In a solar earnings season that included lots of battery talk and YieldCo action, there were varying degrees of profit and loss, but there was a common theme of strong top-line growth.

And that holds true for Vivint Solar in its first-quarter 2015 financial results:

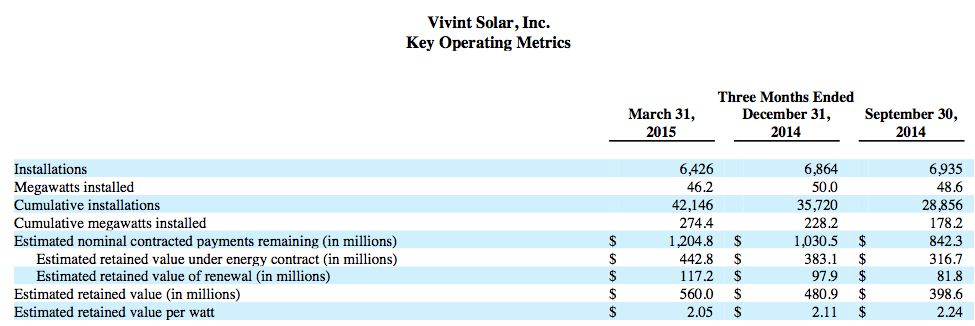

- Q1 installations beat guidance at 46 megawatts -- that's up 131 percent year-on-year

- Revenue of $9.5 million, up 172 percent

- The firm booked approximately 50 megawatts for the quarter, up 90 percent year-over-year

- Operating loss rose from $29.9 million a year ago to $48.7 million

- Installations numbered 6,426 for the quarter, up 100 percent year-over-year; cumulative installations were 42,146

- Estimated retained value increased by approximately $79 million during the quarter to approximately $560 million, up 138 percent year-over-year

The CEO noted that Vivint is working with SolarEdge, Fronius, Tesla, and Enphase on emerging energy storage applications. Vivint sees the usage case as being limited to backup in the near term.

New investment funds

The CEO noted that in the first four months of 2015, Vivint raised $350 million more in funding -- good for another 193 megawatts of future deployments. The company also cited a "commitment letter" for an additional $100 million, as well as a $150 million working capital facility. The CEO also reported a $150M fund and an EPC partnership intended for C&I applications.

Guidance for Q2 and full year 2015

-

Vivint expects to install 63 to 67 megawatts' worth of solar in Q2 The company estimates revenue at $14 million to $15 million and operating expenses of $80 million to $85 million.

-

For the full year 2015, Vivint reiterates an installation guidance of 290 to 310 megawatts

According to the GTM Research U.S. PV Leaderboard, Vivint was the No. 2 solar installer in the U.S. in 2014.

FIGURE: Leading U.S. Residential Solar Installers, 2014

Source: GTM Research U.S. PV Leaderboard, Q1 2015

FIGURE: Vivint Q1 2015 Financials

Source: Vivint