The solar energy industry was still bemoaning the high upfront costs of rooftop solar installations when SolarCity helped pioneer the solar lease, which has virtually eliminated that hurdle. Now, with financial backing from Admirals Bank, SolarCity has set out to do the same thing for the home energy efficiency upgrade business.

“By making energy-saving measures more accessible and affordable,” said SolarCity CEO Lyndon Rive, “we’re doing for energy efficiency what we’ve done for solar power.”

Taking advantage of the new Boston-based Admirals Bank backing, SolarCity is expanding its energy efficiency service, which it began offering in addition to rooftop solar installations in 2010, to customers in Connecticut, Maryland, Massachusetts, New Jersey, New York and Washington, D.C. The company already has 5,000-plus efficiency projects completed or underway in Arizona, California, Colorado, Oregon and Texas.

“We’re trying to bring our customers a full range of clean, affordable alternatives to utility power,” explained SolarCity spokesperson Jonathan Bass. Electricity generated by fossil fuels for a single home, a federal study found, puts more carbon dioxide into the air than two average cars.

Admirals Bank, a federal savings bank with a history as a home improvement lender, will make available between $2,500 and $15,000 per customer, Bass said. That should readily meet the cost of the typical upgrade which, according to SolarCity Manager of Energy Efficiency Services Levi Blankenship, is between $4,000 and $12,000. That investment, Blankenship added, typically reduces a homeowner’s combined natural gas and electricity costs by 20 percent to 50 percent.

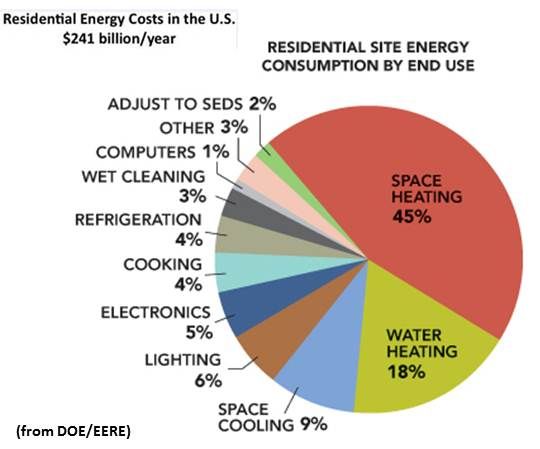

A Department of Energy (DOE) study found that the U.S. spends $241 billion yearly on home energy bills. That’s one in five of the dollars the U.S. spends on energy. It is an average of $1,900 per family.

“We saw with solar that if we reduce or eliminate the upfront costs,” Bass explained, “it makes it available to a new set of customers.” The company’s expectation is that the same thing will happen with energy efficiency.

The SolarCity process begins, Blankenship said, with an on-site home energy evaluation that diagnoses the cause of high utility bills and energy losses. Proprietary SolarCity software does four-billion-plus calculations for each home evaluation and produces a report across nine efficiency categories. SolarCity uses the report to prioritize recommended home improvement options based on energy and cost savings.

“Typically,” Blankenship said. “There two categories of improvements.” Over half a building’s energy consumption is for “space conditioning,” he explained, “either heating or cooling. So the building shell, or envelope, is a huge component.”

A SolarCity 250-home analysis, incorporating DOE statistics, found that about $40 of every $100 spent on heating and cooling is lost to duct and air leakage. In their evaluation, SolarCity people identify the amount of “re-insulation” and “air sealing” needed “to retain heat in the winter and keep it out in the summer so that the furnace and air conditioner do not need to run as often.”

Once they are sure the building shell is efficient, Blankenship said, “We turn our attention to the mechanical equipment itself. The furnace, the air conditioner, the heat pump, the water heater, the equipment that provides conditioned air. We want to be sure it is efficient and sized for the house.”

It is “the granularity of the software evaluation,” Blankenship added, “that makes it possible for us to eliminate client and confusion concerns that may have slowed adoption in the past. The software, coupled with the loans that will make it possible to eliminate upfront costs, is really exciting.”

SolarCity’s efficiency financing already supports a range of local energy efficiency loan and rebate programs. The Admirals Bank-backed Home Energy Loan financing option is expected to further reduce and/or eliminate the upfront cost of energy efficiency upgrades.

“We will work with programs that are out there in our service territories and direct our customers to the best option for them,” Bass said. “But in places where there is no efficiency program, we wanted to give customers the option of evaluations and upgrades.”

SolarCity and Admirals Bank intend to make the loan process as convenient and accessible for customers as possible. Eligible customers will be able to choose between a one-year “Save Now, Pay Later” option and 3-year or 10-year “Pay As You Go” options. The one-year option can be interest-free.

“Commonly, there are utility, county, and/or state rebate programs, but the rebates don’t get paid immediately. There can be a several month lag.” The one-year option gives homeowners time to collect and use the rebates and pay off the balance without incurring interest charges. “If the loan is repaid within one year,” Bass explained, “there is no interest.”

“And they start saving energy and money right way,” Blankenship added.