The following is an excerpt from the September edition of PVNews. Subscribe now to read the entire issue.

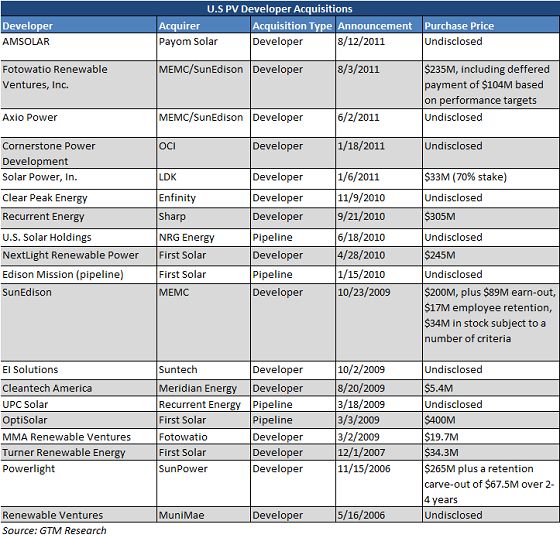

The March issue of PVNews featured a discussion of downstream acquisitions across the vertical solar value chain. Between February 2010 and January 2011, five project development companies were purchased by larger, upstream players (LDK-Solar Power Inc, First Solar-NextLight, Sharp-Recurrent Energy, OCI-Cornerstone, and Enfinity’s-ClearPeak, which is the only exception to this trend, as Enfinity is a developer). Just recently, MEMC/SunEdison, which boasts an impressive pipeline and installation record itself, scooped up both Axio Power and Fotowatio Renewable Venture’s U.S.-based subsidiary.

Since 2006, well over $2 billion has been spent acquiring developers and/or their pipelines, but has it been worth it?

With the $2 billion in developer and pipeline acquisitions also comes over 1.5 gigawatts of contracted and 4 gigawatts of pre-contract projects in the U.S. Relative to the size of the U.S. commercial and utility markets in 2010 (619 megawatts-DC), these are massive figures. Though the domestic solar market has grown rapidly in the past few years and is expected to do so through 2015, do these companies anticipate even bigger growth -- or is this a case of just keeping up with the Joneses?

Comparing all of the acquisitions detailed in the table below, it is clear that multiple strategies have been employed by acquirers. Early movers such as First Solar (OptiSolar) and SunPower (Powerlight) have seen the acquisitions they made back in 2006 start to come to fruition, with large projects connected in the last year. Both of these firms bought developers with late-stage pipelines, and these qualifications are represented in the high purchase prices. First Solar has continued this approach through to the present with the recent purchase of NextLight Renewable Power; MEMC and Sharp pursued a similar strategy with their acquisitions of SunEdison and Recurrent Energy, respectively.

Other firms have sought out developers with smaller pipelines and fewer signed contracts, likely in an attempt to acquire a development arm at a more reasonable price. Upstream giant OCI committed to exploring project development in the U.S. with its acquisition of Cornerstone Power Development, which had relatively few projects with signed PPAs at the time of purchase. Conversely, established developers looking to quickly build out their project portfolio have bought out other developers’ pipelines, though details surrounding these transactions are less readily available that when one company acquires another.

Even with many reputable developers being acquired in the past five years, there are still over 100 other companies actively developing solar projects in the U.S. Without large corporate parents with substantial balance sheets -- are these companies’ projects less likely to be built compared to those developed by vertically integrated entities?

Can a shakeout amongst developers be expected as well? With the amount of available project finance far below demand and the looming expiration of the 1603 Tax Grant, it would seem the U.S. developer market is heading that way.

To continue reading the September issue, including a research excerpt on the U.S. solar trade balance and other industry updates, subscribe today to PVNews. To download the complete July 2011 edition of PVNews, which includes the ranking of top-10 U.S. utility-scale PV developers, please click here.