Space-Time Insight, a startup with utility mapping and visualization software that incorporates real-time data and predictive analytics, has been making significant inroads in North American utility markets, with customers like Southern California Edison, Hydro One, Florida Power & Light, San Diego Gas & Electric and California’s grid operator, California ISO.

This week, the Fremont, Calif.-based startup announced it had landed a $20 million Series C round of venture capital investment, aimed specifically at taking those capabilities to new customers in the transportation and oil and gas industries, as well as new markets in Asia and Europe.

In fact, Space-Time already has some lead customers in both continents, looking at using the startup’s core geographic information systems (GIS) expertise and its more recently developed analytics suite, Steve Ehrlich, senior VP of marketing and product management, said in a Tuesday interview.

It has also identified some “beachhead customers” in the oil, gas and logistics industries, including an unnamed “global delivery services company,” interested in applying its real-time analytics to “save a lot of money and improve their operations,” he said.

“We’re taking the applications we’ve developed around the lines of asset analytics and grid intelligence -- we’ve packaged those up, and we’re now rolling those out to customers across the U.S., as well as Europe and Asia,” he said. “We’re looking at how we can make these solutions repeatable, and as a result, reduce the cost to the customer and the time to market.”

Ehrlich also described in simple terms how the firm intends to apply its expertise to the logistics field, though once again, he declined to cite specific customers.

"You will be able to look at -- not just on a map, but on other interfaces as well -- where vehicles or planes are, and also what's on the vehicles. Is it running at full capacity? Is it on time or late? Is it going the most direct route? Is it the right vehicle for what needs to be shipped?" he said. "These kinds of decisions are hard to make with limited information."

The startup has integrated its utility platform to serve other parties -- its geospatial visualization tool built for Sacramento Municipal Utility District also serves regional emergency responders like firefighters and water management districts, for example. But the move into logistics and resource extraction industries represents a new field, and one that puts it into competition with a whole new set of technology providers.

This week’s investment round included new London-based private equity fund Zouk Capital, along with previous investors Opus Capital Ventures, EnerTech Capital and Novus Energy Partners, and it brings Space-Time’s total investment to date to $45 million, Ehrlich said. Zouk Capital CEO Samer Salty will also join the startup’s board of directors.

Space-Time Insight was named one of GTM Research’s Top 10 Vendors to Watch in Smart Grid for 2013, with GTM analysts noting the company’s successful integration of traditional utility GIS services with next-generation data processing and analytics capabilities. (Greentech Media's Soft Grid 2013 conference on October 1-2 in San Francisco will cover the integration of utility operations and big data advances like these in great detail.)

The startup works with, as well as competes against, traditional utility GIS vendors such as Intergraph and Esri, as well as partnerships like the one between General Electric and Google Maps. But it also incorporates real-time data integration work with systems, including EMC Greenplum and SAP HANA, along with similar big data tools from the likes of Oracle, IBM and OSIsoft.

The goal, Ehrlich said, is to combine locational and time-specific data with a “nodal” approach that links disparate fields of data into specific points of interest to utility operators. That puts the startup’s ambitions beyond the traditional purview of utility GIS, which GTM Research forecasts will account for between a $110 million and $180 million market for U.S. utilities between 2010 and 2015.

In the past few years, Space-Time Insight has also added a set of predictive analytics capabilities, including theft detection and asset management, weather and storm prediction, and renewable energy integration. This places the startup in competition with grid giants such as GE, Siemens, ABB/Ventyx and Schneider Electric/Telvent, as well as with IT contenders such as IBM, Oracle, SAP, SAS, Accenture, Capgemini and Infosys, to name a few.

As for what Space-Time Insight will be providing for its new European and Asian customers, Ehrlich declined to lay out too many specifics, though he noted that one prospective Asian customers was interested in its ability to measure the performance of wind turbines in combination with weather analytics.

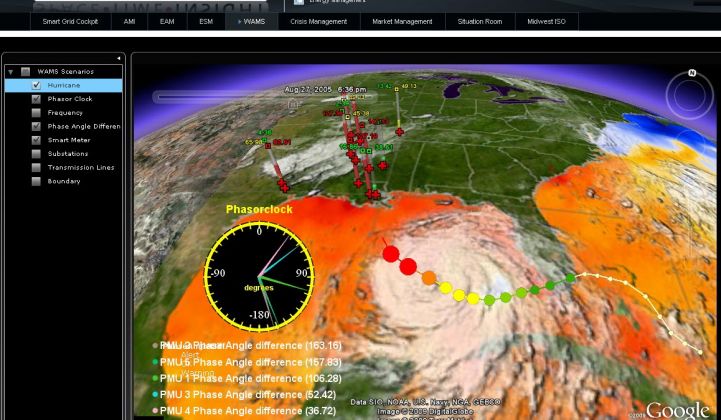

As for the startup's ability to manage super-fast grid data, he pointed to the startup's work on integrating data from phasor measurement units (PMUs), which are collected at rates of 60 times per second, both in demonstration projects [PDF] with the Electric Power Research Institute, and in a soon-to-be-released case study [PDF] involving an unnamed "world-renowned utility" that sustained severe damage during 2005's Hurricane Katrina.

For insight into topics like these and more, sign up for Greentech Media's Soft Grid 2013 conference, which returns for its second year on October 1-2 in San Francisco. Get a taste of what’s to come, as well as the latest updates on market trends and forecasts, with this free GTM Research soft grid market update.

Space-Time Insight and renewables: