Solar module electronics leader (and home energy and storage aspirant) SolarEdge continues to put up strong quarterly and annual numbers, despite a general sense of a slowdown in the U.S. residential solar space.

Current fiscal quarter

-

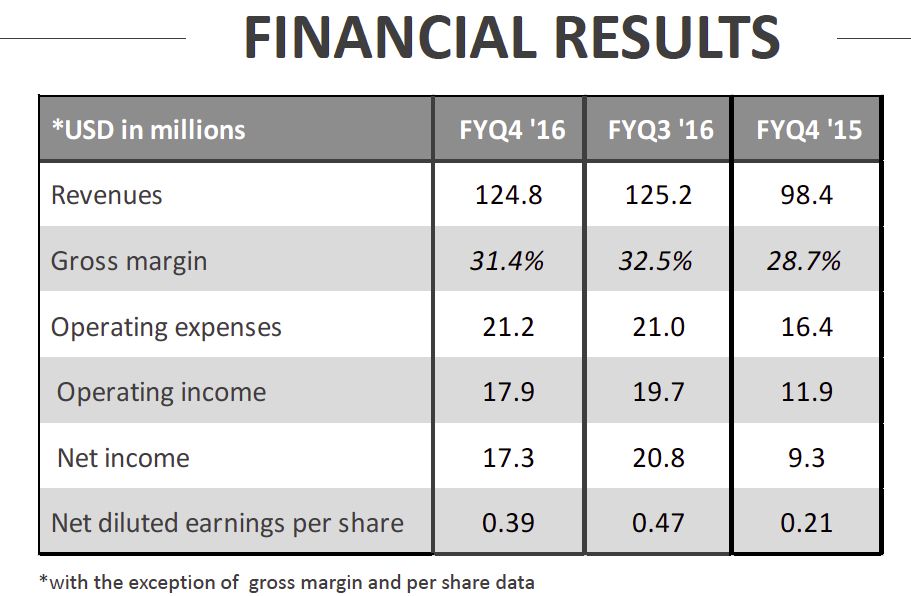

SolarEdge revealed revenues at the low end of guidance and slightly below consensus at $124.8 million for fiscal Q4 2016, about flat with the previous quarter, and a 26.8 percent jump from fiscal Q4 2015

-

Gross margin was 31.4 percent for fiscal Q4 2016, down a bit from the previous quarter but still beating Street expectations

-

GAAP net income was $17.3 million for fiscal Q4 2016, down from $20.8 million in the previous quarter

-

Next-generation inverter technology production ramp is starting

-

427 megawatts (AC) of inverters shipped in fiscal Q4 2016

Fiscal year 2016

-

Revenues for fiscal 2016 were $489.8 million, a 50.7 percent jump from fiscal year 2015

-

Gross margin of 31 percent for fiscal year 2016, up strongly from 25.2 percent in fiscal year 2015

-

Net income was $76.6 million for fiscal year 2016 versus $21.1 million in fiscal year 2015

-

1,615 megawatts (AC) shipped in fiscal year 2016, comprising 1,487,000 optimizers and 58,000 inverters

- Revenues for fiscal 2016 were $489.8 million, a 50.7 percent jump from fiscal year 2015

- Gross margin of 31 percent for fiscal year 2016, up strongly from 25.2 percent in fiscal year 2015

- Net income was $76.6 million for fiscal year 2016 versus $21.1 million in fiscal year 2015

- 1,615 megawatts (AC) shipped in fiscal year 2016, comprising 1,487,000 optimizers and 58,000 inverters

Guy Sella, CEO of SolarEdge, said that he is "seeing less price pressure," as ASP only fell 1 cent per watt from 30 cents per watt last quarter to 29 cents per watt this quarter. Sella said the company had planned for this rate of price erosion and "did not reduce prices to gain share."

The company noted that demand in Germany, the Netherlands and Japan was higher than expected and made up for some of the U.S. shortfalls.

Guidance for next quarter

-

Revenue is anticipated to be within the range of $130 million to $139 million -- in line with Street estimates of $137 million

-

Gross margin is anticipated to be within the range of 30 percent to 32 percent -- in line with Street estimates of 30.7 percent

Energy storage system growth rates?

Sella said that he saw a "temporary" slowdown in U.S. residential solar that was impacting the large installers.

The Tesla-SolarCity merger and the potential for Tesla to develop its own inverters did not present a near-term threat to SolarEdge, according to the CEO. SolarCity currently accounts for more than 10 percent of SolarEdge's business.

Sella also observed that Tesla's Powerwall energy storage production ramp will be much slower than expected. The CEO spoke of a few thousand systems per quarter rather than some of the loftier numbers floated for Powerwall demand.

According to GTM Research's U.S. PV Leaderboard, module-level power electronics -- including microinverters and DC optimizers -- have held a steady 55 percent market share so far in 2016. MJ Shiao, GTM Research's solar head, notes, "Adoption of NEC 2014 in California and installers getting ahead of proposed NEC 2017 rules around rapid shutdown will decrease the price gap between traditional string inverters and module-level power electronics."

“We maintain our profitability and continue to generate cash flow from our operations, quarter over quarter. While this quarter is characterized by a general slowdown in the residential U.S market, we were able to compensate with increased sales in other geographic regions in which we sell,” said Sella, in a release. “We remain on target with our plans to grow our business and increase market share without sacrificing gross margins and profitability.”

As of June 30, 2016, SolarEdge did not have any debt and held $186.6 million in cash or cash equivalents in the bank.