Can SoloPower reverse the global downward pricing trend of solar panels and command a higher price for its unique product?

SoloPower's CEO, Tim Harris, claims his firm can extract a premium for its unique flexible panel in places like Korea or Japan -- regions that have high electricity prices and incentives for rooftop solar or building-integrated photovoltaics (BIPV).

How much of a premium?

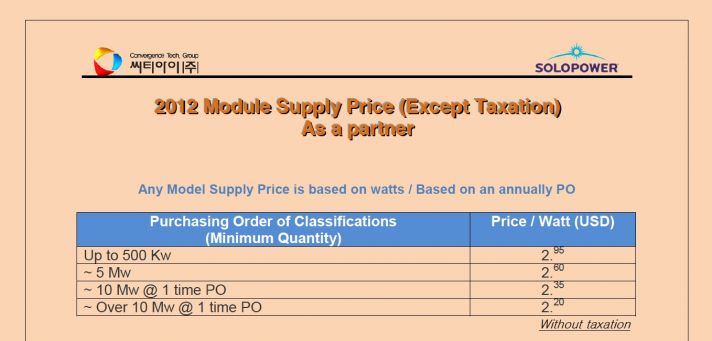

Well, SoloPower's Korean partner CTI is listing prices at $2.20 per watt at 10-megawatt volumes (see image below or PDF here). We'll suggest the disclaimer that these are non-scaled costs, distribution in Korea, and list prices.

But the company still must compete against solar panels from China and the U.S. with costs of $0.70 per watt. And that remains to be seen.

At this point, SoloPower's strategy focuses on Japan, Korea, and Italy -- all strong rooftop markets, where the company can leverage its balance-of-system savings argument.

We reported on SoloPower, its DOE loan guarantee, and its technology risk in an article earlier this week. The company just had the grand opening for its 400-megawatt manufacturing facility in Portland, Oregon. The christening of the factory is a crucial step in SoloPower being able to access some of the $197 million DOE loan guarantee.

SoloPower is going after the same rooftop market as Ascent Solar, Global Solar, and the now-bankrupt ECD, except it is doing it with a more efficient product. The value proposition for flexible modules from SoloPower is that there is less hardware required to install the modules and the installation is easier and less expensive. However, this thesis has yet to be proven in volume and scale. The other alleged advantage of flexible CIGS solar panels is that their lightweight nature opens up "value-engineered" rooftops that could not support the weight of conventional crystalline solar panels. This thesis also remains to be proven.

The question remains as to whether SoloPower can prove the commercial business case for its flexible CIGS solar panels and improve the optics of the beleaguered DOE loan guarantee program. The price of solar panels has plunged and manufacturers of solar panels are dropping like flies due to pricing pressure from Chinese vendors and, to a lesser extent, First Solar of the U.S.

CEO Harris has claimed that his new factory is booked, but the real pipeline is difficult to assess.

Solar panels manufactured in the CIGS thin film materials system have long held the promise of high efficiency at low costs but have yet to deliver -- despite billions of dollars invested by venture capital investors. Solyndra is the most prominent failure, but other CIGS companies like AQT have faltered as well. CIGS firms HelioVolt and Ascent Solar gave over their firms to Asian conglomerate SK Group and TFG Radiant Group, respectively. Nanosolar has shipped in the neighborhood of ten megawatts of solar panels over the course of ten years and three CEOs. MiaSolé, despite strong technical achievements, has been forced to lay off a large fraction of its employees as its management looks for an acquirer or partner. Q-Cells sold its CIGS effort, Solibro, to Chinese power firm Hanergy.

SoloPower has raised more than $200 million from Hudson Clean Energy Partners, Crosslink Capital, Convexa, and Firsthand Capital. The firm has also won significant tax credits and incentives from state government.