Big players in the third-party ownership (TPO) space have the responsibility for a lot of residential rooftop and small commercial solar photovoltaic (PV) systems, and there is money at stake on those systems’ performance.

A homeowner or small business owner who installs a solar PV system can check a computer display, typically provided at installation, and know if it is time to dust the panels or trim an overhanging branch, or whether there is something wrong with the system. TPO players like Sunrun, Clean Power Finance, SolarCity and SunPower (NASDAQ:SPWR) typically guarantee system performance and, with that sector of solar investment soaring, there is a lot of dusting and tree-trimming to be done.

Though tracking and maintaining many small solar systems is a lot like herding cats, such system management is necessary, even vital, for maximizing the return on investment. (See GTM Research's report on Global PV Monitoring here.)

What is unnecessary, according to Mark Liffmann of Clean Power Research (CPR), are excessive, costly maintenance calls and/or the installation of hardware, such as pyranometers, to provide location-specific, time-specific output benchmarks so that the system's software can know if there is shading, soiling or a malfunction.

Clean Power Research (CPR) has a better idea. Its just-released services product capitalizes on proprietary algorithms developed by Dr. Richard Perez of the State University of New York at Albany to interpret National Oceanic and Atmospheric Administration (NOAA) satellite weather data and provide system owners a location-precise, time-specific accounting of benchmark performance without the expense of onsite hardware.

Perez’s algorithms, incorporated into CPR’s SolarAnywhere product, typically provide half-hourly or hourly irradiance information for between one and ten square kilometer areas at ZIP-code-specific locations. SolarAnywhere is part of ongoing efforts to precisely characterize the variability of distributed solar PV systems by the California Independent System Operator, Pacific Gas and Electric (NYSE:PCG), the Sacramento Municipal Utility District, the Electric Power Research Institute, and other institutions.

The data appears comparable to resource assessment information provided to utility-scale solar and wind installations by renewables industry associates like 3Tier, GreenPowerLabs and MeteoTest. The news here is that CPR is making possible the use of SolarAnywhere data at a much smaller scale.

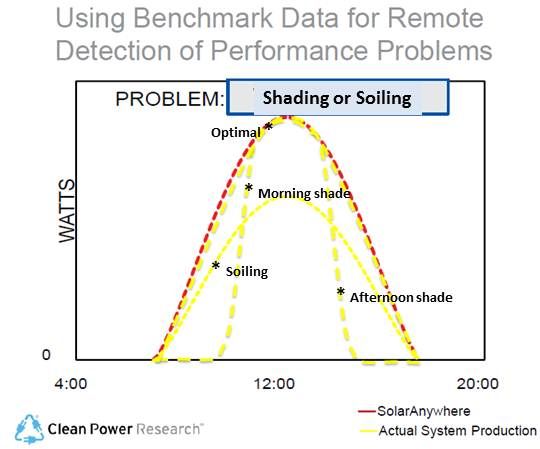

Shading and soiling have specific performance signatures, according to Liffmann. As a small solar system’s software reads its output, it can recognize the compromised performance signatures if it has a real-time optimal output -- in other words, a benchmark -- with which to compare it. But, Liffmann said, optimal output, like the weather, is always changing.

CPR’s SystemCheck generates that real-time optimal performance benchmark for present conditions from NOAA satellite image irradiance data and the PV system’s specifications for the PV system. The solar system’s control software can then compare the system’s expected optimal performance with its measured performance and determine if there is a soiling signature, a shading signature or compromised function, according to DECK Monitoring’s Peter Denato. DECK is the CPR software’s first announced purchaser.

The ability to monitor system performance without installing onsite hardware saves hardware costs and hardware maintenance costs without significantly compromising the ability to optimally maintain the system, Liffmann said. The other alternative -- regular maintenance calls -- would be even more cost-inefficient.

Denato said the cost for five years of CPR services is about half the cost of installing a pyranometer to provide precise location irradiance as a benchmark. He acknowledged the CPR services might only cut total system cost by a small percent, but both he and Liffmann pointed to improved system performance without increased maintenance costs and the ability to make more and better data available to TPO investors as added value.