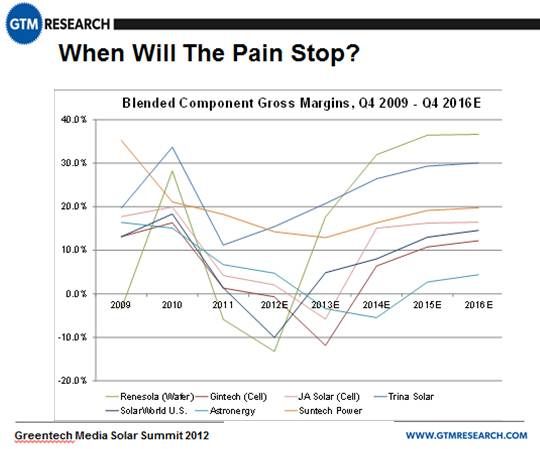

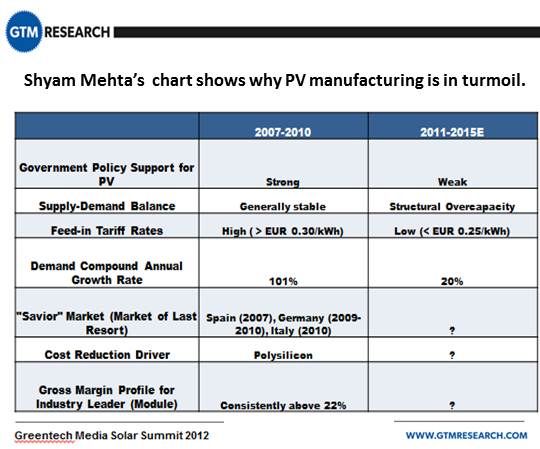

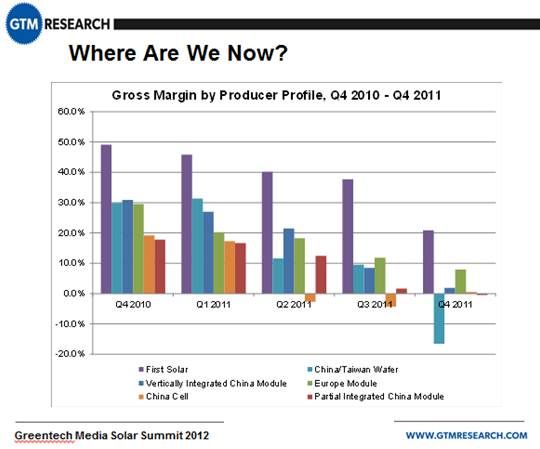

Moderator Shyam Mehta, the GTM Research Senior Solar Analyst, opened by asking how long the current downturn will last and what will catalyze a reversal.

“The oversupply conditions are likely to last for quite a while, and a number of players will disappear from the market before there is more demand,” REC Solar U.S. Managing Director Jan Jacob Boom-Wichers replied. “What could change is that the cost of energy could go up,” he said, “making PV solar a better value proposition.”

“Capacity,” said JA Solar Americas President Jonathan Pickering, “is almost twice the actual demand," adding that it is a “Darwinian world” where “big companies will tend to get stronger.” The current “flight to quality” will accelerate over the next six to twelve months, he predicted. “Strong players will rapidly get stronger. That will accelerate the demise of the weaker companies, which will lead to consolidation.” Recent improving utilization rates, he added, could be a sign of recovery.

“It’s hard to add anything to that,” said Canadian Solar General Manager Alan King. “Our forecast is that somewhere around Q4, we should be back in the black. Right now, pricing is about six months ahead of costs.” Some manufacturers are hurting so badly that they are “selling inventory off for cash at a loss. Those guys will go away. We’ve already seen consolidation. We’ll see companies go out of business. We’ll see acquisitions. The rest of 2012 and part of 2013 will be difficult.”

Turnkey manufacturing system maker Schiller LLC Managing Director Mark C. Willingham said his company’s perspective is unique. “We are sort of the tail of the dog, and the dog is asleep right now, so the tail is not wagging.” But, he added, “we are starting to see a return of opportunity. Right now, people are doing efficiency things, things that can have a very short payback.” And they are, he added, starting to think about “retirement of assets” and “a natural replacement cycle,” which could start “about the end of 2012 or the middle of 2013; it’s not very clear.”

Mehta asked Boom-Wichers to talk about why REC is the last big European manufacturer. “REC is still alive today as a European player because of some insightful decisions made in 2008 to aggressively cut costs by 50 percent.” It invested in its FBR deposition technology, which “allows us to manufacture silicon using 80 percent to 90 percent less energy.” It also made “very tough decisions” to close some Norwegian facilities. “It is a tough battle.”

Mehta asked Pickering about JA Solar’s move from “a pure play in sales of cells to a module manufacturer.”

“It has been dramatic,” Pickering said. “In Q1 2010, we shipped two megawatts of modules, and in Q4 2011, we shipped 180 megawatts. You’ll see that trend continue, to provide the more balanced revenue from cells and modules.” The module business model followed that of the cell business. “Our route to market has been focused again on business-to-business partnerships,” he said. “Our core competency is world-class cell and module production, and we’ll keep that business-to-business approach.”

Is Canadian Solar moving toward development and vertical integration? Mehta asked. “The market is not so large that we can focus on a single segment,” King replied. “I like the idea of virtual vertical integration. We’re not vertically integrated and we don’t want to be, but we’re partnering with best-in-class people … to provide them with diverse products, higher efficiency products, cost-effective products, quality products that will meet the needs of their projects at competitive prices.”

Schiller is “surviving 2012 quite well, with significant wins in ‘11 that will carry us through ’12 and the opening of ’13,” Willingham said. “The question is now, how do you fill that order book six, eight, twelve months out?” Schiller’s answer, he said, is stepping up its strategic partnerships. “The partnership helps defer the costs and the effort results in a better product.” Noting “a lot of upward pressure on the labor cost of crystalline silicon,” Willingham predicted the industry will respond by moving “to even lower cost labor [with] an enormous increase in the level of automation.”

The session ended with a question-and-answer session in which the panel predicted a move to standardization in all segments of manufacturing. It will drive better quality and bring costs down, they agreed, without compromising product differentiation.

End markets, they also agreed, are shifting away from Europe. All are planning to move to new markets in China, India, Japan, the U.S., Latin America, Australia, Southeast Asia and elsewhere. No single business model or single market will dominate. It will require adjusting to local demands and looking at innovative financing. But their modules will work on roofs everywhere and there will be integrators, EPC providers, utility developers and residential installers who want their products.

Customers, they said, will continue to drive efficiency improvements in service to reduced costs and increased yields. There will be no paradigm shifts, but rather, incrementally improving efficiencies at an increasingly rapid pace. “It is the key to survival,” Boom-Wichers said. “All our engineers are working on it at every single stage.”