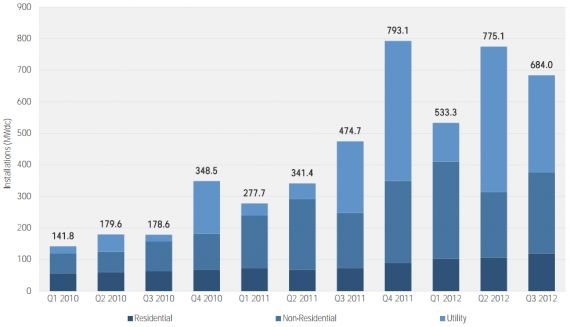

GTM Research and the Solar Energy Industries Association® (SEIA®) today released the U.S. Solar Market Insight: Third Quarter 2012. The report finds that the U.S. solar photovoltaics (PV) market installed 684 megawatts in the third quarter (Q3) of 2012, representing 44-percent growth over the same period last year. This quarter marked the third largest on record for the U.S. PV industry and raised the total installed capacity through the first three quarters of the year to 1,992 megawatts -- already surpassing 2011’s annual total of 1,885 megawatts.

Cumulatively, there are now 5.9 gigawatts of PV (which converts sunlight directly into electricity) operating in the U.S. from more than 271,000 installations. Combined with concentrating solar power facilities (CSP), which convert the sun’s heat to electricity, there are more than 6.4 gigawatts of solar electric capacity installed in the U.S., enough to power more than one million average American households.

The third quarter featured strong growth in distributed generation (DG) markets; the residential PV sector installed more than 118 megawatts, an all-time high for a quarter, while the commercial market (including governmental and institutional facilities) hit 257 megawatts, rising 24 percent above last quarter.

FIGURE: U.S. PV Installations by Market Segment, Q1 2010 to Q3 2012

Source: U.S. Solar Market Insight: 3rd Quarter 2012

In addition to solid growth nationally, Colorado, Florida, Maryland, Massachusetts, and Pennsylvania saw growth of 5 megawatts or greater compared to the previous quarter. Behind Maryland, Massachusetts saw the greatest quarter-over-quarter increase, up from 25 megawatts in Q2 2012 to 40 megawatts this quarter. All Massachusetts installations in Q3 2012 came from the non-residential and residential sectors, boosted by the expansion of net metering allowances and an influx of national retailers that offer leasing and other innovative third-party ownership models.

The GTM and SEIA research teams expect third-party leased PV systems to remain a hot option in the U.S. market for homeowners into 2013 and beyond. During this quarter, residential PV markets in Arizona, Colorado, California, and Massachusetts saw third-party systems range from 57 percent to 91 percent of total residential system installations.

“While Q3 2012 was remarkable for the U.S. PV market, it is just the opening act for what we expect to see in Q4,” said Shayle Kann, vice president of research at GTM. “We forecast more than 1.2 gigawatts of PV to be installed next quarter on the back of developers who are pushing to meet year-end deadlines in both the utility and commercial segments. We also expect to see the residential PV market post another record number in Q4, as third-party residential installers gain more traction in mature, cost-effective markets.”

Historically, Q4 has been the strongest for PV installations in the U.S. In 2010 and 2011, Q4 represented 41 percent and 42 percent of annual installations, respectively. U.S. Solar Market Insight® forecasts a similar Q4 bump in 2012 with approximately 1,200 megawatts to be installed. That would not only account for 38 percent of this year’s forecasted total, but would be the largest single quarter on record for the U.S. PV market by far.

Q4 2012 will also be exceptionally strong for CSP installations, with more than 140 megawatts slated to go online. SEIA and GTM Research expect 2012 growth to top 70 percent with a record 3.2 gigawatts of solar installed -- enough to power more than half a million average U.S. homes.

“This quarter’s record residential growth shows the power of innovation in the U.S. solar industry,” said Rhone Resch, president and CEO of SEIA. “With costs continuing to come down and new financing options, solar energy is affordable today for more families, businesses, utilities, and the military. Thanks to smart long-term policy, the solar industry is growing to meet the challenge of putting Americans back to work and helping to grow both our nation’s economy and our clean energy portfolio.”

System prices for PV projects in the U.S. continued their downward trajectory in the third quarter of 2012. Average residential system prices dropped quarter-over-quarter from $5.45 per watt to $5.21 per watt nationally, while average non-residential prices declined 15 cents per watt, falling to $4.18. Utility system prices, which are currently at $2.40 per watt, continue to see the greatest reduction in prices of the three market segments covered, falling by 30 percent since the third quarter of last year.

For more information on this quarter's U.S. Solar Market Insight report and to download the free Executive Summary, visit www.greentechmedia.com/research/ussmi.