The KEMA study, conducted on behalf of the Copper Development Association to define the impact U.S. growth in storage technologies will have on copper, used two scenarios, one in which there is no tax credit incentive to drive the energy storage sector and another in which the tax incentives proposed in last year's U.S. Storage Act (S.1845) become available.

Presently, 90 percent of all storage capacity is in the form either of heat captured secondary to thermal generation (thermal storage) that is used to reduce heating and cooling loads (1,000 megawatts), or renewables generation captured as pumped hydro (115 megawatts) and compressed air energy storage (CAES, 500 megawatts).

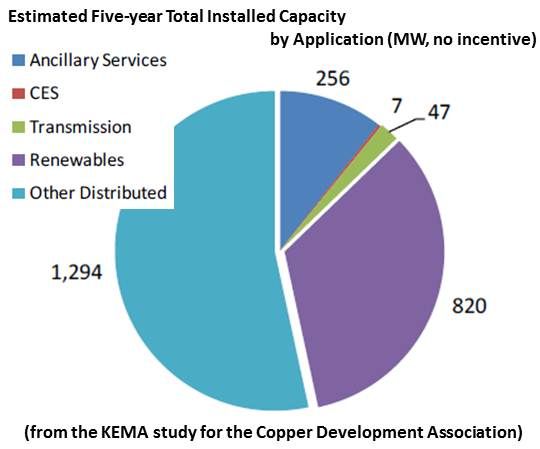

Current investment trends, according to KEMA, indicate the biggest growth will come in distributed storage, ancillary services for the grid and applications that facilitate grid integration of renewables.

Pumped hydro, KEMA found, is not expected to grow significantly through 2016.

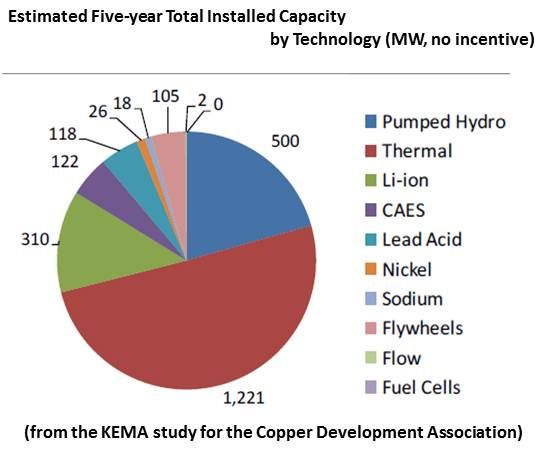

Without a tax incentive driving growth, KEMA foresaw the addition of a total of 630 megawatts of new storage capacity. Thermal storage will grow by 222 megawatts, but battery storage will leap forward, with lithium-ion technology leading (255 megawatts) and lead acid following (72 megawatts). Flywheel technology is expected to grow by 77 megawatts in the next five years, according to KEMA.

The proposed tax incentives, KEMA concluded, would likely increase the energy storage market’s incremental growth by almost 400 percent to 2,300 megawatts. The technologies would also significantly change. Storage for renewables and distributed storage would leap ahead. Community Energy Storage (CES) and storage for the transmission system would begin to play a role and ancillary services, already fundamental to transmission systems, would change little.

Without the tax incentives, which in the current political climate is the most likely foreseeable scenario, KEMA predicted that a little more than half the total U.S. energy storage capacity (1,294 megawatts) would be in distributed storage and 820 megawatts would be used to facilitate the integration of renewables.