Tesla’s solar roof and Powerwall 2.0 announcements show that new products are critical to raising the profile of clean energy.

But recently, there’s been a shift in focus away from individual technologies and toward a broader range of products and services that can serve many functions on the electric grid. Ultimately, Tesla and SolarCity want their individual technologies to meet this need.

Many companies are now focused on designing the grid to better utilize distributed energy assets, said Ryan Hanley, vice-president of grid solutions at SolarCity, speaking on a panel at SXSW Eco last month. He presented along with representatives from Southern California Edison (SCE) and the Electric Power Research Institute (EPRI).

“As 'SolarCity,' it's common to think of us as a solar company,” said Hanley. “I don't think we're a solar company; I think we're a platform company, where any asset can connect into it.”

“We've been working in the background for years on developing that actual software platform, as well as all of the other operational things you need to do to execute against that,” he continued. “To get the most of the value of the platform is to feed it assets.”

Hanley refused to comment in depth on the pending Tesla-SolarCity merger when asked, but he did say that if such an acquisition were approved, he sees it as a way to get more assets onto SolarCity’s platform. Tesla brings electric vehicles and energy storage to the platform, and hopefully other types of assets in future, he said.

Hanley's comments could represent a strategy shift for the leading solar installer with the Tesla acquisition on the horizon. Tesla CEO Elon Musk has also taken a noticeably grid-friendly tone in recent public comments. SolarCity is scheduled to hold an online press conference to discuss the acquisition in more detail today at 5:00 p.m. Eastern Time (which ultimately offered more insight on SolarCity's financial performance).

Though it may not be widely known, SolarCity has already been thinking a lot about how to design the grid to utilize distributed energy resources (DERs), and not just for the sake of putting more DERs on the grid, said Hanley. “The grid -- although...probably the most complex machine in the world -- can be designed, we think, even better,” he said.

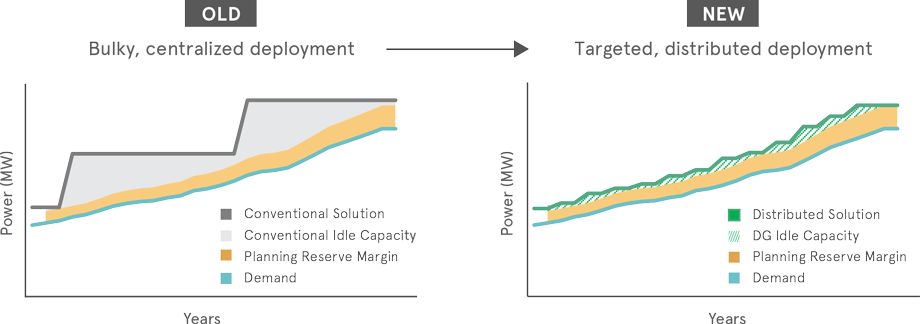

Electric grids are built to meet peak demand that only occurs for a handful of hours each year, which means there’s an enormous amount of underutilization and unnecessary expense. DERs provide an opportunity to fundamentally rethink how the grid is designed. This is where a lot of utilities become hesitant. Rooftop solar in particular has changed where and how electricity is produced, creating issues such as the "duck curve" in areas of high solar penetration.

So what exactly does this ecosystem look like? How will it benefit the grid? And do other energy stakeholders share this view?

"An under-spoken milestone"

One important thing to note, at least according to Hanley, is that the solar industry is changing.

“Today, rooftop solar is, by all means, what has led a lot of the customer engagement [on DERs]. I would describe that more as a construction business than an interactive asset. Even our business has, in the past, been a construction business, where we're putting a piece of hardware on the roof and then, in general, we walk away,” he said. “This next wave of deployments [will entail] making all of those solar assets controllable.”

Hanley pointed to SolarCity’s bundled product offering in Hawaii as an example of where the DER ecosystem is headed. In February, SolarCity launched Smart Energy Home, a package that includes rooftop solar, a smart inverter, battery storage, a controllable Nest thermostat, a smart electric water heater, and controllable switches to manage these technologies and maximize self-consumption.

These are not new assets, said Hanley. “But the fact that we can bundle those together and actually sell a product that saves the customer money, provides the utility service, and also makes us a profit is a big milestone -- maybe an under-spoken milestone of where we're going.”

Similar to SolarCity, competitor Sunrun is offering a solar-plus-storage system with a smart inverter in Hawaii, the Sunrun BrightBox, that’s designed to maximize customer self-consumption. Startups like SolPad are also spearheading new ways to integrate and control DERs. And a myriad of other companies are working on individual elements of the distributed home.

But while the concept of a DER ecosystem is crystallizing, it’s still in the early days of deployment. Hawaii is the only state where SolarCity currently offers its smart home technology suite. And while new technology packages are becoming available, only a handful of utilities are working with vendors to test the integration of DERs for both consumer and grid benefits, and those projects are still at the pilot level.

Ronald Schoff, senior program manager of technology innovation at EPRI, pointed out that disruptive technologies are already here. What's still unknown is how they can be used to benefit the entire power system.

“When we have strategic conversations with utilities, we ask what are the breakthroughs that are going to change the industry going forward, over the next decade or two decades. Most of them say, ‘You're looking at it. They already exist,’” he said. “The question is how are those technologies going to perform. What kind of economic benefit are they going to provide? How do you make sure that the market supports that?”

In some cases, there is still more technical groundwork to be done, Schoff said, such as establishing standards for smart inverters. Next, there needs to be a lot of field testing to find out how different technologies perform in different settings, and troubleshoot issues like communication lags.

“You're only going to find what your key challenges are by putting the equipment out in the field and breaking it, basically, to see how it functions,” said Schoff. “Then, when you find the weak point, innovate, fix it.”

Fostering competition

Some utilities are starting to test how an ecosystem of DERs can serve the grid. SCE is among them with its Preferred Resources Pilot (PRP), a program that was launched in response to the closure of the San Onofre nuclear power plant. Rather than go ahead and build a natural-gas power plant, SCE launched the PRP to see how DERs might solve its generation needs.

A lot of learning needs to happen before DERs can be considered the solution, said Erik Takayesu, director of electric system planning and grid modernization at SCE. The first step is to understand the demand profile the utility is trying to address, which lays the foundation for the portfolio of DERs the utility can acquire. The next step is to contract for resources -- a process SCE already has underway. Then, once the DER projects are selected, the utility has to figure out how to monitor their performance to ensure they’re matching up to present and future load growth.

“The objective is, in essence, to increase the efficiency curve…by filling the gap with distributed resources instead of a single, large capacity solution, like a gas-fired generator,” said Takayesu.

Other utilities are also looking at how DERs can meet grid needs -- not only for generation, but also for services like power quality, voltage control and frequency support. Not all programs have been structured the same way, however, which has been a source of tension.

Source: SolarCity

For instance, Arizona Public Service (APS) is examining how DERs can serve the grid through two pilot programs: the Solar Partner Program and the Solar Innovation Study. The main difference in the APS case, compared to pilots underway in California, is that the utility decided to own the DERs rather than contract for third-party-owned resources.

SolarCity's Hanley said the program differences come down to the vertically integrated control model versus the ecosystem model, where the utility still has visibility and control of the assets on its system, but works with a wide array of technology providers. The vertically integrated model doesn’t actually provide more control, said Hanley; it’s just a different -- arguably less affordable -- business model.

The fact that APS bought, installed and owns the resources used in its pilot programs doesn’t affect the technical insights the utility will gain, he said. “That being said, it could have, from our perspective, been done a lot cheaper by using assets that are already in the ground provided by third parties,” said Hanley.

In the Arizona case, SolarCity already had smart inverters installed in the field that could have been brought into a DER ecosystem model and tested at a low marginal cost. The utility would also have benefited from third-party expertise. SolarCity is already running similar pilot with San Diego Gas & Electric, and could have shared lessons learned with APS.

“We think there's a long-term advantage to innovation if you get more parties involved,” said Hanley. “This drives into the idea that an ecosystem spurs on competition. Competition, we think, is a good thing.”

Competition spurs a larger debate around the utility business model and the concept of infrastructure-as-a-service, Hanley added. There’s an inherent challenge in the traditional utility business model, in that utilities make a profit off of the infrastructure they own and install. SolarCity believes that utilities should be allowed to rate-base services provided by DERs -- a concept that has gained traction in California and New York.

Predictability and visibility

SCE's Takayesu said he thinks the tension utilities feel when it comes to DERs -- whether the utility controls them directly or via a third party -- is mostly related to predictability. Utilities want to know that these resources will be available when needed, particularly intermittent resources like solar. They want to know that DERs will be dependable and durable.

Understanding these attributes has helped inform SCE on the types of DERs it wants to acquire, as well as the technologies, the data analytics, and the communication systems the utility needs to build out, Takayesu said. SCE recently filed a rate case seeking $2.1 billion for grid modernization efforts, including communications and automation equipment to operate the distributed grid.

Right now, utilities have very little visibility into the distribution system, said Schoff. The utility may not know if a customer buys a smart thermostat and an electric vehicle, let alone have the ability to control those resources to benefit the grid.

“We're in a...very early, nascent stage here of understanding the functionality of those [DER] technologies and the value that they might provide in isolation,” he said. “If we're going to face the future problem of how to get [DER] technologies more broadly into the system and how to manage a fleet of them -- that's all enabled by the innovations in communications and electronics.”

So the grid needs to evolve at the same time as DER products come on-line. But in some ways, deploying those technical solutions is the easy part, said Schoff.

“What we lack at the moment is a really clear understanding of the value of that future vision,” he said. “If we can't understand the value, then you can't necessarily justify the investment to force it forward. But that part of it isn't exactly my role.”

Put a value on it

A SolarCity white paper released earlier this year determined that DERs would provide a $1.4 billion net societal impact in California over the next five years, if the state were to fully account for all costs and benefits.

“Doing cost-benefit analyses is probably the worst part of all of our jobs, but they're important because they articulate a vision about how assets could be utilized,” said Hanley, who authored the report.

“This conversation is really about saying there's a lot more value [to DERs]. There are things like dynamic capacity at the system level, transmission level, distribution, voltage support, maybe some resiliency in the future, if you add a battery,” he said. “Those cost-benefit analyses start to develop a framework and, in many ways, add the positive pressure on the technical team by saying, ‘Some economists said that this is real. Can we show that it actually works?’”

Another core component of the $1.4 billion number is multi-use, Hanley said. Specifically, more and more batteries are coming onto the grid and are capable of performing multiple tasks. SolarCity believes batteries should be used for multiple purposes throughout the year in order to provide the most value. So a battery could be sold as a backup power source, but also be configured to make money in wholesale markets.

“That's a departure from the way that planning was done. In the past, you put an asset in the ground and had it do one thing,” he said.

On Friday, Tesla unveiled the Powerwall 2.0 -- the company’s second-generation home battery. Powerwall 2.0 has 13.5 kilowatt-hours of usable capacity, which is more than twice the capacity of the smaller first-generation version with 6.4 kilowatt-hours of capacity. The new battery also provides 5 kilowatts of continuous power and 7 kilowatts at peak at a price of $5,500, including a built-in inverter. The webpage for Powerwall 2.0 lists several supported applications: solar self-consumption, time-of-use load shifting, backup power and off-grid functionality.

The introduction of Powerwall 2.0 comes after Tesla quietly discontinued its 10-kilowatt-hour home battery -- designed primarily for backup power -- earlier this year. At the time, Tesla said it was seeing greater demand for its 6.4-kilowatt-hour battery that supports daily-use applications like solar self-consumption. Powerwall 2.0 presumably replaces the 6.4-kilowatt-hour option, which is no longer featured on Tesla’s website. In the spirit of multi-use, the next-generation battery provides more energy and greater functionality than previous versions, at a compelling price.

While building a stronger value case for a DER technology improves the economics and grid services, it can make the story more complex for customers. The idea of controllability or of aggregating home batteries to participate in a wholesale market may be difficult for customers to grasp. Communicating with customers is an underappreciated part of the DER story, said Hanley.

“In general, our approach in the near term is, don't expose the complexity,” said Hanley. “We think the simplest thing we can tell them is that [they're] saving money, full stop.”

Getting from A to B

Mapping out the costs and benefits of DER technologies given the pace of technology change is really complicated to do, said Takayesu.

“What would the cost-benefit look like for the internet before it was developed? I have no idea how one would actually do that,” he said. “A lot of what we talk about here [with DERs] is kind of visionary stuff about where we want to go. We see the technologies in front of us today and we want to push those into a different place so they can have an overarching benefit to our customers.”

“The way we look at it at Southern California Edison, is do we at least understand what the benefits are to get from point A to point B? Is there a reliability benefit? Is there a safety benefit? Are there environmental benefits? Can we enable customers to do what they want to do and foster more technology innovation?” said Takayesu. “To us, that's the starting point. Then, hopefully, as we go forward, we can get better clarity on where the cost-benefit is in certain instances. But we have to begin somewhere.”

“I don't envy policymakers,” Schoff added. “It's got to be a fairly challenging thing. How do you look at a future that has an entirely different resource mix that is decarbonized and decentralized [and] includes all of these DERs and microgrids? [...] How do you get from here to there with some sort of comprehensive policy that is adaptable and flexible enough to change as the values change along the way?”

In some utility territories, residential time-of-use rates are considered to be a good intermediary solution to the DER cost-benefit debate. Hanley said that SolarCity “enthusiastically” supports the evolution to time-dependent rates. “Everything I said before about a flexible grid that is dynamic and how utilization is the vision -- you can't do that if customers aren't responding and their assets aren't molding to the needs of the grid,” he said.

“If we're trying to sell more than just solar, we're trying to sell things like smart thermostats and batteries, those things aren't necessary if you have a flat rate that doesn’t ever move,” Hanley said.

Rolling out new rates in an effective manner is the challenge, Hanley added. Introducing time-of-use rates too quickly could disrupt the DER market, there’s also a risk of creating equity issues for customers that are unable to respond. It’s important to roll out new rates over time so there’s less shock, he said. Then, as the home energy market catches up, “you can do much more dynamic rates.”

Takayesu noted that time-of-use rates, which will be mandatory for all residential customers in California starting in 2019, are an effective way to incent different behaviors and make the grid more efficient overall. But in a recent interview, Takayesu’s colleague Caroline Choi, SCE’s vice president of regulatory affairs, noted that time-of-use rates don’t solve all of the grid issues DERs create.

Innovation is still key

At SXSW Eco, the three speakers highlighted that innovation continues to be key in the transition to a decarbonized, decentralized electric grid.

EPRI is focused on “the nuts-and-bolts work to ensure that that transition is smooth,” Schoff said, addressing any entrepreneurs in the room. “For us, technology innovation is a key. That's my role -- finding those solutions. [...] If you have ideas, bring them.”

Hanley said there is still a lot of room for innovation within the home. SolarCity and other established companies are working on aggregating a portfolio of assets and working with utilities to control them. Then there’s the level of home control and algorithms that can control these assets. “That’s an area where a lot of innovation could come from,” he said.

Data collection and management is another area that’s ripe for new players, said Hanley, and it’s linked directly to policy questions on the value of distributed energy.

“One of the challenges that we have in the energy industry that's unique from other industries is there's asymmetric information,” he said. “You have a monopoly that has all the data, and the innovators in the ecosystem don't have access to that, and they're not able to innovate at the same level that you could in some other high-tech industries, for example.”

SolarCity works hard to access data for policy discussions, to run different scenarios about what renewable energy penetration, and to create great products. As utilities like SCE invest in grid upgrades like sensors and communications technologies, there will be even more data to mine, which presents a huge opportunity.

“If I had one piece of unsolicited advice or guidance for folks that are thinking about startups, I’d say there is a lot of what we do and what Tesla does that has a barrier to entry. There are high capital expenditures that are hard to replicate. One thing that has zero cost of entry is data analytics,” said Hanley. “Every member of my team has Google alerts on when a new data set comes up on things like EIA or when data comes in [from] proceedings in California. When that data comes out, you guys can crunch that data just as much as we can. There are both really good policy insights coming out of that, but also business ideas and algorithms. And you don't need capex to do that.”

While there’s more work to be done, the panelists held a common view for how DERs could better integrate with the existing electric grid. There are real structural limitations to be overcome if DERs are to integrate at scale, as assets to both customers and the electric grid. Creating a shared vision among stakeholders is the first step in overcoming them, said Takayesu.

“I do believe that there's a sense of urgency around having a common vision as to what the grid of the future needs to look like and moving in that direction quickly, so we don't use that as a barrier for more penetration,” he said.