Energy storage is a small market experiencing fierce growth. The U.S. installed 61.9 megawatts of energy storage in 2014, and GTM Research is forecasting 220 megawatts to be installed in 2015. But, as with the U.S. solar industry, energy storage projects are clustered in states with incentives or in regions where markets are able to place a value on storage.

So it's no surprise that California, Hawaii, and New York have assumed early leadership in energy storage by virtue of their unique incentives, mandates and markets, according to the inaugural GTM Research and Energy Storage Association U.S. Energy Storage Monitor report.

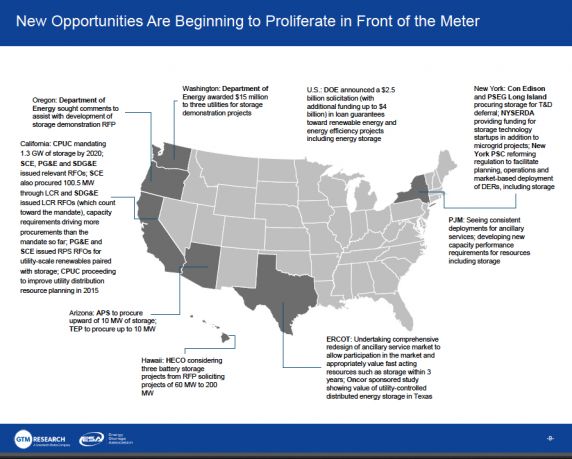

Energy storage in front of the meter

California's PUC has mandated 1.3 gigawatts of storage by 2020. Southern California Edison, as part of it local capacity RFO, is adding 50 megawatts of battery-centered “hybrid electric building” projects from startup Advanced Microgrid Solutions. Another 25.6 megawatts of thermal energy storage will come from Ice Energy. The biggest winner was AES Energy Storage, which will build a 100-megawatt battery system in SCE’s West Los Angeles Basin region.

New York: Con Edison and PSEG on Long Island are procuring storage for T&D deferral.

Arizona and Hawaii are considering large energy storage projects.

PJM: Seeing consistent deployments of energy storage for ancillary services.

Source: GTM Research and ESA's U.S. Energy Storage Monitor report

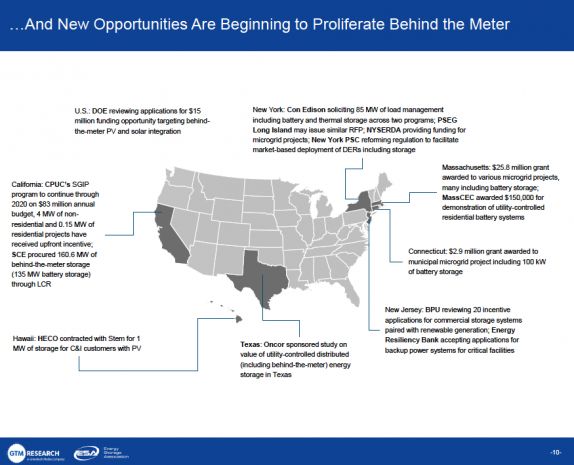

Energy storage behind the meter

California: Southern California Edison was awarded 85 megawatts of behind-the-meter batteries from startup Stem. And the most significant reason why California leads is the CPUC’s SGIP program, which has an $83 million annual budget for distributed generation with generous subsidies for distributed storage. California has led the growth in behind-the-meter markets so far, with 5.7 megawatts of energy storage deployed in 2014, almost 90 percent of the behind-the-meter total.

Hawaii: HECO has contracted with Stem for 1 megawatt of storage for C&I customers with PV solar.

New York: Con Edison is soliciting 85 megawatts of load management, including battery and thermal storage.

Gregg Patterson, the CEO of Demand Energy, noted in a recent interview with GTM, "New York is the most deregulated market in the world (with the exception of maybe New Zealand or Australia). We can take advantage of the transactive energy [market] and drive multiple value streams." Doug Staker of Demand Energy noted that New York has fewer stakeholders, along with an aligned core vision around the state's ongoing REV initiative. He added that storage aims to solve the peak load reduction challenge in New York, while high penetration of PV, along with demand charges, drives storage in California.

GTM Research energy storage analyst Ravi Manghani notes, "New York is currently leading the charge on the future of distributed electricity system, where storage will undoubtedly play an important role. In addition to Con Edison's demand management programs for the Indian Point nuclear plant and the Brooklyn and Queens substation deferral, there will be a handful of energy storage projects announced in summer this year as part of the REV demonstration phase, as requested by the New York PSC. These projects are aimed at providing utilities and third parties a test bed to experiment with different business models and applications that fit within this market-based approach."

Source: GTM Research and ESA's U.S. Energy Storage Monitor report

***

About the U.S. Energy Storage Monitor

Delivered quarterly, the U.S. Energy Storage Monitor report is the industry’s only comprehensive research on energy storage markets, deployments, policies and financing in the U.S. These in-depth reports provide energy industry professionals, policymakers, government agencies and financiers with consistent, actionable insight into the burgeoning U.S. energy storage market. Learn more at www.energystoragemonitor.com.