President Obama’s budget proposal called for making the production tax credit (PTC) permanent and refundable. The PTC is vital to wind and other renewable energy industries.

“Refundability, something we don’t have, would be a way to monetize the tax credit without using tax equity," said American Wind Energy Association CEO Rob Gramlich in a briefing on the industry’s just-released Annual Market Report.

The financing used for new wind projects in 2012, as detailed in the report, was less likely to come from third-party non-recourse project finance sources like tax equity and debt than in previous years. But the total $25 billion investment was big enough to bump up the national gross domestic product (GDP), according to economists at the Commerce Department’s Bureau of Economic Analysis (BEA) and private firm IHS Global Insight (NYSE:IHS).

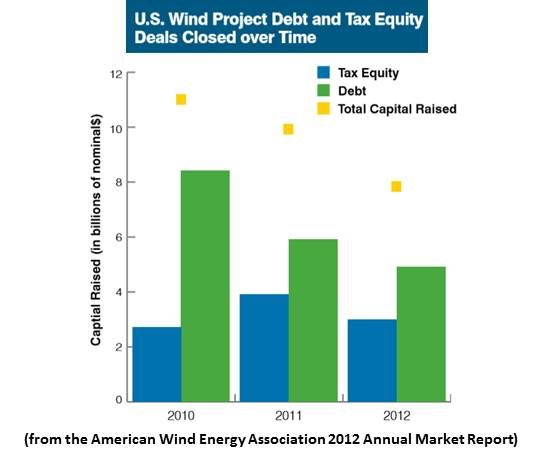

Tax equity financing brought in $3 billion, supporting 2,925 megawatts of new wind capacity, and debt financing accounted for another $4.9 billion, supporting another 4,271 megawatts. The $16.9 billion balance that supported the other 5,935 megawatts of new capacity built last year came from other sources and went to project equity.

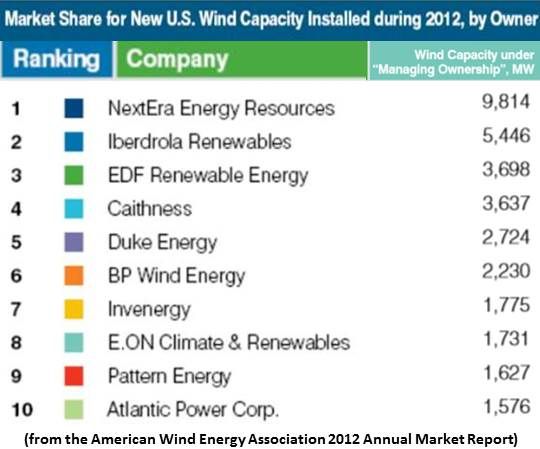

Such project equity came from deep-pocketed investors like Berkshire Hathaway (BRK.A) backing MidAmerican Energy, NextEra Energy (NEE) backing NextEra Energy Resources, and Duke Energy, often hedging against energy market volatility.

Other investors were multinationals backing U.S. subsidiaries. Examples were the parent companies of EDP Renewables North America, EON Climate and Renewables North America and Iberdrola Renewables. Funds, like TIAA-CREF, also bought in, attracted not by tax equity but by the potential of a steady return.

The crucial role of the PTC in bringing money into wind was demonstrated to some extent by the drop in tax equity and debt financing in 2012 in comparison to previous years. It went down, despite wind’s record-breaking year, because “there is not a perfect correlation between when a project is built and when it is funded,” explained AWEA Finance Policy Manager Paul Holshouser. “Project funding can occur as much as a year in advance of construction.”

During 2011, with a three-year PTC in place, tax equity and debt was more than 19 percent higher, with $3.9 billion tax equity and $5.9 billion debt totaling $9.8 billion. In 2H 2012, with the PTC’s expiration imminent, “the pipeline for projects scheduled to be built in the first half of 2013 was very reduced,” Holshouser said, “and there was almost no forward-looking project finance market.”

The shift was exaggerated, Holshouser noted, by the 2010-11 Alta project deal involving Terra Gen, Google (GOOG) and others, which amounted to more than a billion dollars of tax equity and debt. But the trend was there.

Because of improved project performance, tax equity investors are increasingly attracted to the PTC, Holshouser added. In 2011, 54 percent of tax equity investors chose the PTC, with the rest opting for the 1603 Treasury Program. In 2012, 80 percent chose the PTC, the annual report noted, “illustrating how the PTC incentivizes performance.”

President Obama’s call for a permanent and refundable PTC, Gramlich said, “means the renewable energy industries’ message that support must be certain and predictable is being heard and understood.”

But the January 1 PTC extension did not eliminate uncertainty. New language makes projects “in construction” by the end of this year eligible, instead of only those that “start production.” But there is no legal definition of “in construction.” In the past, it has required physical construction or a minimum non-refundable investment.

Developers “are waiting for guidance,” noted MidAmerican Energy lobbyist Jon Weisgall.

There is also uncertainty about the president’s budget. “The House and Senate budget proposals are very different from one another and the president’s budget is in between,” Gramlich said. “The hope is that by early summer, Congress will complete work on gun control and immigration and turn to a grand bargain in which the president’s PTC proposal would be considered.”

One thing is virtually certain. Early in the year, in order to win some lawmakers’ support for the PTC extension, AWEA floated the idea of a long-term phase-out of the tax credit, noting the industry was perhaps two technology cycles, or about six years, away from unsupported cost-competitiveness.

Now, however, AWEA says “the commitment to that idea was it should only be considered in the context of comprehensive tax reform discussions with the other energy industries at the table.”