With intensifying competition in the inverter sector, companies are going to new lengths to guarantee performance.

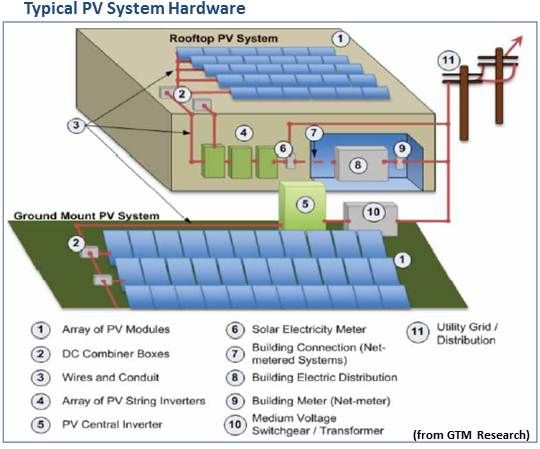

The inverter is the electronic device that transforms solar panels’ direct current (DC) electricity into alternating current (AC) for interconnection to the grid. It can constitute 5 percent of solar system cost, but because it may last less than half a solar panel’s life, its reliability can compromise a project’s bankability.

To prove the Advanced Energy (AE) inverter will meet company quality claims, AE Marketing VP Mike Dooley said, “We are willing to stand up for it. We will guarantee inverter uptime to a customer and we stand behind that with our financial backing.”

AE has been in power electronics technology for three decades and moved into solar in the mid-2000s, when “a very small industry,” Dooley remembered, started growing “with an 80 percent compounded annual growth.” Because it had the core expertise the rapidly growing sector needed, Dooley said, AE saw “a high growth opportunity.”

Despite recession, trade wars and waning federal and state incentives, the solar market still has, Dooley said, “a 30 percent compounded annual growth rate. There are few markets that size and growing that fast.” But today’s market, he added, requires “moving resources to where there is high growth potential."

“There are perhaps a dozen major players,” Dooley said, “the largest being SMA, a German company. It had the largest share, about 40 percent of the worldwide market, in 2010. Probably Power-One would be second.” [Note: Dooley later noted SMA's market share had fallen to 33 percent in 2011 as international competition tightened.]

AE, Dooley said, “is primarily focused on the North American market in the commercial and utility space, where we are at around a 30 percent market share.” In Q2 2012, AE’s solar division sales, largely from utility-scale deals in North America, were $50.8 million, a 12 percent jump from $45.4 million in Q1 and 24 percent greater than Q2 2011’s $40.8 million.

“We have hit our targets over the last two quarters,” Dooley said. “We specialize in the commercial and utility space and work closely with developers and EPCs,” Dooley explained. “We have pretty strong relationships with all the major EPCs and manufacturers and developers -- firms like Recurrent and Swinterton.”

AE’s twelve generic inverters, Dooley said, can service solar in varying system configurations from residential rooftops to utility-scale installations. “There are a variety of design choices,” he explained, “and every design is unique.”

To maintain its market position, AE has added operations and maintenance (O&M) services for its utility-scale customers and offers “a variety of levels of service, from standard O&M work to the full guaranteed-uptime level, where we will maintain not just the inverters but the entire site, and through a contract, we guarantee uptime.”

AE guarantees “98 percent or above uptime, depending on the contract,” Dooley said. “Ultimately, it is a financial commitment from Advanced Energy that we stand behind our product and its ability to deliver energy. Inverter sales are still the bulk of our business but we have hundreds of megawatts under O&M, so we are a significant player in that market, too.”

“As solar implementation slowly moves from the technologically savvy and cutting-edge end-user to those who are looking at solar more as a financial investment,” GTM Research reported in its most recent analysis of the sector, “PV developers will be looking for inverter companies to guarantee the uptime and availability of the inverter.”

And, GTM Research added, companies like AE have begun offering an “insurance service” promising “to compensate the developer for estimated lost production due to inverter downtime beyond a pre-agreed level.” Uptime guarantees like AE's “represent a new level of O&M support,” GTM Research noted, and “can be a huge selling point.”

AE’s “design experience, built over many years and hundreds of megawatts,” Dooley added, “can help customers make inverter and installation design choices that maximize the return and the overall reliability of the system.”

When an event causes a voltage drop on a transmission system, Dooley explained, the solar system’s inverter would shut off “because it would not be good for that system to be pumping electrons onto the grid if a lineman was repairing it.”

But if a series of solar power plants shut down in response to such an event, Dooley went on, it could cause a cascading effect and a system-wide loss of power. “It would be better to have the system stay up and stable,” Dooley said. “Low-voltage ride-through (LVRT) capability allows that.”

AE has also recently participated in a solar industry milestone, Dooley said.

On February 7, 2012, and March 17, 2012, thirty AE 500-kilowatt inverters at PG&E’s fifteen-megawatt Westside Solar Station successfully handled momentary low voltage events caused by faults on an adjacent circuit. Each drop in voltage of approximately 50 percent lasted through seven cycles and caused power drops of between 20 percent and 80 percent. Data showed that AE’s LVRT-equipped inverters stayed on-line.

“Such events and the ride-through of them," Dooley said, “had been simulated in a lab, but this was the first time it has happened on such a large scale on an actual utility grid.”

As penetrations of renewables approach 15 percent on any given leg of a transmission system, Dooley said, “utilities will start to have a strategy on low-voltage ride-through and other grid control inverter operations. Grid interactivity is going to be increasingly important.”