Solyndra, apparently still able to pay its lawyers, is suing China's solar manufacturers Suntech, Trina, and Yingli for $1.5 billion.

In a 52-page complaint on behalf of its client, Solyndra, law firm Winston & Strawn is seeking to demonstrate violations of the Sherman antitrust laws in a $1.5 billion lawsuit. (Here's a link to the document.)

Here's some text from the complaint:

This is an action for attempted monopolization, conspiracy, predatory pricing, tortious interference, and price fixing that seeks redress for the anticompetitive acts of an illegal cartel of Chinese solar panel manufacturers who conspired to, and succeeded in, destroying Solyndra, a company that was once named one of the "50 Most Innovative Companies in the World" by the Massachusetts Institute of Technology.

Defendants initially came to the United States to raise money from American investors by selling American Depositary Shares ("ADS") on the New York Stock Exchange. Incredibly, Defendants elected to deploy the capital they raised from Americans to destroy American solar manufacturers, like Solyndra. To achieve this goal, Defendants employed a complex scheme, in collaboration with each other and raw material suppliers and certain lenders, to flood the United States solar market with solar panels at below-cost prices.

What is more, Defendants' plan to dominate the United States solar market was coordinated by Defendants, trade associations, certain government-related commercial entities, such that Defendants conspired to export more than 95 percent of their production and dump their products in the United States and achieve market domination. In fact, Suntech's then-CEO even admitted to the illegal conduct at issue, noting, "Suntech, to build market share, is selling solar panels on the American market for less than the cost of materials, assembly, and shipping."

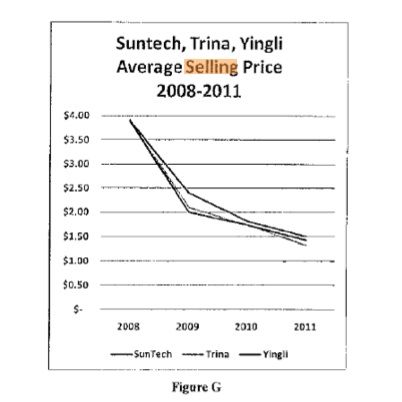

Further to their dumping conspiracy, the three Defendants' prices moved in tandem, falling 75 percent in four years as their massive imports hit the United States market. Consistent with their conspiracy, two Defendants share an address (Yingli and Trina), and the two senior-most executives of Trina and Suntech work together on the board of a Chinese trade association with the stated purpose of "collaboration."

Unfortunately for Solyndra and American consumers, Defendants' plan worked -- Defendants' actions destroyed not only Solyndra, but nearly a dozen other United States solar manufacturers, who have all sought bankruptcy protection.

The complaint goes on to say:

As demonstrated in the chart below, all three Defendants began dumping products inthe United States market at the exact same time and in markedly parallel form. The timing and remarkable similarity of Defendants' pricing behavior completely belies any claim of independent action.

The complaint cites the recent Department of Commerce anti-dumping decision and adds "below-market" interest rate loans from The Export-Import Bank of China and the China Development Back as participants in the conspiracy.

The complaint also lauds the technological achievement of the Solyndra CIGS solar panel design with its lightweight, wind-resistant, non-penetrating architecture. Other CIGS solar companies such as AQT, have gone out of business, or like MiaSolé, HelioVolt, and Ascent, have sold off their assets to Asian conglomerates at deep losses.

The complaint from Solyndra sees a conspiracy "to fix prices at predatory levels."

Trina has responded in a statement, saying it "believes the lawsuit is without merit and will vigorously defend itself against the baseless allegations in the complaint."