plan, E-32 M, tiered based off monthly peak demand levels. A comparison of solar LCOE to energy charges illustrates the challenges for the commercial segment in a world with fewer subsidies. As demand charges tend to be a more significant portion of commercial rates, the potential for avoided cost for a commercial customer is less than for a residential customer. Based on our analysis, solar does not appear to be cost-effective in the commercial space without incentives. Though PV capacity can be generated at a discount to traditional energy starting in 2016, the expiration of the ITC has too large of an effect on this downward trajectory and we do not see price convergence until after 2020.

Based on our analysis, it appears that residential solar generation in Arizona will be cost-effective without the support of state-level incentives until the expiration of the 30 percent ITC. After that point, customers on a standard residential rate plan will have a few years where the LCOE of solar remains below traditional generation pricing, but may not be cheap enough to provide substantial customer savings.We do not expect the same solar energy opportunities for commercial customers, as they see a larger portion of their bill coming from demand charges and therefore do not have the same potential for avoided cost.

For more information on GTM Research’s U.S. solar market analysis, contact [email protected].