In most PV markets, operations and maintenance and asset management start as extensions to project development and construction, so historically, the largest and fastest-growing providers have been EPC and development firms. But in many markets, the tables have turned, and services offered to existing plants now represent the larger business opportunity.

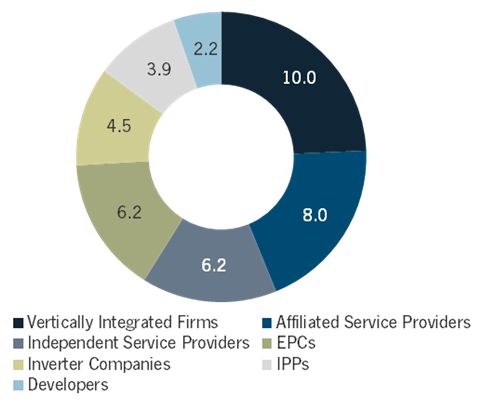

FIGURE: Analyzed Global Managed Fleet by Vendor Category (GW)

Source: Megawatt-Scale PV O&M and Asset Management 2015-2020

Independent service providers (ISPs), once marginal players, have captured significant levels of market share. Examples include European asset managers Vector Cuatro and WiseEnergy, European O&M providers greentech and ENcome Energy Performance, and American O&M and asset management provider Solarrus (parent company of True South Renewables and MaxGen Energy Services). And in the past few years, a number of developers and EPCs have turned their focus to O&M and/or asset management, many of them creating subsidiaries or spin-off companies dedicated to this new service business.

Examples of such vendors, termed "affiliated service providers" (ASPs) in the report, include Ingeteam Service (affiliated with inverter company Ingeteam), Lightsource Renewable Services (affiliated with leading U.K. developer Lightsource Renewable Energy), and EDF Renewable Services (affiliated with EDF EN, the project development arm of French IPP EDF).

In their latest report, Megawatt-Scale PV O&M and Asset Management 2015-2020, GTM Research and SoliChamba Consulting analyzed 76 vendors managing nearly 41 gigawatts of PV megawatt-scale photovoltaic plants in aggregate: service providers are now the leading vendor category, totaling 14.2 gigawatts and growing by 3.5 gigawatts in the first three quarters of 2015. Remarkably, ISPs are outpaced by ASPs: the 16 ASPs analyzed in the report currently manage 8 gigawatts of assets and grew by more than 2 gigawatts in the first three quarters of 2015, while the 17 ISPs currently manage 6.2 gigawatts and grew by 1.5 gigawatts in the same time period. ASPs usually have the advantage of a captive installed base of projects developed, built, owned or equipped by their affiliate(s), while ISPs must win almost every contract in a competitive environment.

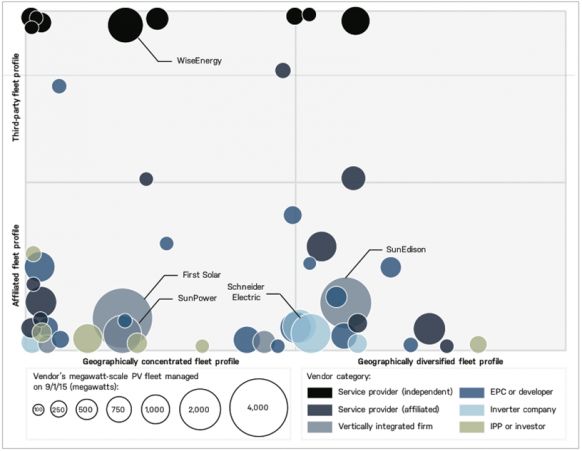

The new GTM Research report analyzes the vendor competitive landscape on a global scale, covering 15 key markets with a focus on European and American firms. The simplified figure below presents the competitive landscape and highlights the continued dominance of vertically integrated firms First Solar (No. 1 with 4.3 gigawatts), SunEdison (No. 2 with 3.2 gigawatts), and SunPower (No. 4 with 1.8 gigawatts). These firms manage large fleets predominantly located in North America, and primarily fueled by their own project development activities, although SunEdison shows a greater level of geographical diversification than First Solar and SunPower (more than half of its managed fleet is located outside of its primary market).

FIGURE: Global Megawatt-Scale PV O&M and Asset Management Competitive Landscape Overview

Source: Megawatt-Scale PV O&M and Asset Management 2015-2020

Schneider Electric ranks No. 3 with 1.9 gigawatts under management, illustrating the increased interest of inverter companies in O&M business: ABB, Enphase Energy, and SMA are also actively seeking O&M contracts, often focusing on maintenance of inverters they manufactured (with a few exceptions). WiseEnergy ranks No. 5 with 1.5 gigawatts and is one of only two ISPs with a gigawatt-scale fleet.

Despite the rise of affiliated service providers as a category, no such vendor made it into the top 5 providers analyzed in the new GTM Research report. Three of them came close: Ingeteam Service, Lightsource RS/Lightsource AM, and EDF ENS/EDF RS all rank in the top 10 providers and manage over 1 gigawatt of plants each.

Moving forward, new construction activity is expected to slow down in the U.K. (2016) and in the U.S. (2017) due to regulatory changes. Service providers (both ISPs and ASPs) are well positioned to gain market share in the years to come as the source of O&M and asset management contracts becomes the installed base of operating assets rather than the pipeline of new projects.

***

For more information about O&M and asset management, including market size and forecasts, activities and strategies, prices, competitive analysis, vendor services, and future outlook for each of the major PV markets, refer to the GTM Research report Megawatt-Scale PV O&M and Asset Management 2015-2020: Services, Markets and Competitors.