Raising venture capital is never easy.

But imagine raising money for a solar startup -- given the current market and past solar VC transgressions, not to mention the flinchiness of the remaining cleantech VCs.

Now imagine raising funding for a solar manufacturing startup amidst a bloodied and rationalizing overcapacity market. (Certainly, a downstream solar company has a better chance of gaining funding these days.)

Despite these headwinds, Solexel, an advanced silicon solar cell startup, just raised $14.7 million from undisclosed investors, according to an SEC document caught by Bloomberg. It was the third close of the company's now $51.3 million C Round according to the firm.

Previous investors include SunPower, KPCB, Technology Partners, DAG Ventures, Gentry Ventures, Northgate Capital, GSV Capital, Oak Hill, Ecofin, and Spirox. The firm's Board of Directors are Mehrdad Moslehi and Michael Wingert of Solexel as well as John Denniston of KP, Ira Ehrenpreis of Technology Partners , Doug Rose of SunPower, Les Vadasz of Intel, and Greg Williams of DAG Ventures. Gentry Securities has been enlisted as a placement agent in this and previous fundraising efforts. Gentry's investments include Fisker, Bloom Energy, Amyris, Agrivida, and Glori Energy -- all Kleiner Perkins portfolio companies.

The startup's total VC funding to date is north of $150 million. Solexel has also scored $17 million in DOE and NSF grants.

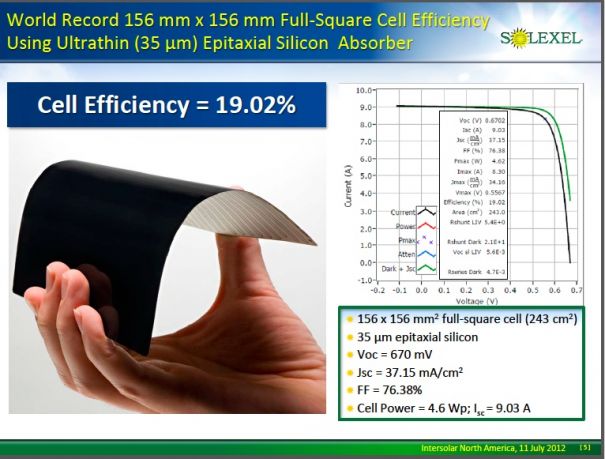

Mark Kerstens, Solexel’s Chief Sales & Marketing Officer, as well as acting CFO, informed GTM that there were new investors in this tranche, that the now 45-employee startup hit an NREL-certified cell efficiency of 21.2 percent, and the firm is still planning manufacturing scale-up in Malaysia.

Last year's investment from SunPower provides at least one backer with real knowledge of solar technology -- and one that shares some common technological traits with Solexel: high-efficiency solar cell performance and a back-contact cell architecture. Surviving due-diligence with SunPower speaks well of the startup's technology and path.

Solexel had some layoffs, like most every solar company, earlier this year.

GTM spoke with Solexel last year when the firm unstealthed. Solexel hopes to bring 20-percent-efficient photovoltaic modules at a cost of $0.42 per watt to market in 2014.

In contrast, First Solar, the thin-film solar leader, recently announced that its manufacturing cost will be $0.63 to $0.66 per watt in 2013 and will plunge to $0.40 per watt by 2017. First Solar has a real history of execution on its promises. (GTM Research Senior Analyst Shyam Mehta looks at the potential of 36 cents per watt silicon-based modules here.)

As we reported earlier, Solexel looks to partner in Malaysia to build the cells.

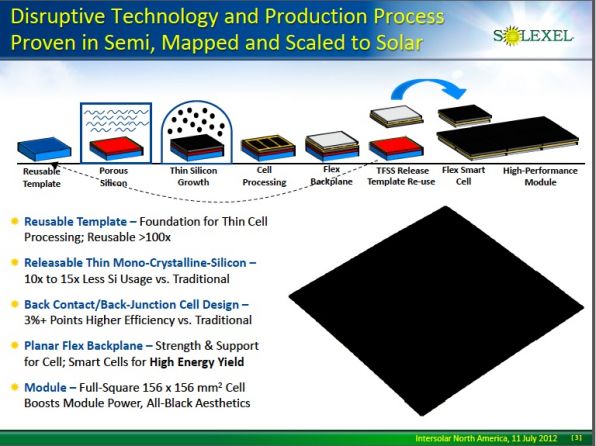

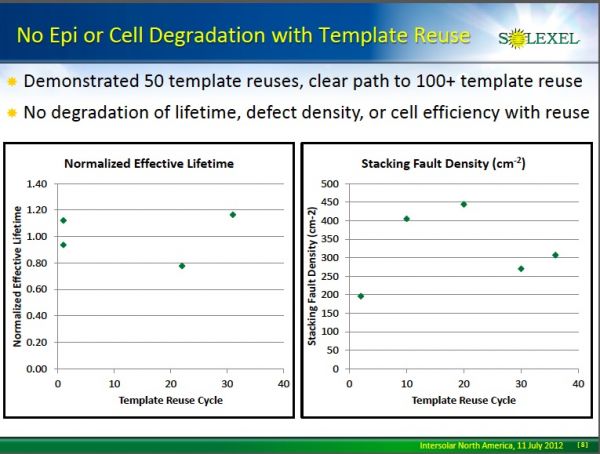

Solexel is hoping to mass produce 35-micron-thick, high-performance, low-cost monocrystalline solar cells using a lift-off technology based on a reusable template and a porous silicon substrate. According to the company's claims, the process ensures that the thin silicon is supported during handling and processing, while the back-contact, p-type cell dispenses with the need for expensive silver, using aluminum instead. The process uses no wet steps, according to the CEO, Michael Wingert, and employs CVD on trichlorosilane gas at atmospheric pressure with silicon deposited at a rate of 2.5 microns per minute. The cell uses almost ten times less silicon than conventional c-Si cells, at about 0.5 grams per watt.

Mehrdad Moslehi, the CTO and founder of the firm, told GTM that at 156mm x 156mm, Solexel produces the largest back-contact cell in the industry. The firm will use a contract manufacturer to construct the modules, which will be available in frameless as well as framed versions. The firm claims that its cells don't need the support of glass, and it envisions flexible, non-glass sandwich panels in future product offerings.

A resin and fiber carrier, akin to circuit board material, supports the thin cell and allows a switch to be added for module shading tolerance, possibly creating the space for some additional features in future generations.

Solexel, by virtue of its high efficiency, is looking to appeal to the residential market initially and then to subsequently move into commercial rooftops and ground-mount applications.

The firm has claimed to have "eight top-tier strategic customers (leading global developers and distributors)," but the term "customer" typically implies money changing hands for production-level products, so Solexel is getting a bit ahead of itself with that terminology. The firm also claims that its "production volume [is] fully subscribed by strategic customers."

Solexel still has a long way to go in proving its low costs and high efficiencies at volume in today's oversupplied market. If the firm can keep its promises, its cost and performance will make it a market leader. No startup has yet to execute on that promise at commercial scale.

Other firms in the thin silicon business include 1366 Technologies with its "direct wafer" technology using molten silicon directly converted into wafers, and Crystal Solar using a vapor deposition process for making thin crystalline silicon wafers.