Here's a bit more color on GTM Research's most recent solar analysis, U.S. Residential Solar Economic Outlook, from GTM senior solar analyst Cory Honeyman and GTM VP Shayle Kann during a dial-in with UBS on Wednesday.

As Kann said, this is "a new way of thinking about the economics of residential solar." He suggested that the industry had not been paying enough attention to rate design and NEM to fully understand their impact on solar.

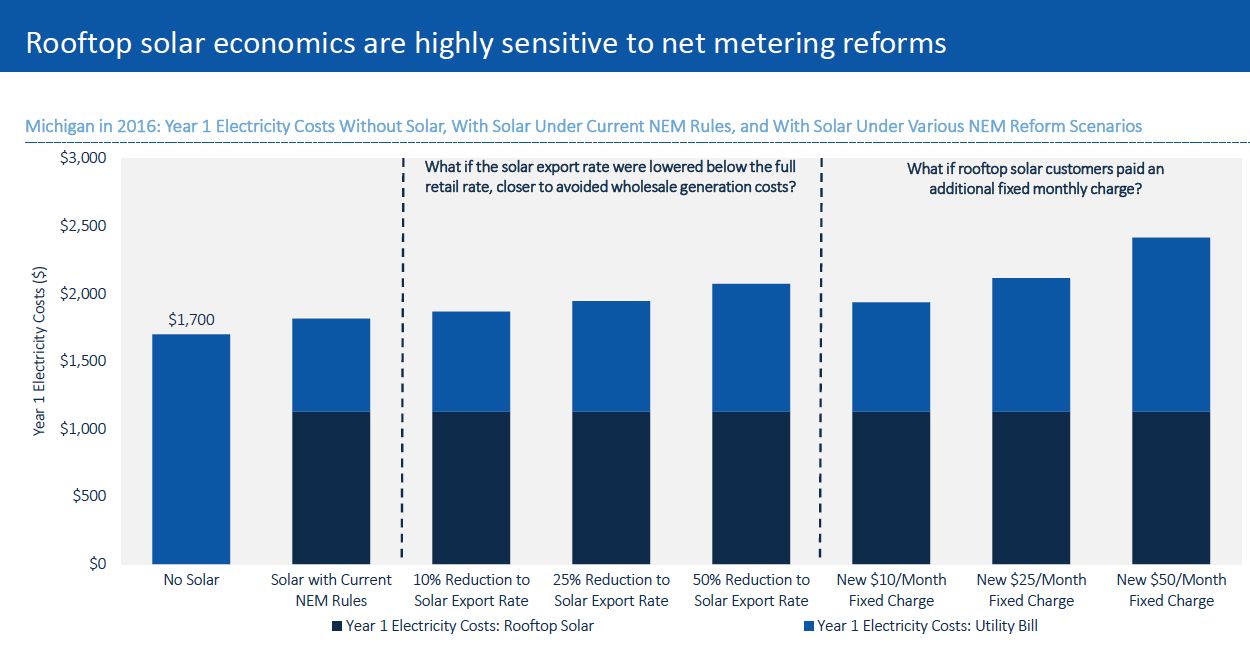

Kann and Honeyman said that the traditional presumption -- namely, that "as installation costs continue to decline and retail electricity rates continue to rise, residential solar economics become increasingly attractive in a growing number of states" -- is increasingly being challenged by volatile rate design and NEM rulings.

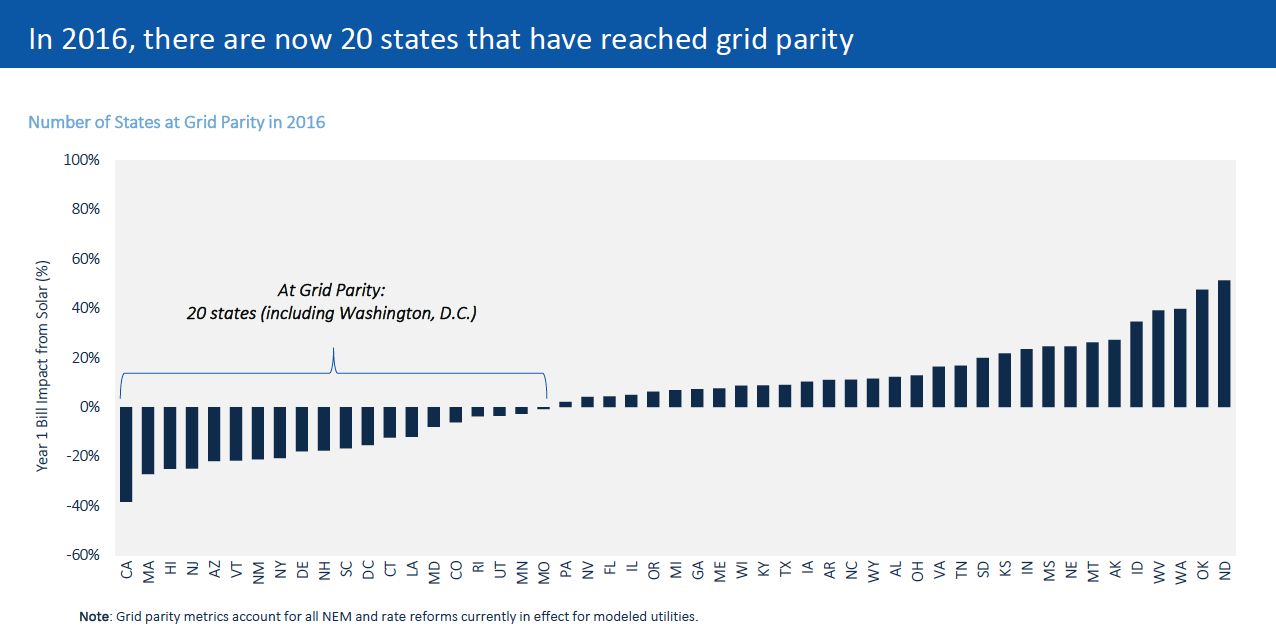

Honeyman noted that simple grid parity calculations are mostly incorrect -- simply comparing the cost of solar versus the retail electricity price has never been "an accurate way to measure parity" on a bill that is a mix of volumetric and fixed charges. The analysts at GTM Research used utility- and state-specific rate design, system production and installation costs to more accurately gauge solar’s attractiveness.

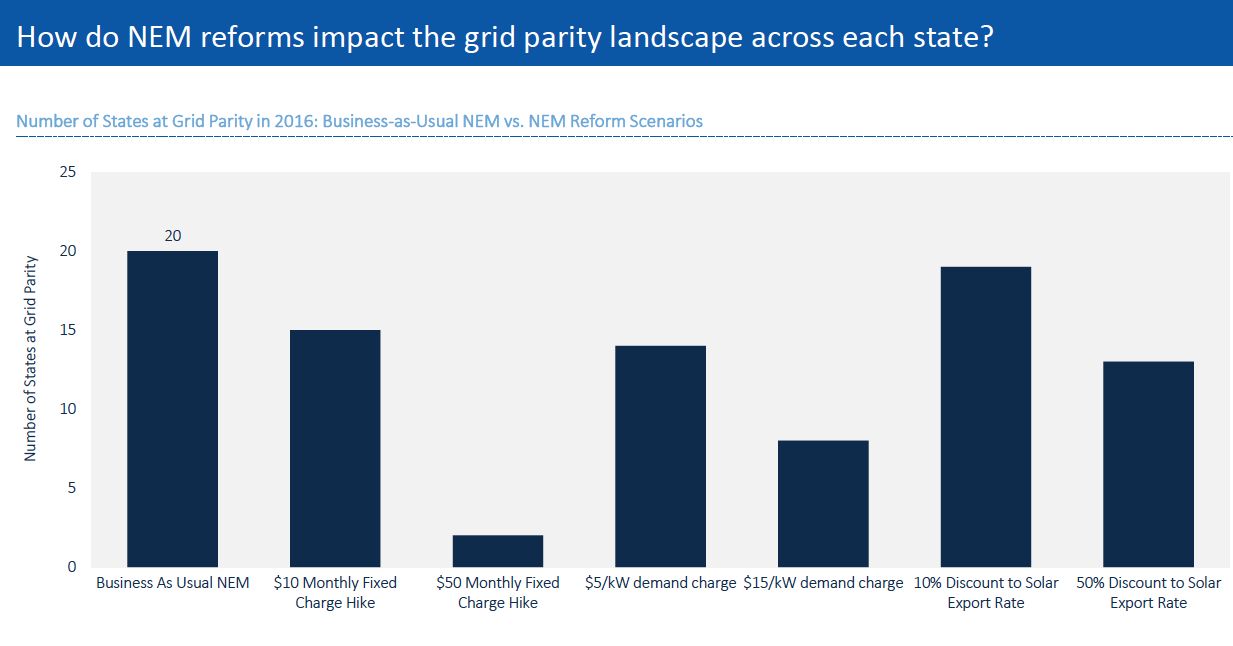

Honeyman said, "We're looking at 20 states where residential has hit that grid parity benchmark" but stressed that "solar savings are a local equation." He added, "Rate design and NEM rules set the ceiling on how much can be saved by solar."

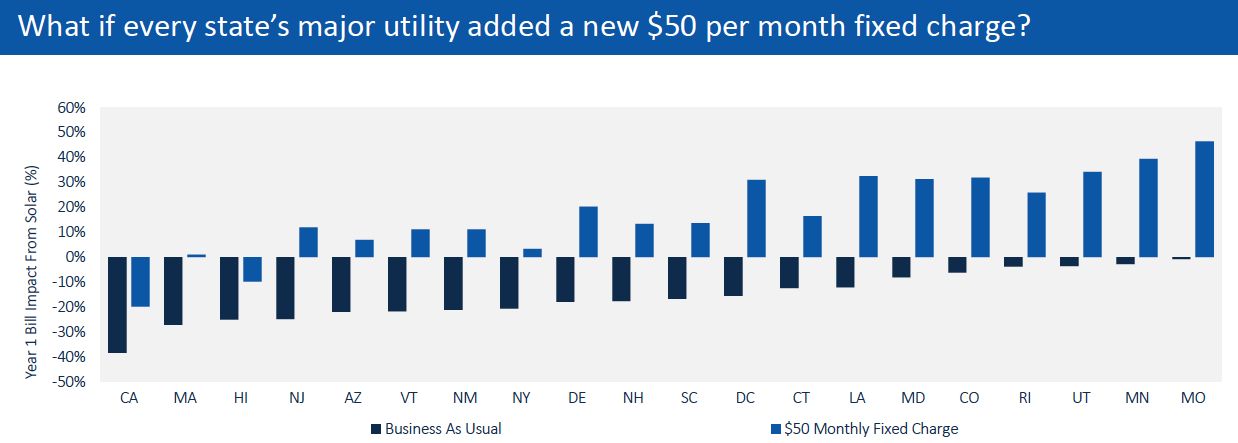

The addition of a $50-per-month fixed charge would eliminate 18 of those 20 states from qualifying under GTM Research's definition of grid parity. The report finds, "Through 2020, incremental cost reductions to rooftop solar, alongside incremental retail rate hikes in most utility service territories, will serve as sufficient tailwinds to expand the number of states that reach grid parity from 20 to 42 states."

Kann said, "Most utilities are talking fixed charges and rolling back the value of solar exported to the grid," although he notes that utilities "have not been terribly successful" in raising fixed charges. He adds that what is more prevalent is "lowering the export rate" to the grid as has been done in Hawaii, Nevada and California. Other blunt tools used by PUCs include demand charges for residential consumers, which will impact the economics of solar, but not as negatively as would the imposition of fixed charges, according to Kann.

According to the new report, "In the long run, when solar becomes a mainstream power source beyond 2020, regulators and utilities are more likely to align compensation for solar exports more closely to wholesale market pricing, underscoring the need for continued installed cost reductions to counter a policy environment in which rooftop solar compensation is significantly undercut."

It continues: "The future value proposition of rooftop solar will depend on its pairing with other distributed energy resources, namely, battery storage, which will enable rooftop solar production to better align with peak electricity price periods and optimize self-consumption to mitigate the risk of net metering reforms that roll back the value of solar exported to the grid."

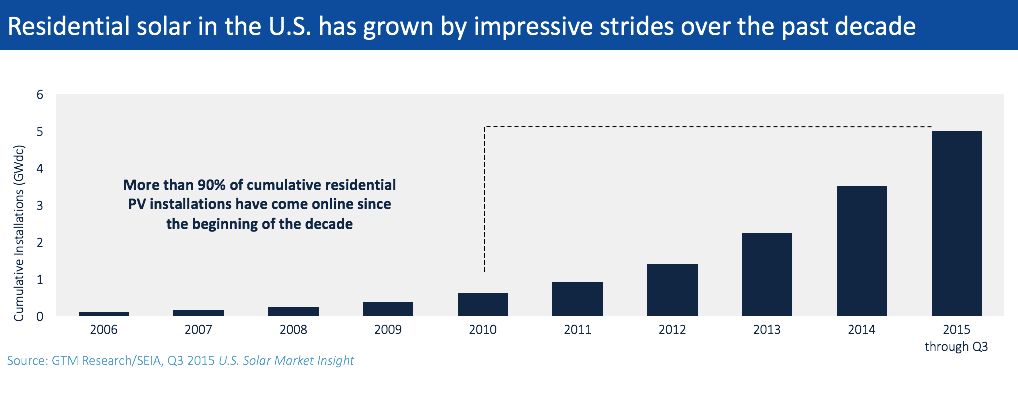

Honeyman suggests, "With more utilities re-evaluating net metering rules and rate design, the residential solar economic outlook can no longer depend on a static policy landscape like the one that helped encourage the nearly 1 million homeowners who now have rooftop solar. Looking ahead, it is no longer a question of if, but rather when and to what extent, rate structures and net metering rules will be revised.”

Kann says to "watch this space" for more analysis from GTM Research on how time-of-use rate changes will impact solar.

Download the new report's free executive summary here.